Technical Analysis – USDCAD fortifies short-term bullish structure

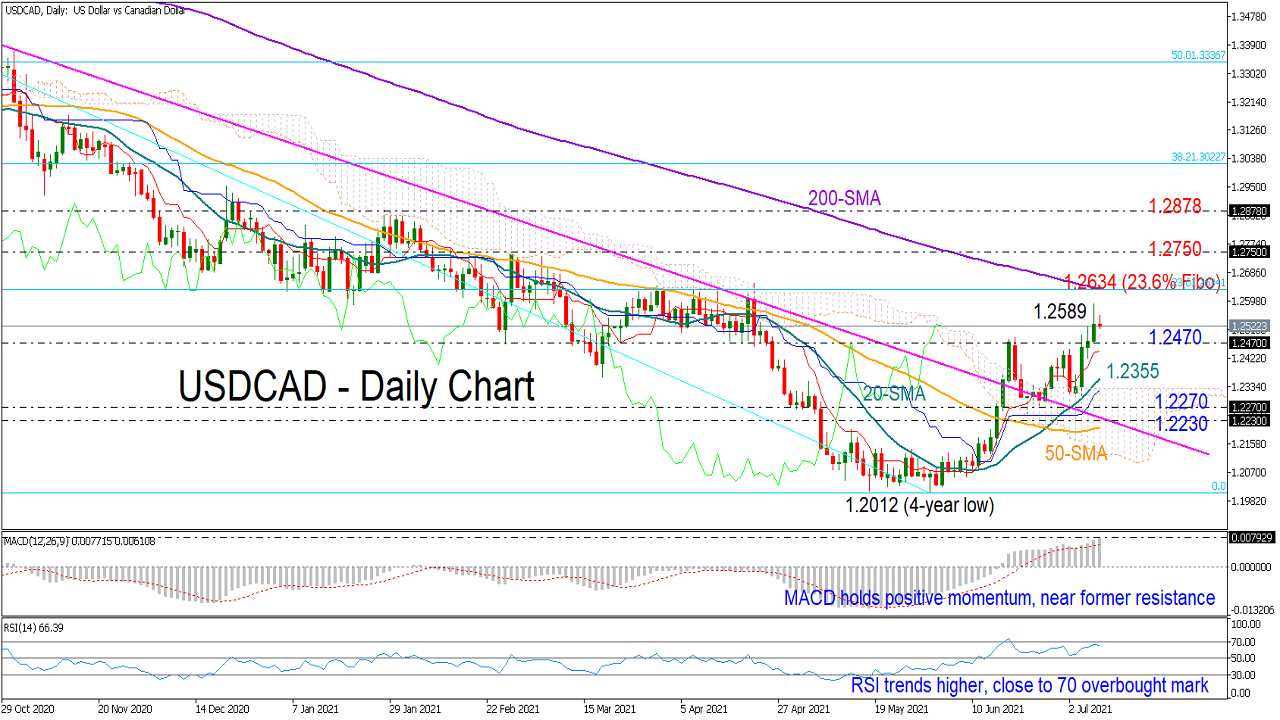

USDCAD charted a new higher high at 1.2589 on Thursday, signaling that the trendline cracked in June could be something more than temporary.

The bullish cross between the 20- and 50-day simple moving averages (SMAs) is endorsing the above narrative but technically, a sustainable move above the previous high of 1.2652 is needed to invalidate the long-term downtrend and hence bring new buyers into the market. The 200-day SMA and the 23.6% Fibonacci retracement of the March 2020 – May 2021 downfall are in the neighborhood as well at 1.2634, enhancing the upward burden in the area.

More advances are possible according to the momentum indicators. However, any upside corrections should be taken with a grain of salt as the MACD is currently hovering around a former resistance region and the RSI is in short distance from its 70 overbought mark, warning that a pullback, perhaps around 1.2650, could occur.

If that is the case, the pair could reverse to seek support near 1.2470, while lower the 20-day SMA at 1.2355 may stop the price from testing the 1.2270 level. The broken descending trendline and the 50-day SMA could also adopt a protective role slightly beneath at 1.2230 if downside pressures strengthen.

Alternatively, if the 1.2652 area proves easy to claim, the next obstacle could pop up near 1.2750, whereas a sharper upturn could head for January’s peak of 1.2880.

In brief, USDCAD looks to have set up for more increases in the near term, though room for improvement could be limited as the price is approaching overbought levels.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.