Turkish lira falls apart, what can turn the tide?

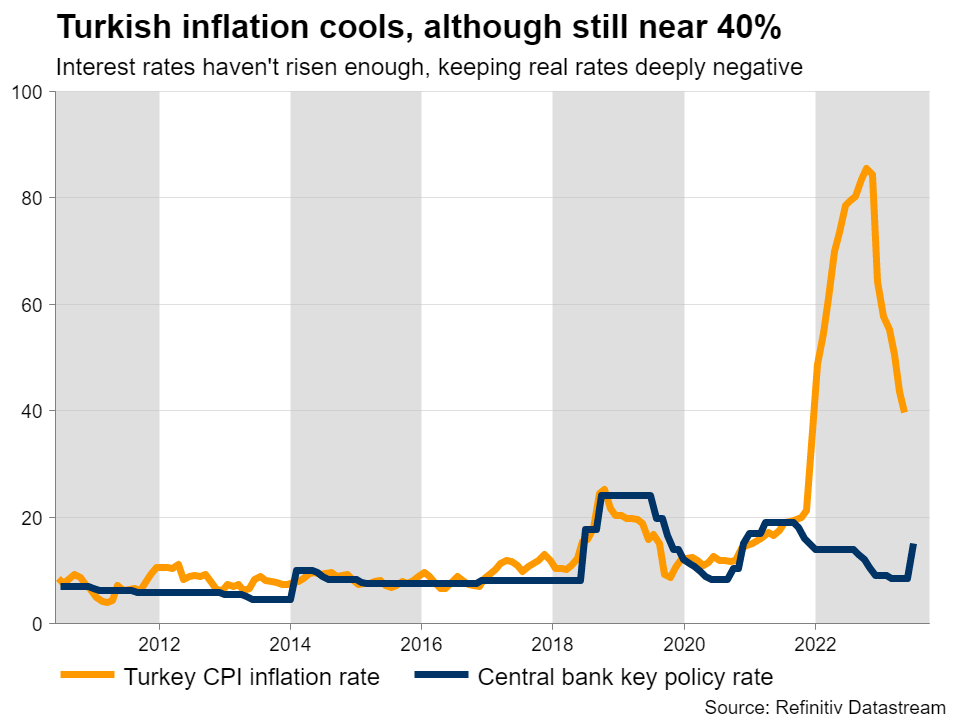

That’s only half the story, though. Another element that ravaged the lira was the central bank’s latest decision on interest rates. With a new governor coming in, there was rampant speculation about a massive increase in rates to fight runaway inflation. Some economists expected rates to be raised immediately to 25%, so when the central bank only lifted them to 15%, investors saw that as a huge disappointment. With inflation running around 40%, this move was seen as a ‘half measure’ that won’t be sufficient in cooling the economy down. Behind the downtrendTaking a step back, the lira’s downtrend is not a new phenomenon. The currency has been in decline for more than two decades, although the losses accelerated sharply after 2018 as inflation started to fire up and the nation’s deficits blew up. When inflation moves far higher but interest rates don’t follow suit, the result is that real interest rates fall deep into negative territory. That’s toxic for the lira because it discourages investors and consumers from holding it. Nobody wants to keep a currency that is constantly losing its value, if they are not compensated through high interest rates.

That’s only half the story, though. Another element that ravaged the lira was the central bank’s latest decision on interest rates. With a new governor coming in, there was rampant speculation about a massive increase in rates to fight runaway inflation. Some economists expected rates to be raised immediately to 25%, so when the central bank only lifted them to 15%, investors saw that as a huge disappointment. With inflation running around 40%, this move was seen as a ‘half measure’ that won’t be sufficient in cooling the economy down. Behind the downtrendTaking a step back, the lira’s downtrend is not a new phenomenon. The currency has been in decline for more than two decades, although the losses accelerated sharply after 2018 as inflation started to fire up and the nation’s deficits blew up. When inflation moves far higher but interest rates don’t follow suit, the result is that real interest rates fall deep into negative territory. That’s toxic for the lira because it discourages investors and consumers from holding it. Nobody wants to keep a currency that is constantly losing its value, if they are not compensated through high interest rates.  Many have attributed the central bank’s reluctance to raise rates to political pressure from President Erdogan, who has characterized high interest rates as “the mother and father of all evil”. The fact the central bank has changed its Governor four times over the last five years is a testament to this political arm-twisting, as Erdogan simply replaced any leaders that dared to raise rates much. Therefore, it can be argued the central bank has effectively lost its independence, leaving it unable to take the actions necessary to extinguish inflation. Even the new governor - who has a background as a Wall Street banker - could not break this spell. Making matters worse for the lira, Turkey runs a chronic current account deficit, which has swelled in recent years. That means the nation is a net-borrower, importing more than it exports and relying on capital flows from abroad to finance the difference. Over time, these deficits can exert massive downward pressure on a currency, especially if they keep widening.

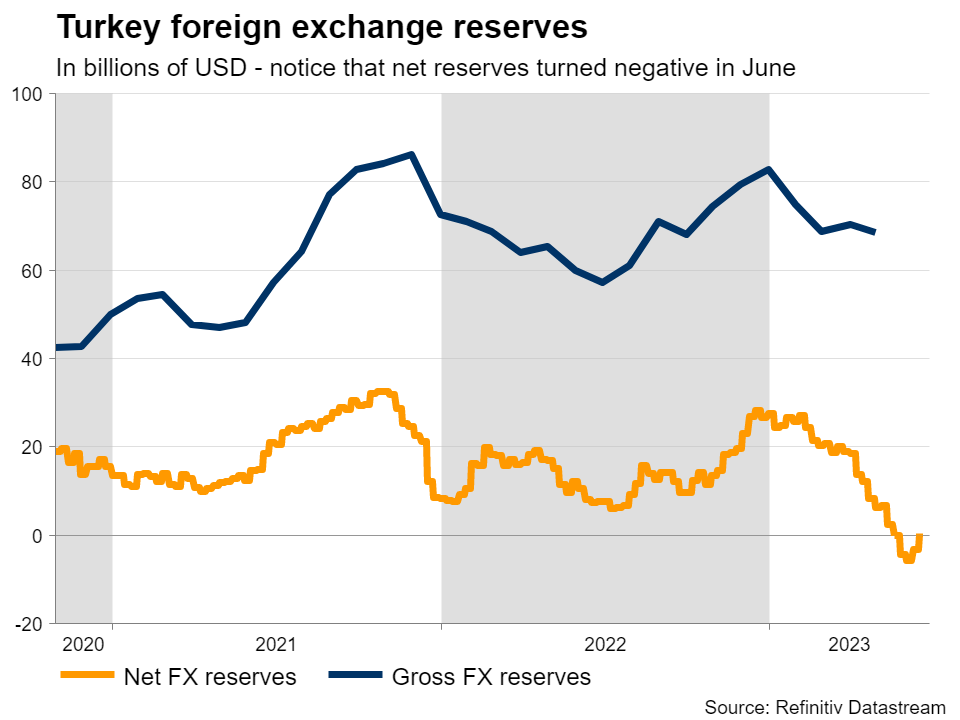

Many have attributed the central bank’s reluctance to raise rates to political pressure from President Erdogan, who has characterized high interest rates as “the mother and father of all evil”. The fact the central bank has changed its Governor four times over the last five years is a testament to this political arm-twisting, as Erdogan simply replaced any leaders that dared to raise rates much. Therefore, it can be argued the central bank has effectively lost its independence, leaving it unable to take the actions necessary to extinguish inflation. Even the new governor - who has a background as a Wall Street banker - could not break this spell. Making matters worse for the lira, Turkey runs a chronic current account deficit, which has swelled in recent years. That means the nation is a net-borrower, importing more than it exports and relying on capital flows from abroad to finance the difference. Over time, these deficits can exert massive downward pressure on a currency, especially if they keep widening.  The government has tried all sorts of unconventional tactics to stop the lira’s bleeding, such as making it more difficult to short the currency, introducing special savings accounts that compensate consumers if the lira falls sharply, and de facto confiscating foreign currencies from private banks to boost its FX reserves. These moves helped slow down the pace of depreciation for some time, alongside regular FX interventions, albeit at the cost of draining reserves. What’s next Looking ahead, there isn’t much that can turn the tides in the lira. What the currency desperately needs are higher interest rates, to slow down nominal growth and eradicate inflationary pressures, a painful process that will most likely involve a recession. Yet, President Erdogan seems determined not to let that happen. Slashing government spending could help to lower inflation, although this strategy might still be bearish for the lira initially, given its negative implications for economic growth. Plus, fiscal austerity would be a wildly unpopular move politically, making it seem even less likely.

The government has tried all sorts of unconventional tactics to stop the lira’s bleeding, such as making it more difficult to short the currency, introducing special savings accounts that compensate consumers if the lira falls sharply, and de facto confiscating foreign currencies from private banks to boost its FX reserves. These moves helped slow down the pace of depreciation for some time, alongside regular FX interventions, albeit at the cost of draining reserves. What’s next Looking ahead, there isn’t much that can turn the tides in the lira. What the currency desperately needs are higher interest rates, to slow down nominal growth and eradicate inflationary pressures, a painful process that will most likely involve a recession. Yet, President Erdogan seems determined not to let that happen. Slashing government spending could help to lower inflation, although this strategy might still be bearish for the lira initially, given its negative implications for economic growth. Plus, fiscal austerity would be a wildly unpopular move politically, making it seem even less likely.  That leaves structural reforms and regulatory changes, but admittedly, it’s highly doubtful any such policies would be powerful enough to rescue the currency. If there were easy solutions from a legislative perspective, they would have been implemented already. As such, it’s difficult to see a path towards a sustainable FX recovery, at least under the current political leadership. While a near-term correction seems plausible after such a dramatic downfall, it is unlikely to go very far, with real rates so deep in negative territory and FX reserves exhausted.

That leaves structural reforms and regulatory changes, but admittedly, it’s highly doubtful any such policies would be powerful enough to rescue the currency. If there were easy solutions from a legislative perspective, they would have been implemented already. As such, it’s difficult to see a path towards a sustainable FX recovery, at least under the current political leadership. While a near-term correction seems plausible after such a dramatic downfall, it is unlikely to go very far, with real rates so deep in negative territory and FX reserves exhausted. Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.