Market Comment – Yen tumbles to fresh lows, dollar awaits GDP

Yen falls to new 34-year low ahead of BoJ decision

Dollar traders await GDP and PCE data

Wall Street mixed, gold stays on the back foot

Will Ueda appear in a hawkish suit this time?

Will Ueda appear in a hawkish suit this time?The yen extended its tumble to a fresh 34-year low, falling below 155.00 per dollar. With less than 24 hours to go for the Bank of Japan’s decision, investors are likely sitting on the edge of their seats in anticipation of the gathering’s outcome.

Recently, Governor Ueda said that they may raise interest rates if the yen’s declines result in accelerating inflation and added that they could begin reducing their huge bond buying at some point. With inflation accelerating notably in February, despite ticking a bit down in March, and taking into account that the wage negotiations resulted in the largest pay hikes in 33 years, investors may be on the lookout for hints and clues on how soon the next hike will be delivered. Currently, they are expecting the next 10bps hike in June.

However, the BoJ has a history of disappointing hawkish expectations, and thus should this be the case again, the yen is likely to continue falling and perhaps revive intervention concerns. That said, officials could wait for a while longer before stepping in, given that they have repeatedly warned that they will respond if the moves are speculative and not based on fundamentals. Indeed, they have been silent lately perhaps as the latest leg south in the yen was driven by fundamentals.

The BoJ has a history of disappointing hawkish expectations, and thus should this be the case again, the yen is likely to continue falling

On the other hand, Ueda may want to make sure he avoids a 2022 déjà vu, when Kuroda’s dovish remarks pushed the yen off the cliff and forced authorities to intervene and save the currency. So, he could decide to adopt a more hawkish stance.

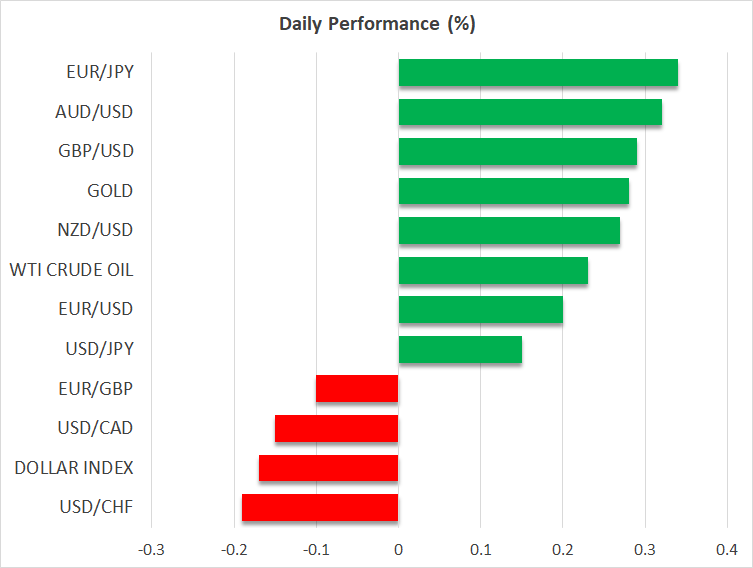

Will the Fed refrain from cutting rates this year?Although it gained ground against the yen, the dollar traded on the back foot against most of its major peers, perhaps as traders were reluctant to initiate new long positions ahead of the US GDP data later today.

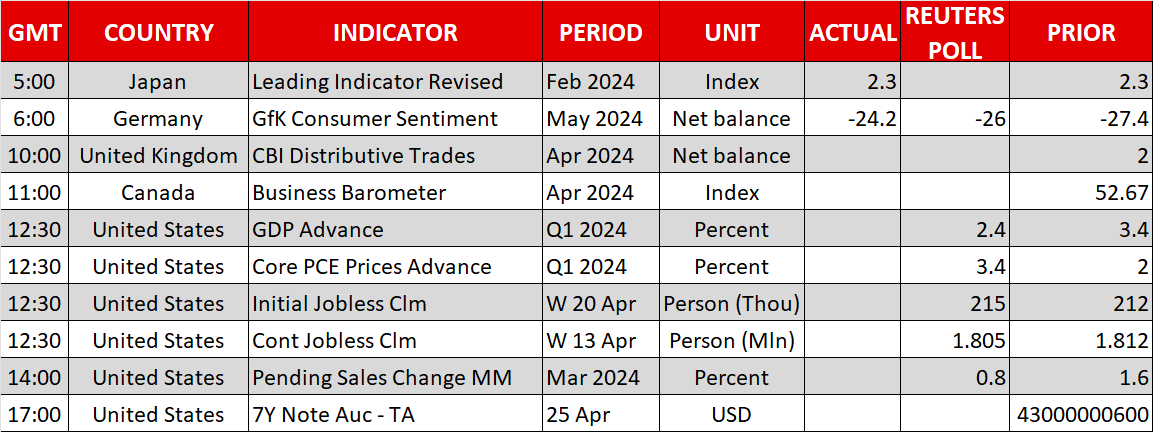

Expectations suggest that growth in the world’s largest economy slowed to an annualized 2.4 q/q in Q1 from 3.4%, but with the Atlanta Fed GDPNow model pointing to a 2.7% growth rate, the risks may be titled to the upside. Following the downside in the S&P Global PMIs on Monday, investors may need to see stellar GDP data before they further scale back their rate cut bets, and thereby allow the dollar to stage a comeback.

Investors may need to see stellar GDP data before they further scale back their rate cut betsWall Street set to open lower, gold extends correction

US equities closed mixed on Wednesday as stock traders remained cautious as well ahead of the GDP data. However, after the closing bell, although Meta reported better than expected results for Q1, its shares plunged more than 15% on weak revenue guidance, increasing the risks for a lower open on Wall Street today. The tech earnings continue today with results from Microsoft and Alphabet.

Gold traded a bit lower yesterday as the easing geopolitical tensions allowed investors to continue offloading safe-haven positions. However, central bank buying, and strong Chinese demand remain big supportive factors, keeping the outlook positive. What's more, although delayed, the next move on US interest rates is more likely to be a cut, which is positive for the yellow metal.

However, central bank buying, and strong Chinese demand remain big supportive factors, keeping the outlook positive

Actifs liés

Dernières actualités

Avertissement : Les entités de XM Group proposent à notre plateforme de trading en ligne un service d'exécution uniquement, autorisant une personne à consulter et/ou à utiliser le contenu disponible sur ou via le site internet, qui n'a pas pour but de modifier ou d'élargir cette situation. De tels accès et utilisation sont toujours soumis aux : (i) Conditions générales ; (ii) Avertissements sur les risques et (iii) Avertissement complet. Un tel contenu n'est par conséquent fourni que pour information générale. En particulier, sachez que les contenus de notre plateforme de trading en ligne ne sont ni une sollicitation ni une offre de participation à toute transaction sur les marchés financiers. Le trading sur les marchés financiers implique un niveau significatif de risques pour votre capital.

Tout le matériel publié dans notre Centre de trading en ligne est destiné à des fins de formation / d'information uniquement et ne contient pas – et ne doit pas être considéré comme contenant – des conseils et recommandations en matière de finance, de fiscalité des investissements ou de trading, ou un enregistrement de nos prix de trading ou une offre, une sollicitation, une transaction à propos de tout instrument financier ou bien des promotions financières non sollicitées à votre égard.

Tout contenu tiers, de même que le contenu préparé par XM, tels que les opinions, actualités, études, analyses, prix, autres informations ou liens vers des sites tiers contenus sur ce site internet sont fournis "tels quels", comme commentaires généraux sur le marché et ne constituent pas des conseils en investissement. Dans la mesure où tout contenu est considéré comme de la recherche en investissement, vous devez noter et accepter que le contenu n'a pas été conçu ni préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et, en tant que tel, il serait considéré comme une communication marketing selon les lois et réglementations applicables. Veuillez vous assurer que vous avez lu et compris notre Avis sur la recherche en investissement non indépendante et notre avertissement sur les risques concernant les informations susdites, qui peuvent consultés ici.