Week Ahead – Focus on US retail sales as debt ceiling drama rumbles on

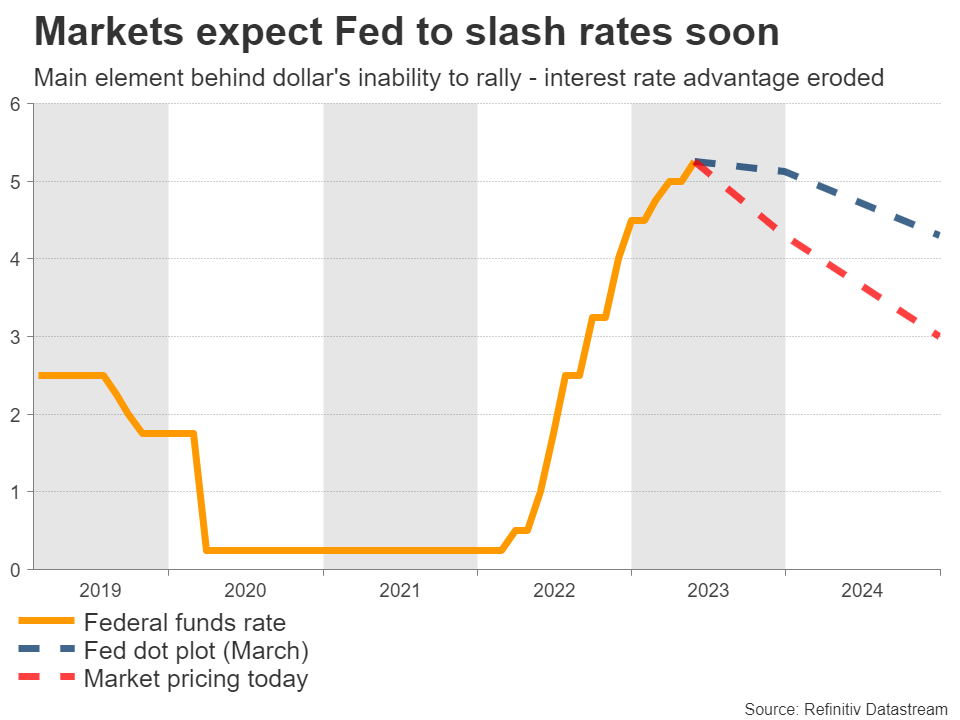

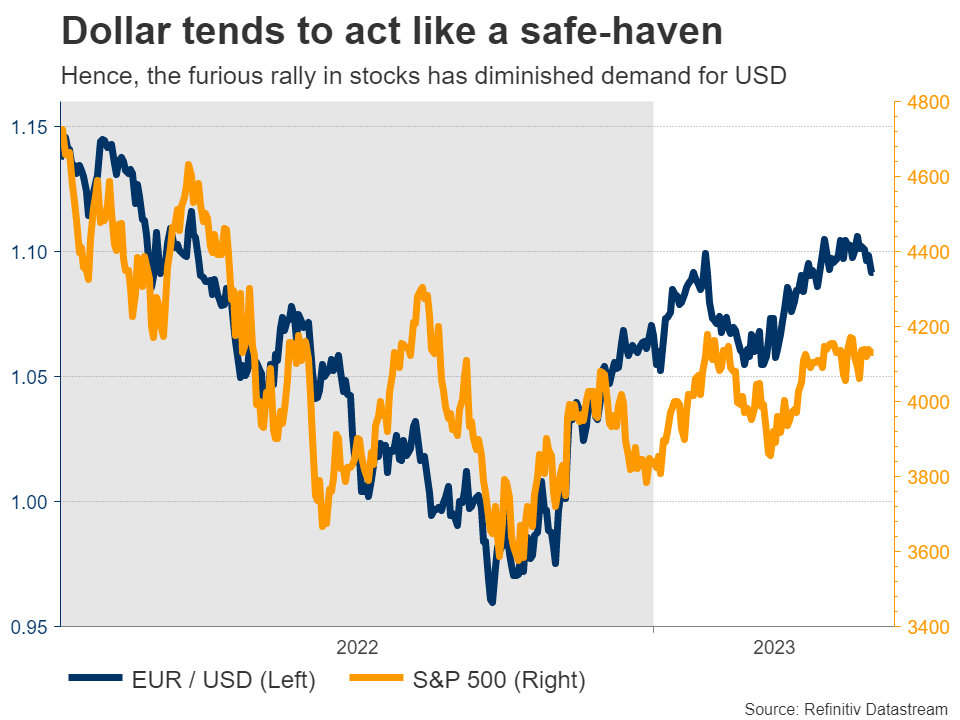

Traders seem to be betting that the problems in the banking system will override inflation concerns, forcing the Fed to reduce borrowing costs in order to avoid a domino of bank failures, even if that means tolerating a period of higher inflation. Another problem for the dollar has been the rally in stocks. Since the greenback often acts like a haven asset, the optimistic tone in markets has limited demand for the reserve currency. The charts tell the same story - the dollar index topped in late September, right before the stock market bottomed. In other words, the dollar’s yield advantage has been eroded because of rate-cut bets, and its safe-haven qualities are not very popular right now. Therefore, for the greenback to start ‘working’ again, it might need an equity selloff that fuels demand for protection or a stream of encouraging data that dispels speculation of imminent rate cuts.

Traders seem to be betting that the problems in the banking system will override inflation concerns, forcing the Fed to reduce borrowing costs in order to avoid a domino of bank failures, even if that means tolerating a period of higher inflation. Another problem for the dollar has been the rally in stocks. Since the greenback often acts like a haven asset, the optimistic tone in markets has limited demand for the reserve currency. The charts tell the same story - the dollar index topped in late September, right before the stock market bottomed. In other words, the dollar’s yield advantage has been eroded because of rate-cut bets, and its safe-haven qualities are not very popular right now. Therefore, for the greenback to start ‘working’ again, it might need an equity selloff that fuels demand for protection or a stream of encouraging data that dispels speculation of imminent rate cuts.  This puts extra emphasis on US retail sales out on Tuesday, which will reveal how consumers are holding up. Forecasts point to a 0.7% monthly increase in April, a rebound following a decline of similar size last month. This notion is supported by an increase in Visa’s US Spending Momentum Index, yet similar card data from Bank of America point to a spending rise of just 0.3% in April, presenting some downside risks. Meanwhile, debt ceiling negotiations will continue. The Treasury Secretary has warned the US could face default by early June without a deal, although in reality, it is likely closer to July. Outside of short-term Treasury yields and credit default swaps, markets haven’t cared much about this standoff so far, but that might change as the X-date draws closer. China and Japan await key dataCrossing into China, the ball will get rolling on Tuesday with retail sales, industrial production, and fixed asset investment - all for April. Investors will be looking at whether the reopening momentum has started to fade, as recent business surveys suggested. Over in Japan, things will heat up with GDP growth data for Q1 on Wednesday, ahead of the latest round of inflation stats on Friday. The Japanese economy is expected to have grown again entering 2023, albeit just barely.

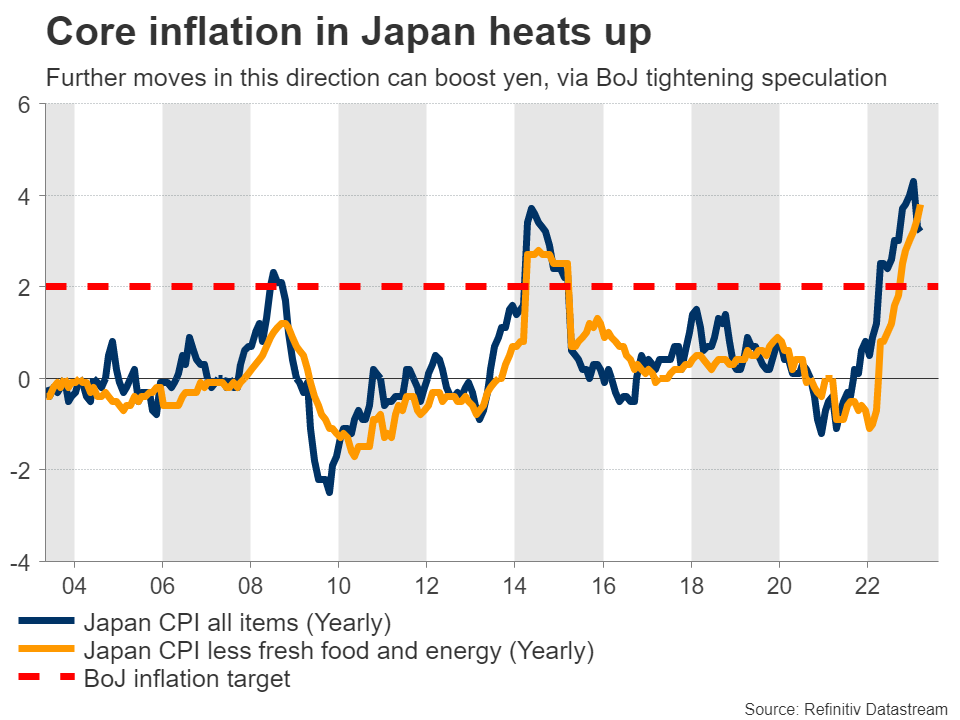

This puts extra emphasis on US retail sales out on Tuesday, which will reveal how consumers are holding up. Forecasts point to a 0.7% monthly increase in April, a rebound following a decline of similar size last month. This notion is supported by an increase in Visa’s US Spending Momentum Index, yet similar card data from Bank of America point to a spending rise of just 0.3% in April, presenting some downside risks. Meanwhile, debt ceiling negotiations will continue. The Treasury Secretary has warned the US could face default by early June without a deal, although in reality, it is likely closer to July. Outside of short-term Treasury yields and credit default swaps, markets haven’t cared much about this standoff so far, but that might change as the X-date draws closer. China and Japan await key dataCrossing into China, the ball will get rolling on Tuesday with retail sales, industrial production, and fixed asset investment - all for April. Investors will be looking at whether the reopening momentum has started to fade, as recent business surveys suggested. Over in Japan, things will heat up with GDP growth data for Q1 on Wednesday, ahead of the latest round of inflation stats on Friday. The Japanese economy is expected to have grown again entering 2023, albeit just barely.  On the inflation front, inflationary pressures probably continued to heat up in April, mirroring the forward-looking Tokyo CPIs. That would be pleasant news for the Bank of Japan, possibly fueling speculation for policy tightening in the future, perhaps this summer already. The BoJ’s reluctance to tighten policy has devastated the yen, so any hints that this might change can help the currency regain strength. Governor Ueda has signaled he’s open to tightening, provided that inflation is persistent. For the yen, the dream scenario would be for the BoJ to start tightening right as other central banks stop, during a period of turbulence in global markets.Risk-linked currencies eyed, Turkey goes to electionsTurning to currencies with strong links to risk sentiment, the British pound will be in the spotlight Tuesday with the release of jobs data for March. The Bank of England disappointed traders this week by not providing any strong clues about future action, so markets are pricing the rate decision next month almost like a coin toss. In Australia, there’s a barrage of releases starting on Tuesday with the minutes of the latest RBA meeting, where the central bank unexpectedly raised interest rates. The wage price index for Q1 will follow Wednesday, ahead of jobs numbers for April on Thursday. Over in Canada, the latest inflation stats are out Tuesday, ahead of retail sales on Friday. Market pricing suggests the Bank of Canada is done raising rates, so anything that challenges this perception could inject more volatility into the Canadian dollar, which has been shaken around lately by massive swings in oil prices.

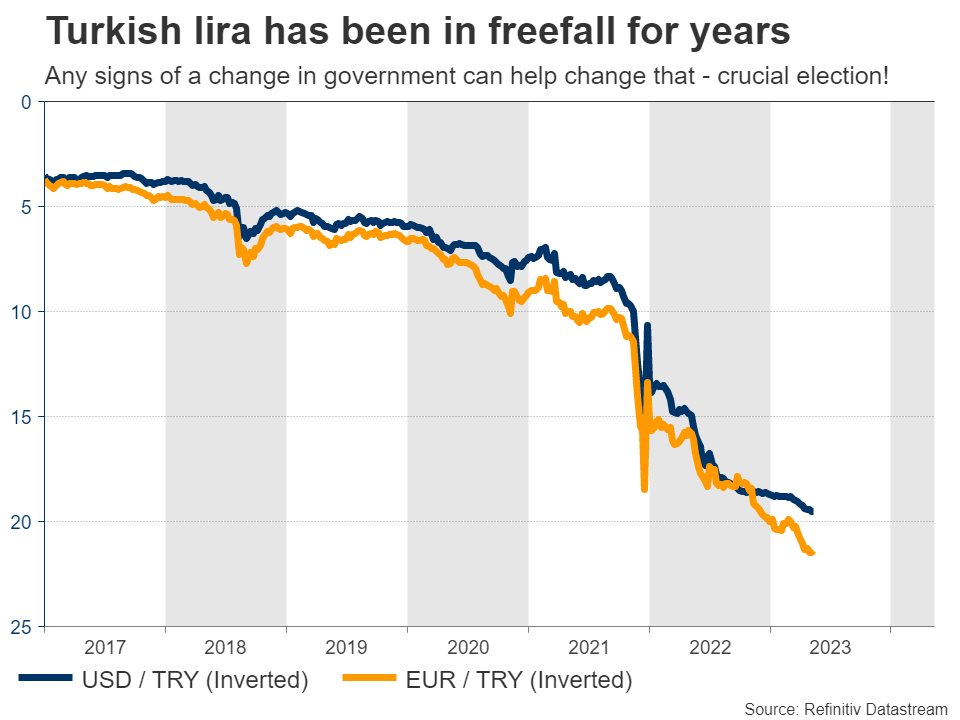

On the inflation front, inflationary pressures probably continued to heat up in April, mirroring the forward-looking Tokyo CPIs. That would be pleasant news for the Bank of Japan, possibly fueling speculation for policy tightening in the future, perhaps this summer already. The BoJ’s reluctance to tighten policy has devastated the yen, so any hints that this might change can help the currency regain strength. Governor Ueda has signaled he’s open to tightening, provided that inflation is persistent. For the yen, the dream scenario would be for the BoJ to start tightening right as other central banks stop, during a period of turbulence in global markets.Risk-linked currencies eyed, Turkey goes to electionsTurning to currencies with strong links to risk sentiment, the British pound will be in the spotlight Tuesday with the release of jobs data for March. The Bank of England disappointed traders this week by not providing any strong clues about future action, so markets are pricing the rate decision next month almost like a coin toss. In Australia, there’s a barrage of releases starting on Tuesday with the minutes of the latest RBA meeting, where the central bank unexpectedly raised interest rates. The wage price index for Q1 will follow Wednesday, ahead of jobs numbers for April on Thursday. Over in Canada, the latest inflation stats are out Tuesday, ahead of retail sales on Friday. Market pricing suggests the Bank of Canada is done raising rates, so anything that challenges this perception could inject more volatility into the Canadian dollar, which has been shaken around lately by massive swings in oil prices.  Finally in Turkey, the nation will elect its next parliament and president on Sunday. President Erdogan is lagging behind his main rival Kilicdaroglu, although neither candidate is expected to secure 50% of the votes, which means there will probably be a second round in two weeks. A strong showing by Kilicdaroglu could help the Turkish lira to appreciate, perhaps with a large gap at the open on Monday, on expectations that a new government will restore orthodox economic policies and allow the central bank to raise interest rates in order to fight runaway inflation.

Finally in Turkey, the nation will elect its next parliament and president on Sunday. President Erdogan is lagging behind his main rival Kilicdaroglu, although neither candidate is expected to secure 50% of the votes, which means there will probably be a second round in two weeks. A strong showing by Kilicdaroglu could help the Turkish lira to appreciate, perhaps with a large gap at the open on Monday, on expectations that a new government will restore orthodox economic policies and allow the central bank to raise interest rates in order to fight runaway inflation. Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.