Daily Market Comment – BoE clips pound’s wings, equities brace for turbulence

- Sterling capsizes after BoE opens door to negative rates

- Fed disappointment torments equities, but dollar doesn’t get the memo

- Market turmoil might continue today amid major option expiries

- Crude oil stages heroic comeback on supply hopes

Bank of England does another policy U-turn

Bank of England does another policy U-turn The BoE injected another dose of volatility into British assets yesterday after it announced that it is studying the implementation of negative interest rates, just six weeks after it downplayed this policy as ineffective. It seems that some political turbulence and a spike in covid infections can work magic in making an policy attractive all of a sudden.

The pound slipped as investors ramped up their easing bets. Markets now assign an 80% probability for a quarter-point rate cut by August next year. Admittedly, whether the BoE ventures into the realm of negative rates will depend mostly on how the Brexit saga plays out. A no-deal scenario for instance would all but ensure rates are headed lower, as the central bank does all it can to avoid a double-dip recession.

With the BoE out of the way, it’s all about Brexit again. The road to a trade deal looks full of twists and turns, though not impossible as there has been some progress lately, most notably on fisheries. While the coming weeks might be packed with drama as the political posturing intensifies, an eleventh-hour deal still seems more likely than not. From a purely game theory perspective, neither side can afford to throw their economies back into the meat grinder that would be a no-deal Brexit, deepening the scars the pandemic has left.

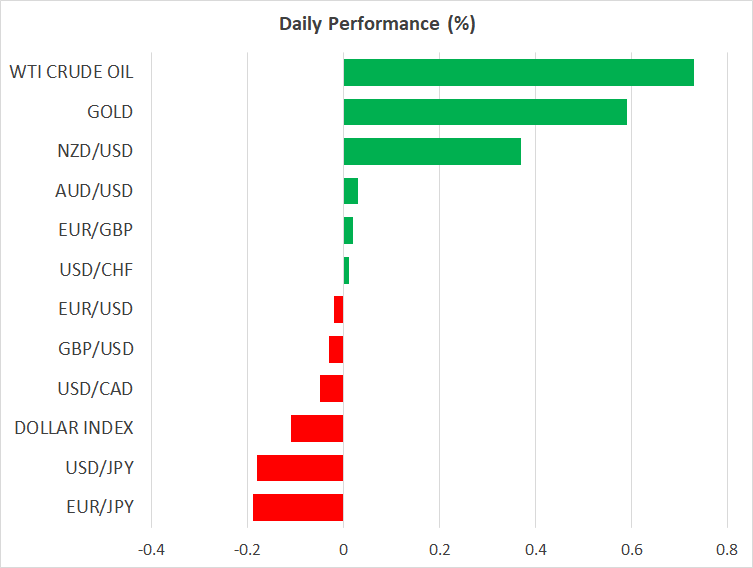

Fed frustration keeps stocks heavy, but dollar sinks tooWall Street was in a grumpy mood yesterday, frustrated that the Fed did not raise its stimulus dose right here and now. The S&P 500 fell 0.8%, with a late-session rally keeping the losses in check. The Nasdaq 100 was even heavier, shedding 1.5% amid a rout in tech darlings.

The odd one out was the dollar, which surrendered its Fed-inspired gains to trade lower despite the risk-off atmosphere. The reserve currency’s utter inability to sustain a rally echoes just how negative markets are on its longer-term prospects, as for the Fed to succeed in its fight to lift inflation the dollar must be a casualty. Don’t fight the Fed?

The turmoil might not be over yet as today is quadruple witching day, where futures and options on stocks and indices all expire. This often leads money managers to recalibrate their exposure to equities, fueling volatility in the process amid some ‘forced’ rebalancing. That said, any technical breaks today should be taken with a pinch of salt as they might simply reflect flows and position squaring, not swings in investor sentiment.

Wobbles now, but long term is brightAll told, while there are some near-term risks surrounding equity markets, like election uncertainty and the prospect of the US recovery stalling without another relief package, it’s difficult to be pessimistic on the broader path. Consider for a moment the scenario where a covid vaccine is developed and distributed by mid-2021, but rock bottom interest rates stay with us until 2024. It’s a jackpot for risky assets – the best of all worlds.

Furthermore, Trump and House Speaker Pelosi have been coming closer in the stimulus negotiations lately. It wouldn’t be unthinkable to see some deal before the end of the month that ‘surprises’ markets. Otherwise, it might be a tough six weeks until the election.

Crude back in vogue, Fed-speak in focusIn energy markets, oil prices defied the gloomy mood to score major gains yesterday, after Saudi Arabia hinted that OPEC’s strategy of bringing more production online might be abandoned in an environment where demand is faltering.

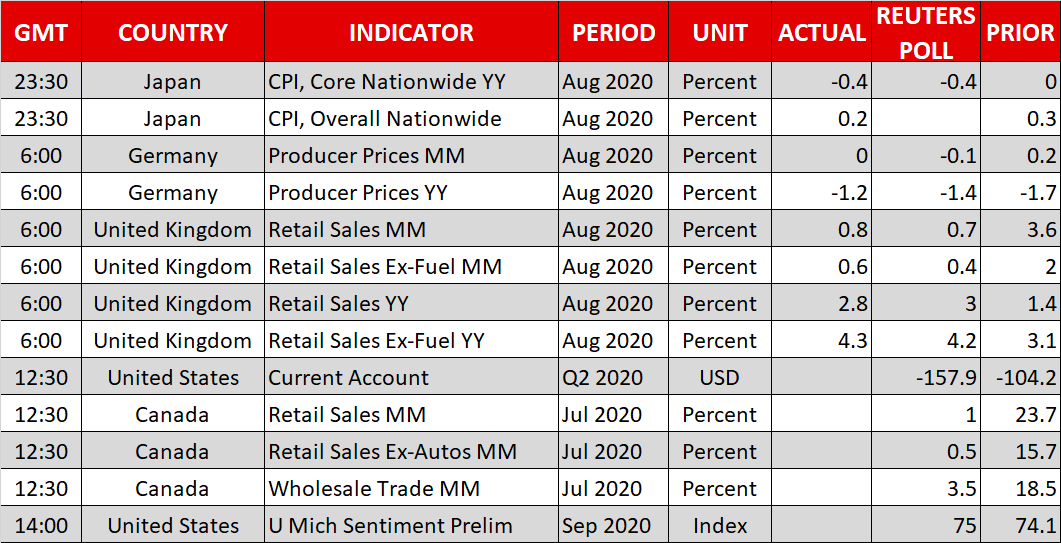

Finally, the calendar today includes retail sales from Canada and US consumer confidence data, though markets may focus more on central bank speakers. BoE chief economist Haldane delivers remarks at 11:00 GMT, before the Fed’s Bullard (14:00 GMT) and Bostic (16:00 GMT).

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.