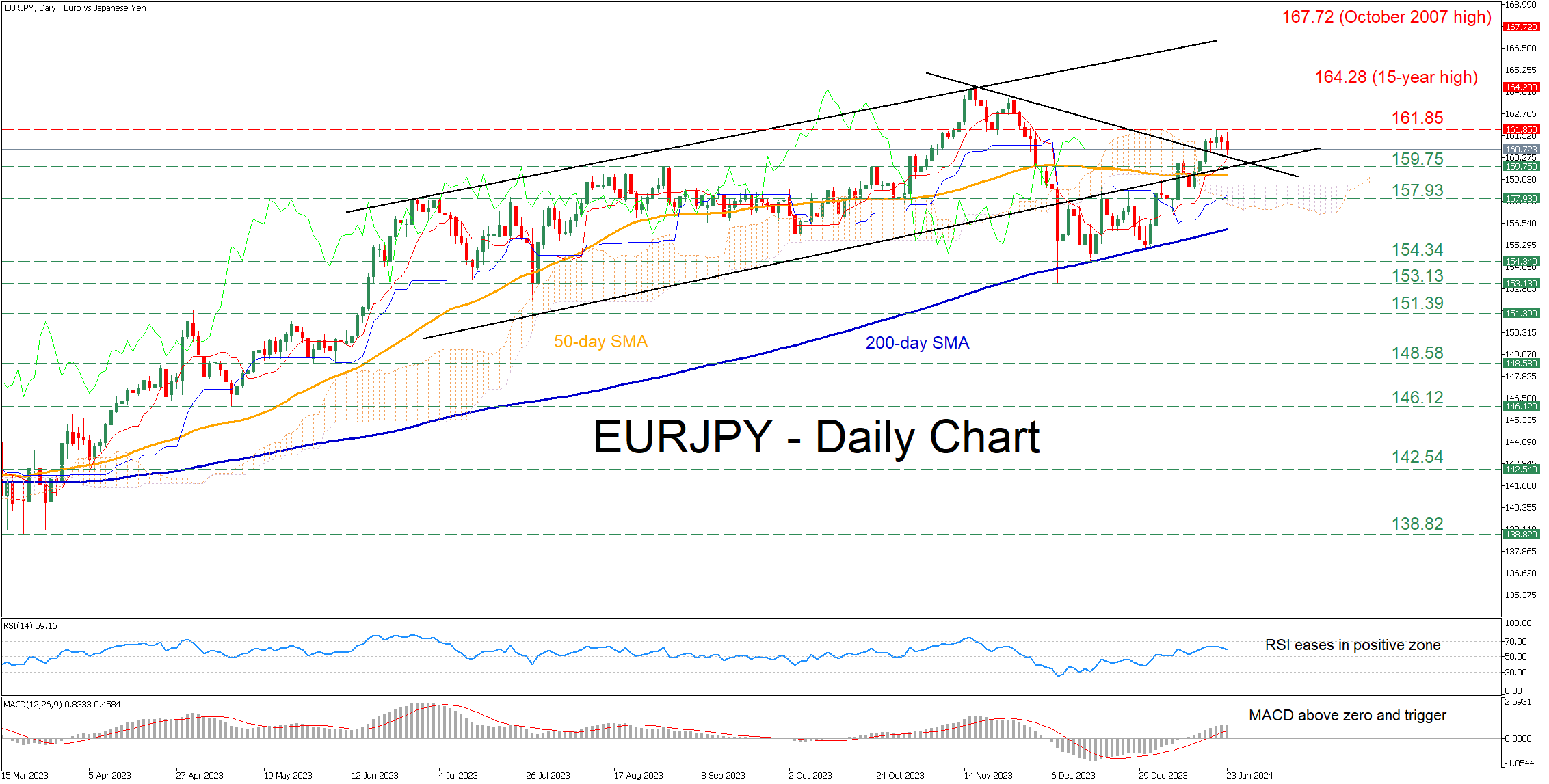

Technical Analysis – EURJPY re-enters its bullish channel

EURJPY bounces back after 200-day SMA prevents decline

Rejoins its bullish setup in place since summer

Momentum indicators are within their positive territories

Should buying pressures persist, the price may revisit the January high of 161.85. A break above that area could pave the way for the 15-year high of 164.28. Failing to halt there, the pair could storm higher to fresh multi-year peaks, where the October 2007 high of 167.72 could curb any upside attempts.

On the flipside, if the price reverses lower, immediate support could be found at the previous resistance of 159.75, which overlaps with the lower bound of the ascending channel. Further retreats may then cease around 157.93, a region that acted both as resistance and support in recent months. Even lower, the October-December support of 154.34 could act as the next line of defence.

In brief, EURJPY managed to pause its short-term selloff with some help from the 200-day SMA and jump back above the Ichimoku cloud. Therefore, the technical picture will remain positive for as long as the price holds within its medium-term bullish pattern.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.