Daily Market Comment – All about nonfarm payrolls

- US employment report today crucial for dollar and stocks

- Sterling gains altitude as BoE strikes a more cheerful tone

- Gold hammered, Wall Street celebrates new records

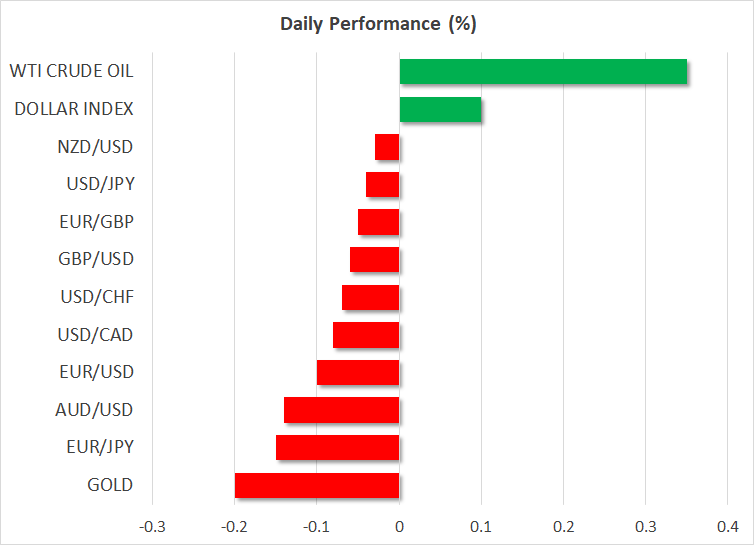

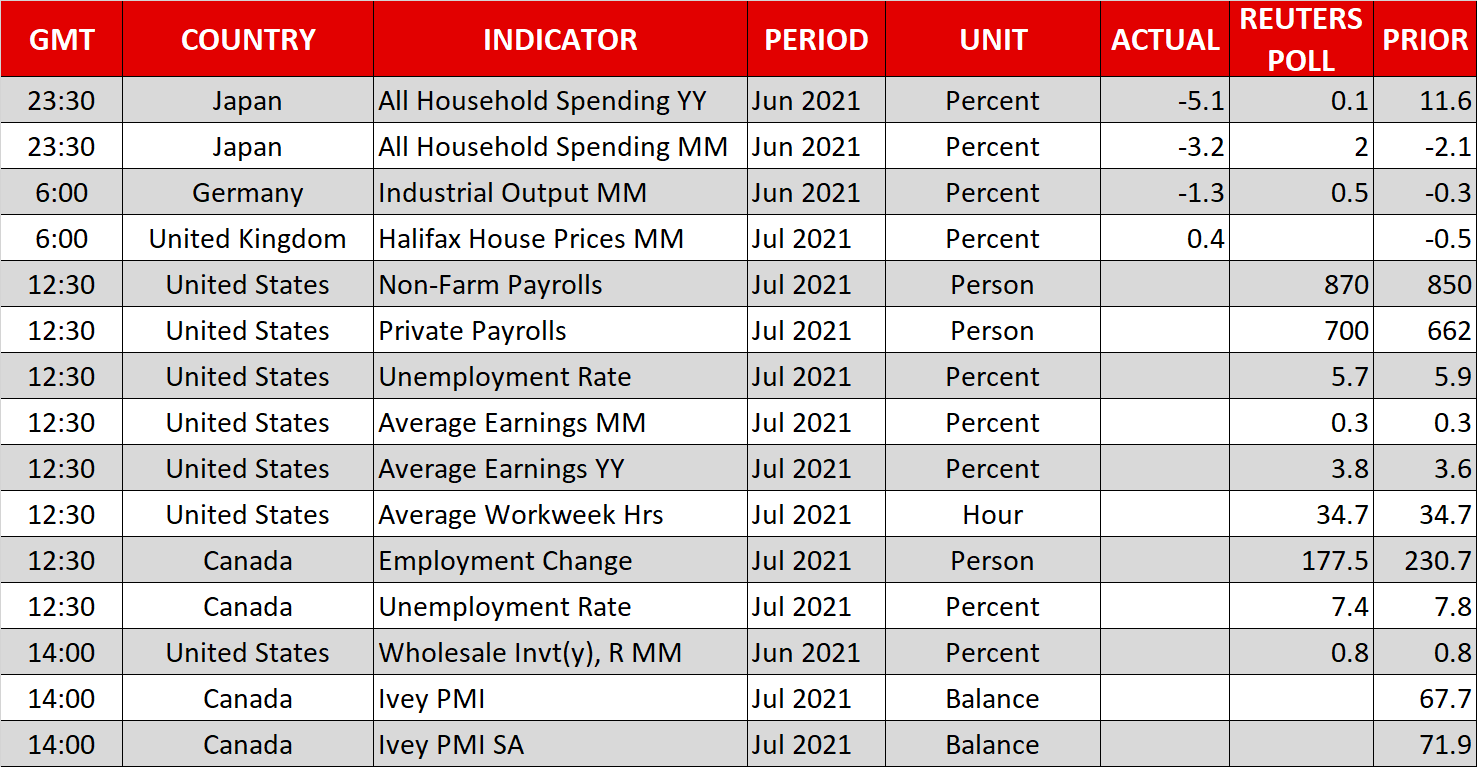

Dollar braces for nonfarm payrollsThe stakes are sky-high going into this US employment report. Fed officials have made it crystal clear that the most important element for the normalization of monetary policy is the labor market. Hence, the upcoming data could determine whether a September taper announcement is realistic or premature. Nonfarm payrolls are forecast to clock in at 870k in July, pushing the unemployment rate down two clicks to 5.7%. That said, there is tremendous uncertainty around these forecasts. The most optimistic analyst sees payrolls at 1.6 million, while the most pessimistic one anticipates only 350k. It’s really a guessing game, especially since the labor market tea leaves for the month were mixed. Arguing for a strong report were the ISM business surveys, both of which showed employment gains firing up. However, the ADP jobs report was disappointing and jobless claims rose during the NFP survey week, pointing to some weakness. The market reaction will depend on the magnitude of any surprise. Anything above 1.3 million for nonfarm payrolls could fuel bets for an earlier withdrawal of Fed stimulus, turbocharging the dollar but hitting stocks. On the flipside, a figure below 500k might sink the dollar and lift equities. Something in-between is unlikely to rattle markets much. Bear in mind that the S&P 500 has closed higher after every single employment report this year. Bad news for the economy is good news for stocks as investors price in more Fed liquidity for longer, while good jobs news is great for corporate bottom lines. All news is good news for stocks essentially. For equities to bleed, it would probably take an incredible jobs report that sparks panic about the Fed tapering immediately. BoE outlines normalization plansThe Bank of England kept policy unchanged yesterday but there were some fireworks. Only one member voted to end quantitative easing right away, which sent the pound a little lower on the decision. Markets expected two dissenters. However, the overall rhetoric was quite hawkish, so the pound soon recovered to trade higher overall. The Bank signaled that some monetary tightening will likely be needed if the economy continues to recover well, while the latest economic forecasts saw inflation hitting 4% this year. But the most crucial part was around asset purchases. Once the Bank Rate hits 0.5%, the Bank will stop reinvesting bonds that mature on its balance sheet, essentially draining liquidity out of the sterling market. This means that after two rate increases, the BoE will begin ‘quantitative tightening’ like the Fed did back in 2017-2019, which is great news for the pound in the longer term. Stocks climb, gold struggles, Canadian jobs eyedThe party on Wall Street continues to rage, with both the S&P 500 and the Nasdaq closing at new record highs yesterday. The earnings season has been spectacular so far, reflecting the strength of the recovery. Looking ahead, the next major catalyst for equities is the $3.5 trillion reconciliation package that is currently being brewed in the Senate. Meanwhile, gold took a hit yesterday and remains under pressure early on Friday, suffering at the hands of a firmer US dollar and a recovery in real Treasury yields. A break either below $1790 or above $1835 is needed for bullion to escape its trading range. Finally, Canadian employment data will also be released today. Expectations are for another solid report, which could vindicate the Bank of Canada’s decision to keep trimming its asset purchases.

Dollar braces for nonfarm payrollsThe stakes are sky-high going into this US employment report. Fed officials have made it crystal clear that the most important element for the normalization of monetary policy is the labor market. Hence, the upcoming data could determine whether a September taper announcement is realistic or premature. Nonfarm payrolls are forecast to clock in at 870k in July, pushing the unemployment rate down two clicks to 5.7%. That said, there is tremendous uncertainty around these forecasts. The most optimistic analyst sees payrolls at 1.6 million, while the most pessimistic one anticipates only 350k. It’s really a guessing game, especially since the labor market tea leaves for the month were mixed. Arguing for a strong report were the ISM business surveys, both of which showed employment gains firing up. However, the ADP jobs report was disappointing and jobless claims rose during the NFP survey week, pointing to some weakness. The market reaction will depend on the magnitude of any surprise. Anything above 1.3 million for nonfarm payrolls could fuel bets for an earlier withdrawal of Fed stimulus, turbocharging the dollar but hitting stocks. On the flipside, a figure below 500k might sink the dollar and lift equities. Something in-between is unlikely to rattle markets much. Bear in mind that the S&P 500 has closed higher after every single employment report this year. Bad news for the economy is good news for stocks as investors price in more Fed liquidity for longer, while good jobs news is great for corporate bottom lines. All news is good news for stocks essentially. For equities to bleed, it would probably take an incredible jobs report that sparks panic about the Fed tapering immediately. BoE outlines normalization plansThe Bank of England kept policy unchanged yesterday but there were some fireworks. Only one member voted to end quantitative easing right away, which sent the pound a little lower on the decision. Markets expected two dissenters. However, the overall rhetoric was quite hawkish, so the pound soon recovered to trade higher overall. The Bank signaled that some monetary tightening will likely be needed if the economy continues to recover well, while the latest economic forecasts saw inflation hitting 4% this year. But the most crucial part was around asset purchases. Once the Bank Rate hits 0.5%, the Bank will stop reinvesting bonds that mature on its balance sheet, essentially draining liquidity out of the sterling market. This means that after two rate increases, the BoE will begin ‘quantitative tightening’ like the Fed did back in 2017-2019, which is great news for the pound in the longer term. Stocks climb, gold struggles, Canadian jobs eyedThe party on Wall Street continues to rage, with both the S&P 500 and the Nasdaq closing at new record highs yesterday. The earnings season has been spectacular so far, reflecting the strength of the recovery. Looking ahead, the next major catalyst for equities is the $3.5 trillion reconciliation package that is currently being brewed in the Senate. Meanwhile, gold took a hit yesterday and remains under pressure early on Friday, suffering at the hands of a firmer US dollar and a recovery in real Treasury yields. A break either below $1790 or above $1835 is needed for bullion to escape its trading range. Finally, Canadian employment data will also be released today. Expectations are for another solid report, which could vindicate the Bank of Canada’s decision to keep trimming its asset purchases.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.