Market Comment – Dollar enjoys a bid; stocks concerned about a hawkish Fed

Fed meeting in the spotlight; equities under pressure

Dollar strength continues, could intensify if Fed appears hawkish

Questionable yen intervention result; more action over the next sessions?

Bitcoin fights for $60k level; oil in retreat despite Middle East headlines

May starts on a high note

May starts on a high noteThe Fed meeting concludes today with the decision announced at 18:00 GMT and the press conference taking place 30 minutes later. The market does not expect a rate change but there is an increasing possibility of a tweak in the current balance sheet reduction programme. The focus will also be on the overall rhetoric and particularly Chairman Powell’s responses to questions about the Fed’s next rate move.

Going into the meeting, the Fed is facing mixed data. For the first time since October 2023, there are some signs of a slowdown in the economy, as seen at the recent GDP print for the first quarter of 2024 and the PMI surveys. Having said that, inflation remains elevated with Tuesday’s strong employment cost index complicating the outlook. Therefore, today's data releases ahead of the Fed gathering, which will include the ISM manufacturing PMI, will be quite important.

For the first time since October 2023, there are some signs of a slowdown in the economy

The Fed has a difficult task today. Powell will try to buy more time, but the market is getting anxious about the possibility of no rate cuts during 2024. US equities had a rough day yesterday, despite the positive earnings report from Amazon, with the three key indices ending the session with more than 1% losses for the time since April 12.

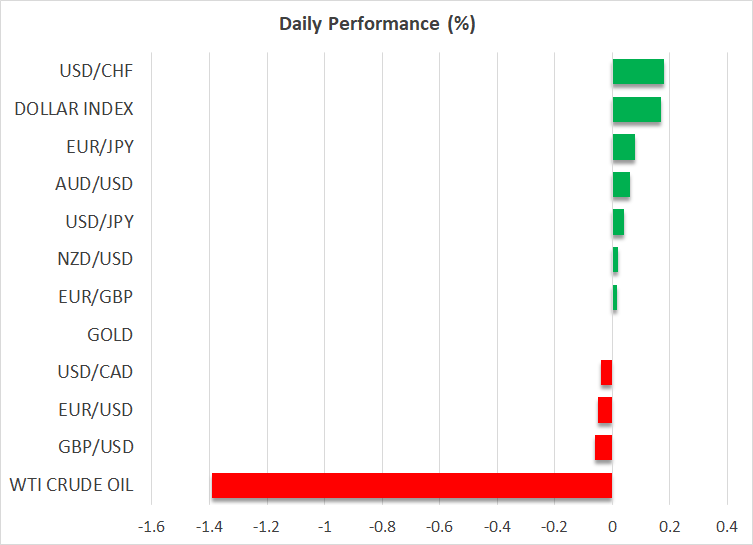

Dollar strength continuesThe euro got an initial boost from the stronger euro area data yesterday, but as the US session progressed later in the day, it came under pressure, especially against the dollar. A relatively hawkish show from the Fed today might sustain the current dollar strength but its performance could gradually fade if US stocks come under severe pressure again.

A relatively hawkish show from the Fed today might sustain the current dollar strengthMore BoJ interventions on the way?

Dollar/yen is hovering around the 157 area as the market continues to digest Monday’s intervention. A look at the most recent interventions by Japan reveals that first, the BoJ tends to intervene multiple times, unless there is another plan in the works like quantitative easing, and second, market interventions as a stand-alone reaction have proven to be an insufficient measure.

This means that only a combination of domestic and foreign developments, such as a hawkish BoJ and a Fed rate cut soon, could allow the yen to sustainably appreciate against the dollar.

Interesting moves in both bitcoin and oilBitcoin remains under selling pressure as it tries to stay above the $60k level. The completion of the much-touted halving and a lack of positive news on the ETFs front appear to have cast a shadow on the king of cryptos.

In the meantime, WTI oil futures are preparing to test the April lows as the market appears more relaxed about geopolitics. However, developments in the Middle East could come to the foreground soon if the discussed ceasefire is not agreed and an Israeli ground operation in Rafah commences.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.