Technical Analysis – GBPUSD edges higher after completing golden cross

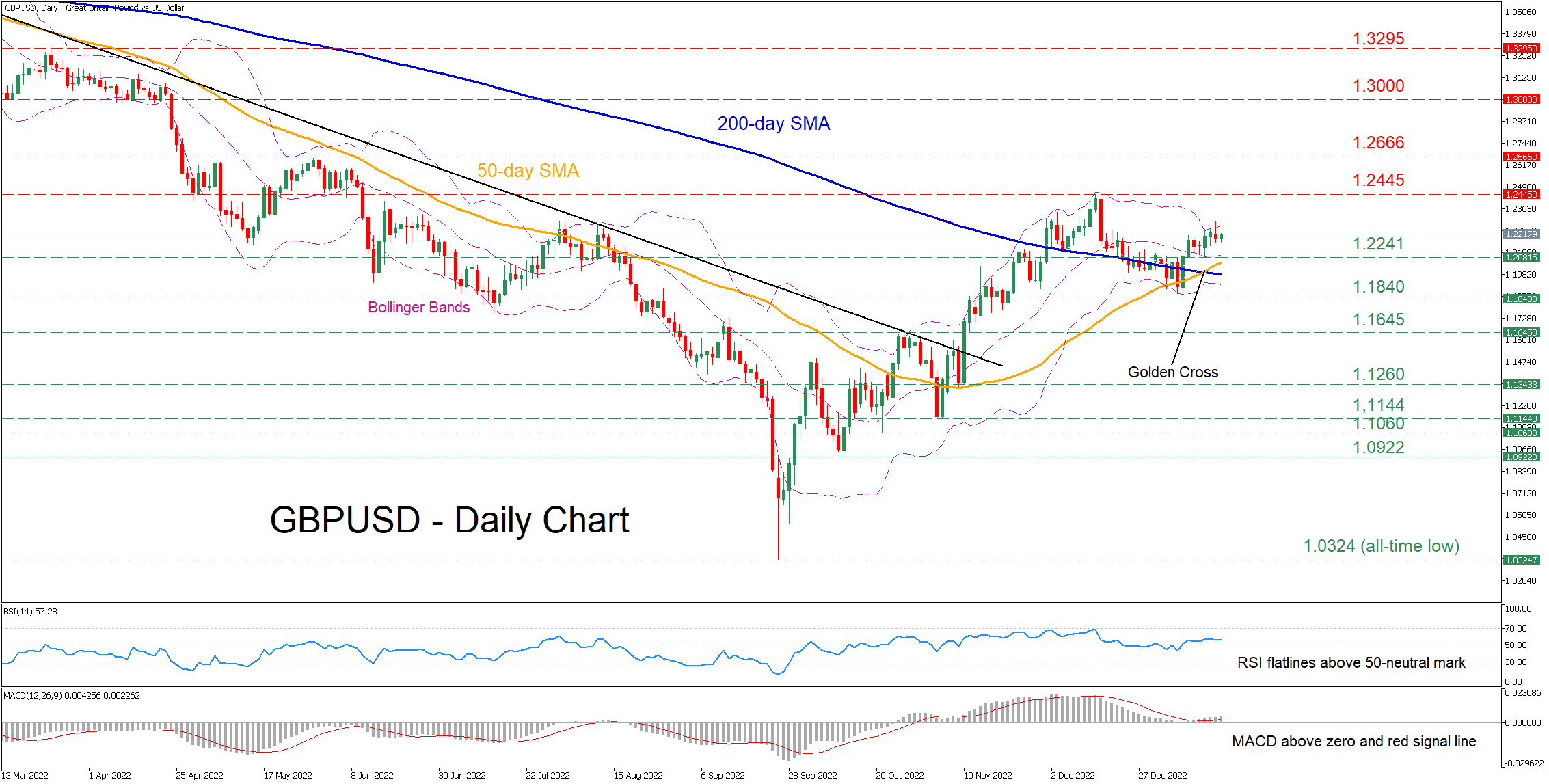

GBPUSD has been attempting a rebound since September when the pair recorded an all-time low of 1.0324. Even though the price experienced a minor pullback after its advance got rejected at 1.2445, the recent completion of a golden cross between the 50- and 200-day simple moving averages (SMAs) has induced upside pressure.

The short-term oscillators currently suggest that bullish forces are reigning supreme. Specifically, the RSI is hovering above its 50-neutral mark, while the MACD histogram is strengthening above both zero and its red signal line.

Should the positive momentum intensify further, the pair could initially test the recent rejection region of 1.2445. Breaking above that zone, the bulls could aim for the May peak of 1.2666. Further advances could then come to a halt at the 1.3000 psychological mark, which acted as strong support in March 2022.

On the flipside, bearish actions could send the price to challenge the recent support of 1.2241. Should that floor collapse, the January low of 1.1840 may curb potential declines. Diving lower, the pair might face the October resistance of 1.1645, which could act as support in the future.

Overall, GBPUSD seems to have the necessary momentum to resume its medium-term rebound. Therefore, a break above the recent rejection point of 1.2445 could confirm the bullish scenario.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.