Daily Market Comment – Biden leads as Trump begins legal fight; dollar eases, stocks surge

- Biden edges closer to the White House but faces legal battles as Trump not giving up

- Markets undaunted by election stalemate, see good and bad in all outcomes

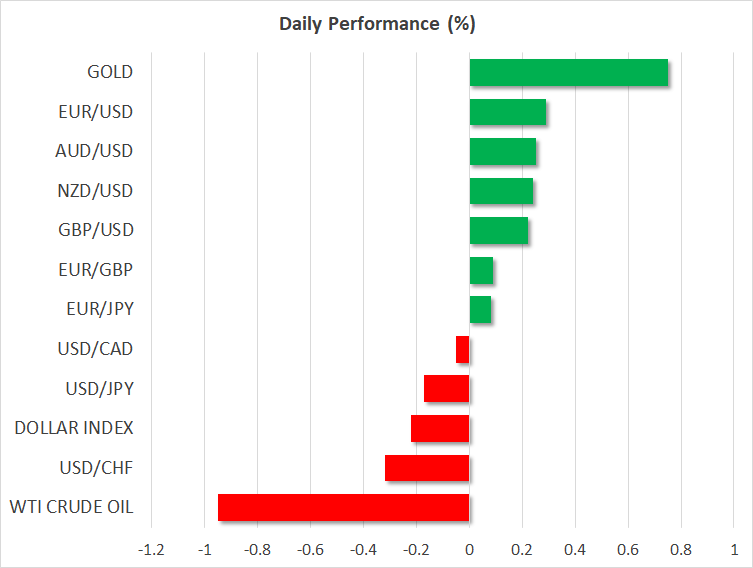

- Dollar near lows as Treasury yields extend slide, stocks shine in post-election rally

- Pound lifted by fresh BoE stimulus; less room for surprises by the Fed

World holds breath in tightest election race ever

World holds breath in tightest election race everDemocratic nominee Joe Biden was one state away from victory early on Wednesday as counting continued across the United States to determine the winner of the 2020 presidential election. As things stand, Biden could secure enough electoral college votes by winning Nevada where he’s currently in the lead, whereas Trump would need to win all remaining states in order to reach the magic number of 270. Even on that assumption there are some question marks as Arizona has not been formally called for Biden and may yet slip away to Trump.

However, the remaining electoral college votes are not the only thing standing in the way of Biden taking over the White House as the Trump campaign has not wasted any time and launched legal challenges in three states, adding to the two states where legal proceedings have already begun. Trump is also demanding a recount in Wisconsin, which the Democrats flipped.

If the final votes confirm a projected win for Biden, Trump is likely to explore all legal avenues available. But other than state-by-state litigation, it is unclear whether Trump can take his fight directly to the Supreme Court.

Investors certainly don’t seem to think so judging by the market reaction. Aside from that, there is a growing consensus among traders that the mounting legal actions will only delay the inevitable should Trump lose as there is little evidence of electoral fraud.

Treasuries and stocks like the election messThe close election contest has led investors to unwind their pre-election trades that were driven by expectations of a ‘blue sweep’. Even if Biden wins, there is little hope of Democrats gaining a majority in the Senate and markets are now calibrating to the new reality of a Democratic president working together with a Republican-controlled Senate.

In practice, what that means is it will be extremely difficult for Biden to push through a large fiscal stimulus package. Hence, this is why investors are flocking back to the Treasury bonds they dumped just prior to the election, grinding yields sharply lower. But it also means the Fed will have to pull its weight more to support the economy and more importantly for equities, it might not be possible for the Democrats to undo some of the Trump administration’s tax cuts without having control of the Senate.

Furthermore, a likely gridlock in Congress is good news for Wall Street’s tech giants as there would be less of a chance of lawmakers moving quickly on new legislation to regulate the industry.

The tech-heavy Nasdaq Composite surged by 3.9% on Wednesday and futures were pointing to a further 2% gain at today’s open. Asian and European shares also rallied, shrugging off the political uncertainty in Washington.

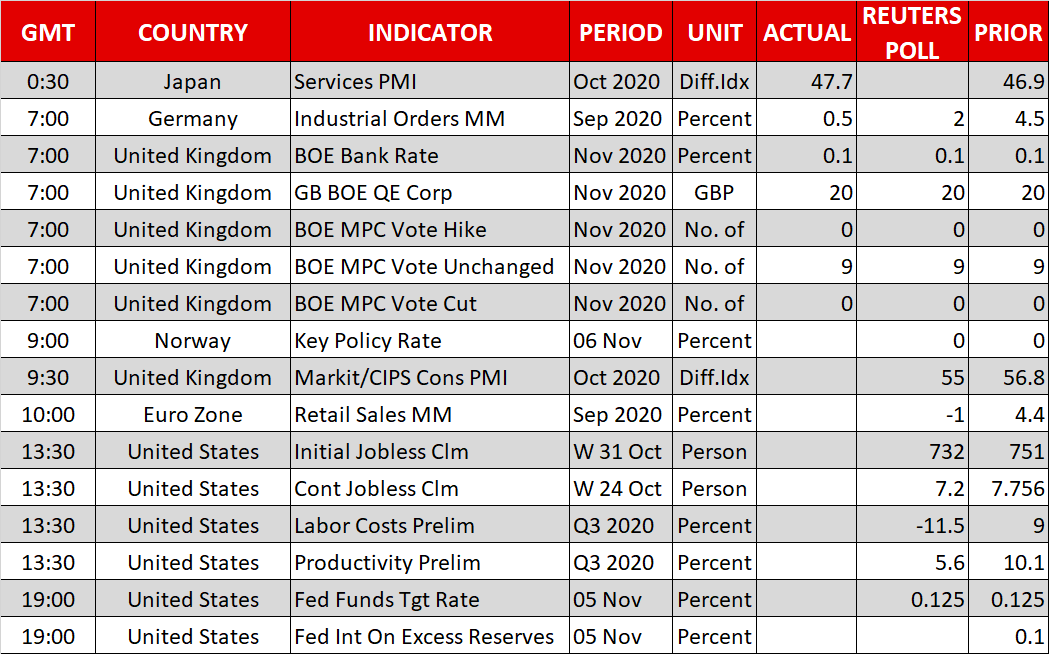

BoE joins RBA in second wave stimulus, Fed unlikely to follow suitThe Bank of England took markets by surprise on Thursday by announcing a bigger-than-expected increase to its asset purchase program, ramping it up by £150 billion instead of the forecasted £100 billion. There was no update on the possibility of negative interest rates, but the fresh injection of stimulus cheered the pound amid the downgraded economic forecasts on the back of the new lockdown restrictions in Britain.

Sterling firmed above $1.30 and the euro benefited too, rising by 0.5% on expectations that the European Central Bank will too boost its asset purchases in December.

The BoE is the second central bank this week to loosen monetary policy after the Reserve Bank of Australia cut rates and expanded QE on Tuesday. The spotlight is now on the Federal Reserve, which is due to announce its decision at 19:00 GMT.

However, with the US election still hanging in the balance, it’s highly unlikely the Fed will do anything more than just acknowledge the increased downside risks to the economy. Besides, the US recovery has yet to show significant signs of strain like the Eurozone's and the UK's and so the Fed can afford to take the time to assess the situation.

Nevertheless, should Chair Powell sound more downbeat than expected, that could pressure the US dollar, which is already on the backfoot today as some of the election jitters ease. The greenback has slid to a more than one-week low against a basket of currencies, helping gold make a decisive break above the $1900/oz level.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.