Daily Market Comment – Bond yields take a dive, prop up equities, but FX sidelined

- Bond yields plunge unexpectedly, signalling easing inflation anxiety

- US stocks near records but ECB, US CPI awaited for fresh drivers

- Dollar steady, loonie edges up ahead of BoC

US yield curve flattens: sign of confidence or trouble?

US yield curve flattens: sign of confidence or trouble?Government bond yields took an unexpected dive on Tuesday as a combination of strong auction demand, safe-haven flows and easing inflation worries boosted the bond market. The yield on 10-year US Treasuries slumped to a one-month low, hitting 1.513%. The 30-year yield also fell sharply and Eurozone, Australian and Japanese yields are some of the other notable movers. In the US, key parts of the Treasury curve – the spread between 10-year and 3-month notes and 10- and 2-year notes – were the flattest since March today.

A flattening yield curve is typically associated with weakening growth and inflation expectations, but ebbing inflation jitters are likely to be the main factor behind this pullback, which began in late March. The US yield curve steepened substantially once all the pandemic stimulus started flooding in and this is the first major retreat in this part of the curve since last summer.

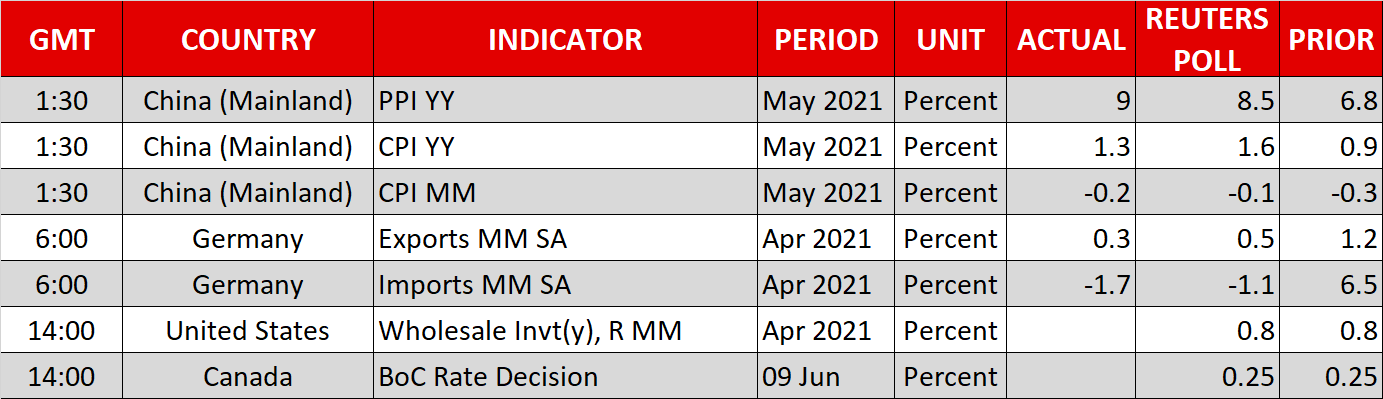

But as more and more data has come rolling in, markets have slowly been aligning their views with the Fed’s, which is that there is no reason at this point to think the current surge in inflation won’t be temporary.

That notion will be put to the test tomorrow when the latest CPI numbers are due in America, but for now, investors are more relaxed about the prospect that the major central banks won’t be in a hurry to withdraw all the stimulus.

US stocks outperform, with a little help from falling yieldsThe decline in Treasury yields have been a boon for many of Wall Street’s popular tech and growth stocks. Lower yields are just about the only thing justifying all the bloated valuations that ballooned from the injection of stimulus cash. Moreover, they are behind the Nasdaq’s latest rebound.

The Nasdaq Composite outperformed again on Tuesday, closing 0.3% higher, while the S&P 500 ended the day flat. Nasdaq futures are also leading the US market today.

However, stocks elsewhere around the world were mostly in the red on Wednesday and markets have generally been suffering from a lack of direction all week.

Yesterday’s internet outage that affected several news and government websites was cited as sparking some risk-off trades and that may have dampened the mood slightly, as well as exacerbated the inflows into bonds.

With the buying spree for sovereign bonds looking somewhat overdone, there’s a danger of a sharp reversal in the coming days, especially as the ECB meeting and US CPI data are coming up tomorrow.

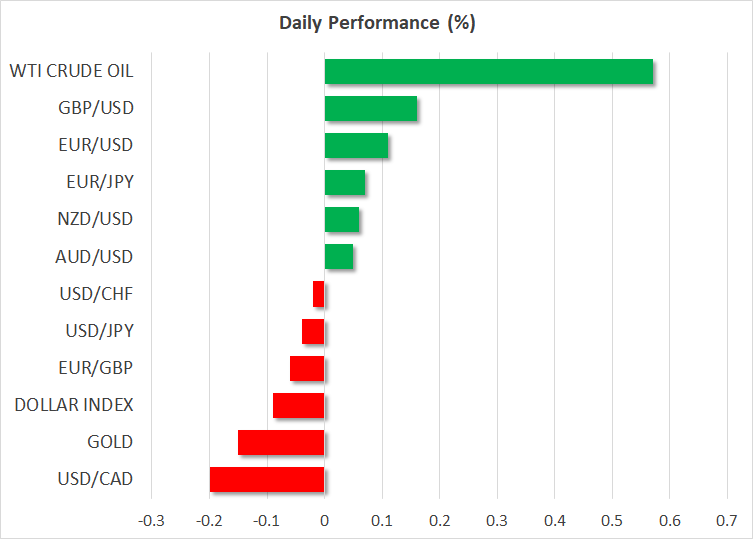

All calm in FX markets, pound and loonie breathe some lifeA spike in yields might resuscitate the US dollar, which has been drifting aimlessly in the past couple of days. The greenback barely flickered from yesterday’s record jump in US job openings in April that indicated the recent soft payrolls numbers were down to Americans unwilling to go back to work rather than because of a weak labour market.

The euro has also been stuck in a tight range this week and was last trading at $1.2185. The ECB is expected to stick to its dovish script when it announces its latest policy decision on Thursday, so the near-term prospects of euro/dollar breaking above $1.22 are low at the moment.

In contrast, the Bank of England appears more confident that the British economy will recover strongly and Chief Economist Andy Haldane hinted at “turning off the tap” for monetary policy support earlier today. The pound edged up to $1.4180 after his remarks, making it the best performer in the European session.

The Canadian dollar wasn’t far behind, however, firming to around C$1.2090 to the US dollar as investors anticipate the Bank of Canada also sounding upbeat about the Canadian economy when it announces its policy decision later today at 14:00 GMT.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.