Daily Market Comment – Biden unveils infrastructure plan, OPEC meets

All eyes on infrastructure and taxes

All eyes on infrastructure and taxesThe threat of higher taxes in America hasn't spooked financial markets so far, but this serenity will be tested today at around 20:00 GMT, when President Biden unveils the details of his ambitious infrastructure plan. The latest reports suggest the package will cost a little over $2 trillion, partially funded by raising taxes on businesses and investments.

Specifically, the corporate tax rate could be hiked to 28% from 21% currently, while capital gains on large investments might be taxed in a progressive manner like regular income, with the rate scaling higher as the amount itself increases. Payroll taxes on the highest income earners could be increased a shade too.

The striking part is how well markets have absorbed these leaks. Signals for higher corporate taxes after decades of taxes being slashed would normally wreak havoc in stocks, but investors remain tranquil. This might reflect expectations that the final package will be watered down in Congress, and that the money raised through taxes will be used to fund productive investments, ultimately benefiting the economy.

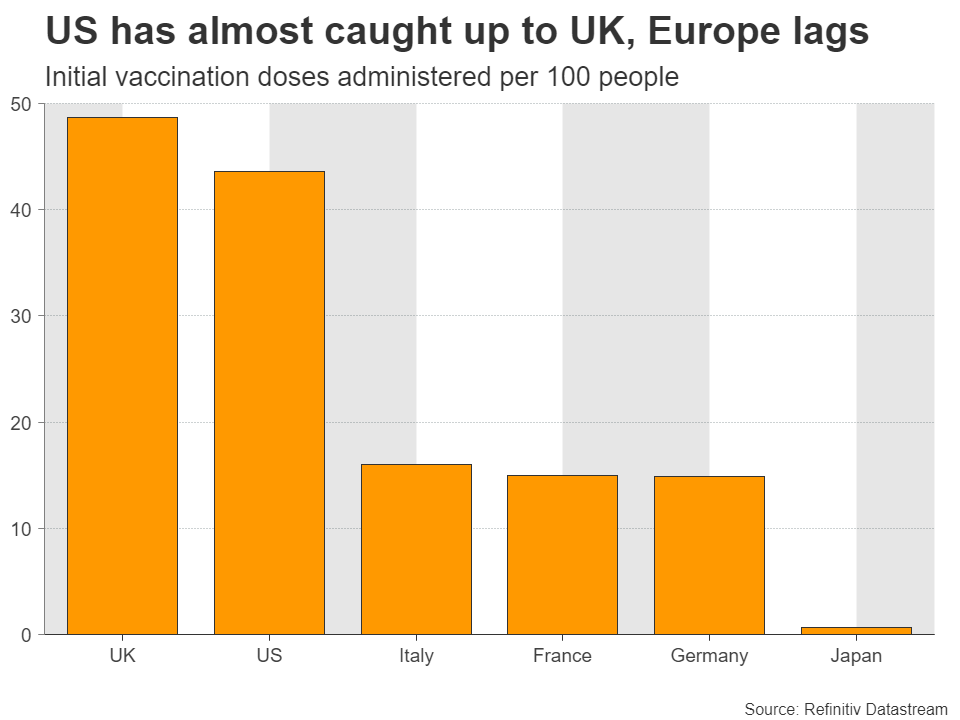

Still, the actual details could be crucial. How big is the final price tag, and how much will taxes be hiked to offset it? If the plan is only partially funded by new taxes, then the deficit will continue to balloon, softening the blow for markets. Even if the dollar and equities retreat as markets grapple with the threat of taxation, the overall trajectory for both seems positive in an environment where America out-vaccinates and out-recovers most nations.

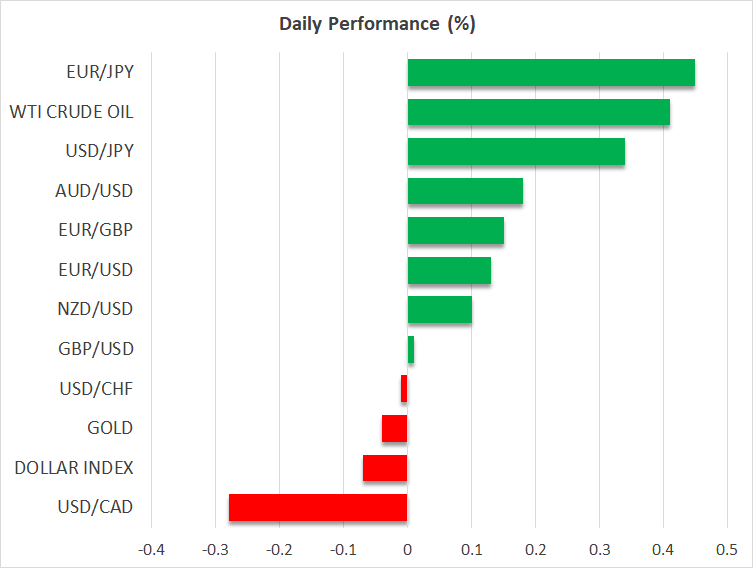

Dollar climbs, stocks cool, yen demolishedElsewhere, it was a relatively quiet session on Tuesday. The grand theme setting the tempo in the FX scene is the spike in Treasury yields. This is translating into a stronger US dollar as the reserve currency regains its yield advantage, powered by expectations that the Fed will be among the first central banks to raise interest rates again.

In contrast, the Japanese yen and the Swiss franc have been demolished by this rising yield environment, as rate differentials widen against them. The BoJ caps domestic yields from rising beyond a certain level and the SNB boasts the lowest rates globally. Both the yen and franc appear to have reclaimed their old role as 'funding currencies', whereby investors borrow in a low-yielding regime to invest in higher-yielding assets abroad.

The euro is another popular funding currency that's likely to keep struggling. Europe has fallen way behind in the global immunization race, several economies are still shut down, and government spending pales in comparison to America. It is difficult to imagine what can turn this narrative around.

In equities, the S&P 500 retreated a touch but remains within breathing distance of its record highs. In this sense, the prospect of higher corporate and capital gains taxes doesn't seem fully priced in yet, so there might be scope for a pullback. That said, with almost 45% of Americans having received a vaccine jab and an overload of federal spending in the pipeline, any correction could be short-lived.

OPEC meets, barrage of data coming upIn energy markets, there's an OPEC meeting today. The cartel and its allies are unlikely to unwind their supply cuts as global demand is still far too fragile to absorb any meaningful increase in oil production. If the supply cuts are indeed extended, there might be a positive but minor reaction in oil prices.

Meanwhile, gold has been battered and bruised by the stronger dollar and rising Treasury yields. A break below the $1676/ounce lows could be devastating.

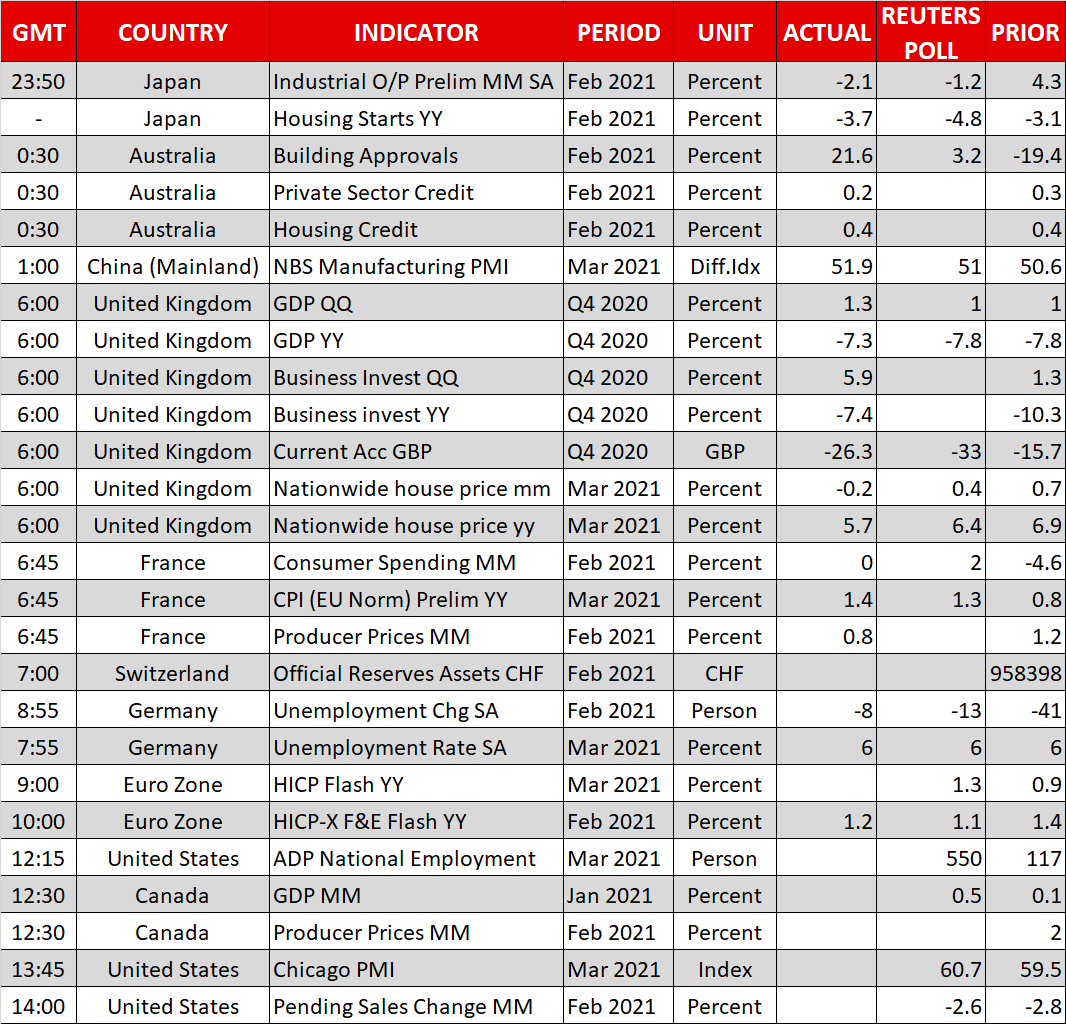

Finally, there's a barrage of key data due out of the Eurozone, America, and Canada.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.