Daily Market Comment – Dollar steady, stocks mixed ahead of US inflation data

- Dollar drifts sideways in choppy trading as investors brace for jump in US inflation

- Stocks lack direction as yields firm, US data, earnings awaited

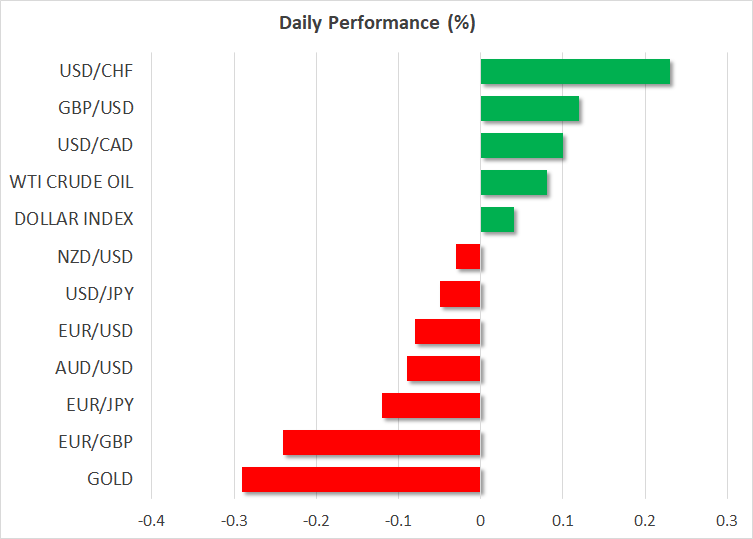

- Pound extends gains but most majors stuck in tight ranges, gold slides again

All eyes on US inflation

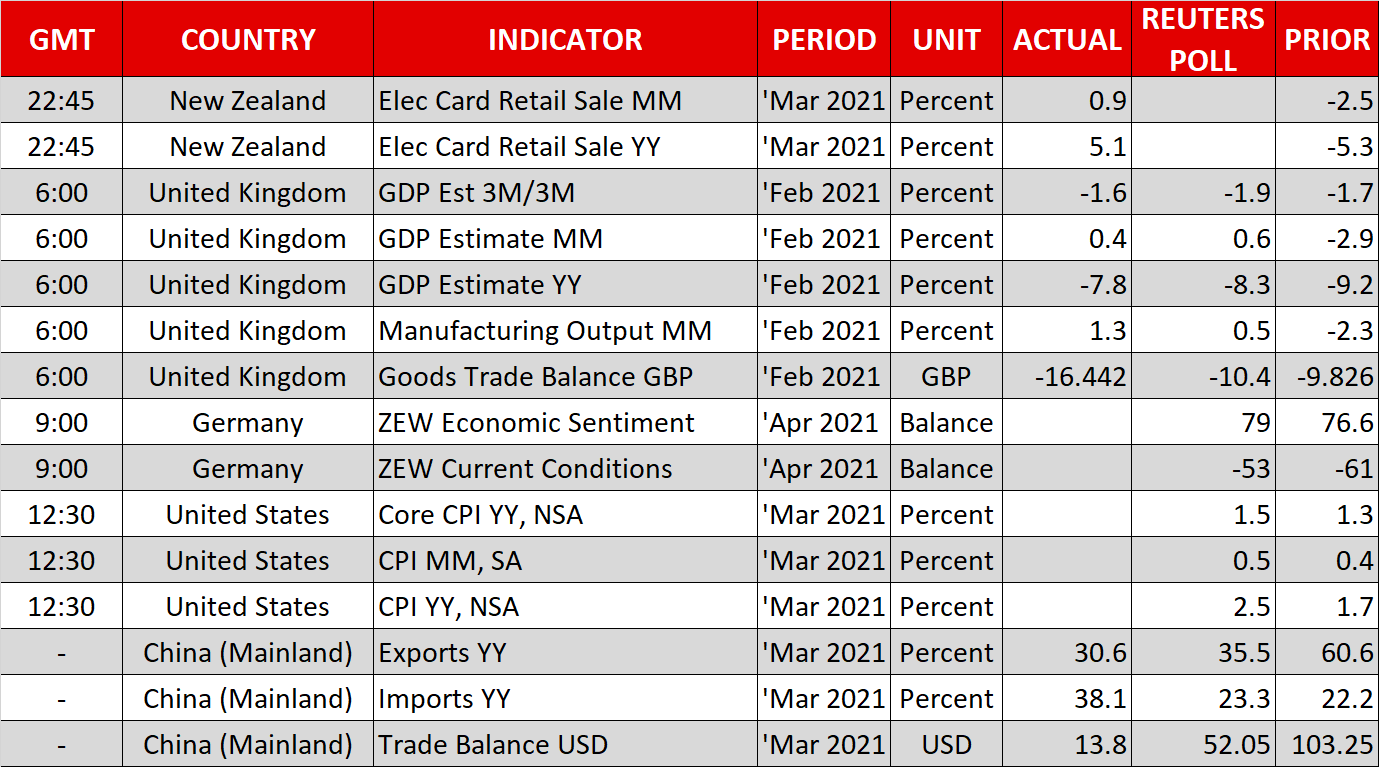

All eyes on US inflationWith yesterday’s $96 billion Treasury auction passing uneventfully, investors have turned their attention to the latest reading of the consumer price index out of the United States later today. Expectations of a spike in US inflation have been running high for some time now and markets are likely to get the first taste of actual inflation shooting above the Fed’s 2% target at 13:30 GMT.

After plunging to almost zero per cent during the pandemic, America’s headline inflation rate is projected to have surged to a more than one-year high of 2.5% y/y in March. Supply-chain disruptions, soaring energy prices and pent-up demand, not to mention last year’s low base effect, are all anticipated to push up consumer prices over the next few months.

However, inflation expectations have stabilized lately as the Fed appears to have calmed market fears of inflation spiralling out of control even as policymakers hint at being perfectly comfortable to fall behind the curve. The Fed has been unified in its message that it believes any big overshoot of inflation will be temporary and that its main priority right now is achieving maximum employment.

Nonetheless, markets are likely to be sensitive to a bigger-than-expected jump in CPI, especially if strong inflation numbers are followed up by robust retail sales figures on Thursday, which would heighten concerns about an overheating US economy.

Dollar marginally higher on firmer yieldsBut there was some relief ahead of the key data releases as Monday’s auctions of US government bonds – part of a $370 billion Treasury sale over three weeks – was met with sufficient demand. There will be more auctions today, for 30-year notes, but while the yield on those was steady, the 10-year yield was edging higher, giving the dollar a nudge up.

The greenback has been see-sawing in recent sessions, with the dollar index forming a strong support region just above 92.0. The index’s trend has been defined by euro/dollar’s tight range in recent days and the upcoming data could be what triggers a breakout in either direction for the pair.

The euro’s unusual resistance against the US dollar is being driven by some doubts about the ECB’s commitment to keeping Eurozone yields low as well as signs that the EU’s troubled vaccination campaign is finally gathering speed.

Subdued moves in FX and commodity spheresThe UK’s vaccination programme on the other hand has suffered a setback due to its over-reliance on the AstraZeneca jab, which has been mired in safety concerns, and this has been quite a drag on the pound. However, it’s been a positive start to the week so far for sterling as non-essential businesses in England and Wales have been allowed to reopen their doors as of Monday. In addition, the monthly GDP print released today showed the UK economy grew slightly in February, while January’s contraction was milder than initially estimated.

The Australian dollar continued to struggle despite upbeat trade figures out of China today. Soaring Chinese demand for imports was unable to lift the aussie but did buoy oil prices. The kiwi was up slightly ahead of the RBNZ policy decision early on Wednesday. Gold, meanwhile, remained on the backfoot, as it headed for a third-straight day of losses, brushing one-week lows. The precious metal could get a boost if US inflation beats expectations but even that may not be enough to counter the negative pressure from a possible subsequent surge in Treasury yields.

Stocks look to US earnings for directionThe mixed mood was also evident in equity markets where on top of the inflation angst, the start of the Q1 earnings season is also making some traders nervous. The S&P 500 held near record highs on Monday, but e-mini futures indicated another lacklustre session for Wall Street today.

That could easily change in the coming hours, though, if the US data sparks volatility in bond markets and as the earnings results start to come in. JP Morgan, Goldman Sachs and Wells Fargo will kick off the season tomorrow as investors eye a further recovery in bank earnings.

免責聲明: XM Group提供線上交易平台的登入和執行服務,允許個人查看和/或使用網站所提供的內容,但不進行任何更改或擴展其服務和訪問權限,並受以下條款與條例約束:(i)條款與條例;(ii)風險提示;(iii)完全免責聲明。網站內部所提供的所有資訊,僅限於一般資訊用途。請注意,我們所有的線上交易平台內容並不構成,也不被視為進入金融市場交易的邀約或邀請 。金融市場交易會對您的投資帶來重大風險。

所有缐上交易平台所發佈的資料,僅適用於教育/資訊類用途,不包含也不應被視爲適用於金融、投資稅或交易相關諮詢和建議,或是交易價格紀錄,或是任何金融商品或非應邀途徑的金融相關優惠的交易邀約或邀請。

本網站的所有XM和第三方所提供的内容,包括意見、新聞、研究、分析、價格其他資訊和第三方網站鏈接,皆爲‘按原狀’,並作爲一般市場評論所提供,而非投資建議。請理解和接受,所有被歸類為投資研究範圍的相關内容,並非爲了促進投資研究獨立性,而根據法律要求所編寫,而是被視爲符合營銷傳播相關法律與法規所編寫的内容。請確保您已詳讀並完全理解我們的非獨立投資研究提示和風險提示資訊,相關詳情請點擊 這裡查看。