Daily Market Comment – Bond markets come alive as tighter policy looms, stock rally eases

- Sovereign bond yields jump on optimism and rising prospect of policy tightening

- Equities rebound fizzles out as lingering doubts about Evergrande cuts party short

- Dollar gives up all post-Fed gains but limited bounce back for riskier currencies

Bond markets finally wake up to the sound of central banks

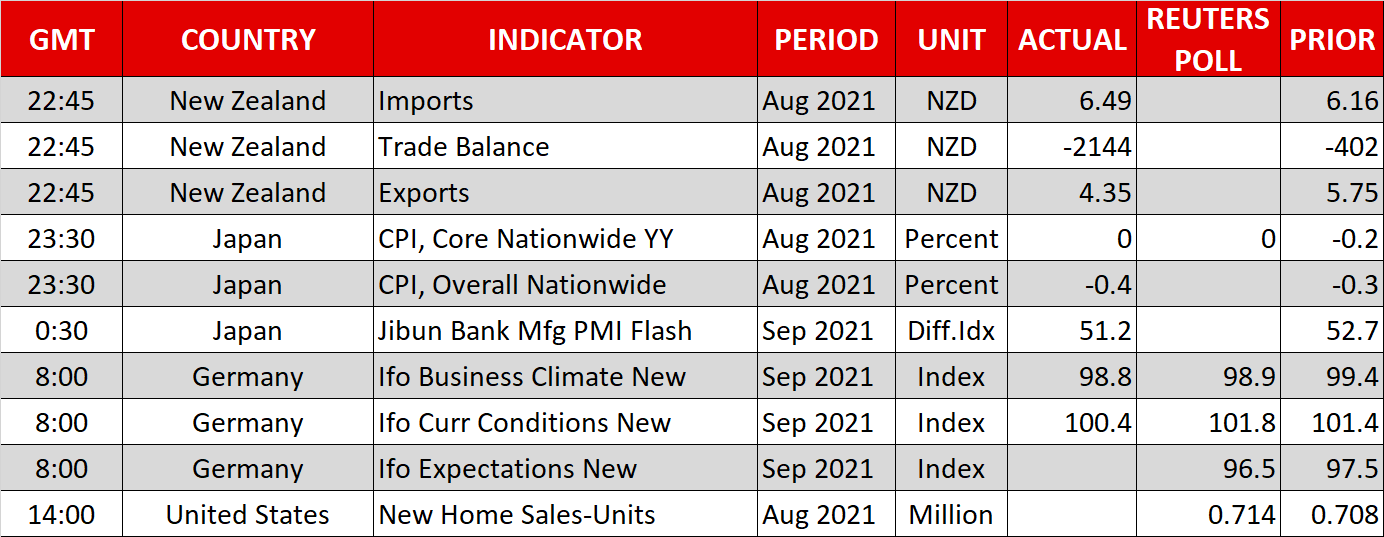

Bond markets finally wake up to the sound of central banksUS Treasury yields led the surge in global government bond yields amid a delayed response to the flagging of an imminent taper announcement by the Federal Reserve on Wednesday. Bond traders finally took notice of the global shift in monetary policy after both the Bank of England and Norges Bank followed up the hawkish soundbites at their respective meetings on Thursday.

The Norges Bank hiked its policy rate by 25 basis points, becoming the first major Western central bank to do so during the pandemic, while the Bank of England signalled the possibility of a rate increase in Q1 2022.

The yield on 10-year UK gilts shot up after the BoE meeting, hitting the highest since March 2020 today. However, with the Fed likely to keep buying bonds until the middle of next year, 10-year Treasury yields could only manage a 2½-month high of 1.4520%.

Higher yields and Evergrande woes dent stock rallyWall Street seemed unfazed by the initial spike in yields and the major US indices rallied for a second straight day on Thursday. Fed Chair Powell’s bullish take on the US economy, combined with the repeated message by world central banks that the supply constraints and consequent surge in inflation will be temporary, helped to revive optimism about the global growth outlook. Investors will be able to hear more from Powell later today when he speaks at 14:00 GMT.

The Dow Jones gained the most, closing up 1.5%, while the S&P 500 and Nasdaq Composite ended the day with gains of 1.2% and 1.0%, respectively. However, e-mini futures were in the red on Friday, with Nasdaq futures slipping the most. The jump in long-term borrowing costs is likely weighing on tech stocks with bloated valuations as yields extended their gains today.

However, ongoing uncertainty surrounding Evergrande’s liquidity problems is casting a shadow over the broader markets amid fears of a possible global contagion from the crisis. Most Asian stock markets closed lower today and European shares fell back as well at the open.

Evergrande missed an interest payment on its dollar bonds on Thursday, despite coming up with funds to settle a local bond payment. The company has 30 days to make the payment before defaulting but the lack of transparency around its financial health as well as about any potential state bail out by Chinese authorities is making investors nervous.

Rebound in risky FX falters despite soft dollarThe mood in currency markets was also somewhat dampened on Friday from the slight risk-off in equity markets, though the safe haven currencies were struggling to gain significant traction.

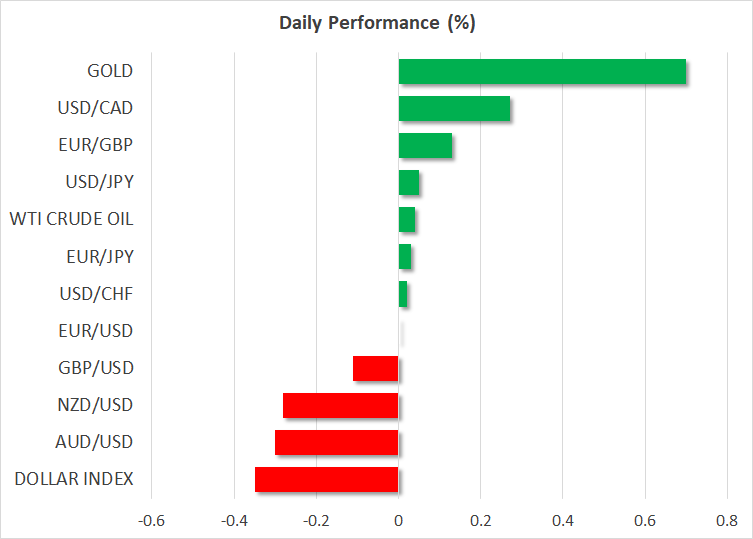

The US dollar edged up slightly from yesterday’s lows against a basket of currencies and the yen and franc were mixed. The greenback’s downside reversal from the immediate post-Fed boost hasn’t translated into much of a rebound for the risky commodity-linked dollars. The aussie, kiwi and loonie are not showing a clear direction in the aftermath of the FOMC meeting and all three were paring the previous session’s gains today.

The euro hovered near its highs, however, around $.1735, while sterling was seeking support from the $1.37 level. The pound got a strong lift from the Bank of England on Thursday as investors brought forward their expected timing of a rate hike, with interest rate futures indicating odds of more than 50% for a move in February 2022. But the downside risks for the British economy have been growing lately and traders don’t seem to share the same optimism as BoE policymakers. Hence, the boost to the pound would have been much more spectacular otherwise.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.