Daily Market Comment – Commodity currencies in agony, stocks undecided

- Dollar stands tall as commodity FX continues to break down

- Big tech keeps US stocks afloat, Chinese markets sink

- All eyes on the Fed’s Jackson Hole symposium next week

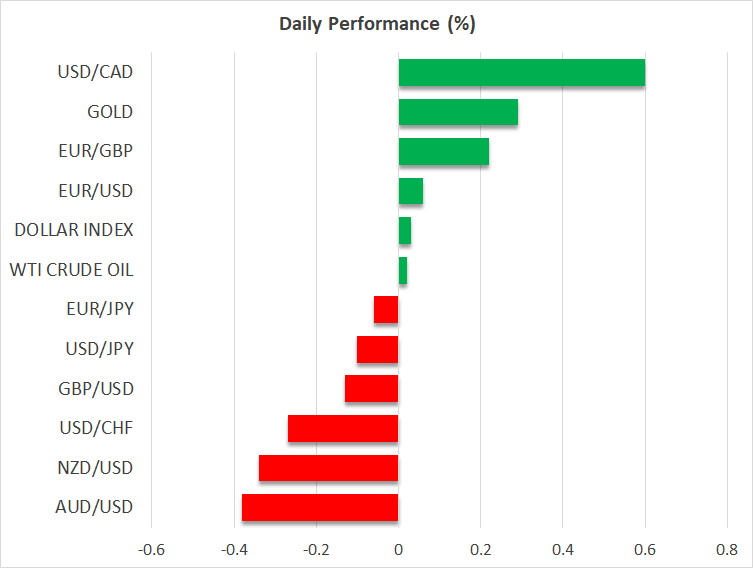

Commodity currencies bite the dustIt's been a wild week for financial markets, dominated by concerns that the Delta outbreak will put the brakes on the global economic recovery. Even though many of the major economies are protected by a vaccine shield, the fear is that the virus could cool demand in developing markets, which ultimately comes back to bite everyone. Adding fuel to the pessimism has been the relentless regulatory crackdown in China, where Beijing continues to tighten the screws on the tech sector. The nation just passed a strict data protection law, the latest in a long series of moves to align the Chinese economy with the party’s social values. All this is playing out against the background of a slowing Chinese economy, amid a fading credit impulse and new restrictions to battle the Delta variant. As a result, commodities and commodity-linked currencies have been taken to the cleaners, with the loonie, aussie, and kiwi all headed for a weekly loss of around 3% against the mighty dollar. Crude oil and iron ore prices tell the same story. While most charts are painting a scary picture right now, past episodes of covid-fueled panic didn’t last very long. This is almost a self-correcting mechanism. If virus fears escalate enough, there comes a point where investors begin to anticipate greater liquidity injections from central banks and more fiscal firepower from governments, which ultimately calms market nerves. That said, it might get even uglier before we reach that point. Wall Street fights backThe volatility in equity markets is starting to reach a crescendo. Wall Street managed to hang on for dear life on Thursday, with the major indices erasing some early losses to close virtually unchanged, propped up by tech heavyweights like Microsoft. However, futures are pointing lower again on Friday. While indices like the S&P 500 haven’t fallen much, there is a major sector rotation taking place under the hood. Small caps and many unprofitable ‘growth’ stocks have been demolished lately whereas tech titans have stood their ground, highlighting that quality tech has almost transformed into a defensive play during this crisis. The overall message seems clear. Small caps will either suffer from a global slowdown or from a withdrawal of Fed liquidity, as investors move higher along the quality spectrum. Neither will be as damaging for mega-cap US tech. Of course, China is a different beast. Tech stocks have taken heavy damage lately as Beijing continued its regulatory crusade, with the pain now spilling over into other sectors like healthcare and alcohol producers amid concerns the hammer will fall on those next. Hong Kong’s Hang Seng index lost almost 2% today to touch new lows for the year. Dollar awaits Powell’s signalsThe calendar is almost empty today, with the only noteworthy release being Canada's retail sales for July. It's been a tough week for the loonie despite the nation’s inflation rate rising further, as the currency realigned itself with suffering oil prices. On the other hand, all this pessimism has put the wind back into the dollar’s sails, which won the battle against some crucial technical levels across multiple charts and is now headed for a healthy weekly gain. Whether this lasts will depend on next week’s speech by Fed Chairman Powell at the Jackson Hole economic symposium. Will he lay the groundwork for a September taper announcement or will he play it slow? The answer will likely drive the dollar for now, even though in the big picture, it doesn’t matter much whether tapering is announced in September or November.

Commodity currencies bite the dustIt's been a wild week for financial markets, dominated by concerns that the Delta outbreak will put the brakes on the global economic recovery. Even though many of the major economies are protected by a vaccine shield, the fear is that the virus could cool demand in developing markets, which ultimately comes back to bite everyone. Adding fuel to the pessimism has been the relentless regulatory crackdown in China, where Beijing continues to tighten the screws on the tech sector. The nation just passed a strict data protection law, the latest in a long series of moves to align the Chinese economy with the party’s social values. All this is playing out against the background of a slowing Chinese economy, amid a fading credit impulse and new restrictions to battle the Delta variant. As a result, commodities and commodity-linked currencies have been taken to the cleaners, with the loonie, aussie, and kiwi all headed for a weekly loss of around 3% against the mighty dollar. Crude oil and iron ore prices tell the same story. While most charts are painting a scary picture right now, past episodes of covid-fueled panic didn’t last very long. This is almost a self-correcting mechanism. If virus fears escalate enough, there comes a point where investors begin to anticipate greater liquidity injections from central banks and more fiscal firepower from governments, which ultimately calms market nerves. That said, it might get even uglier before we reach that point. Wall Street fights backThe volatility in equity markets is starting to reach a crescendo. Wall Street managed to hang on for dear life on Thursday, with the major indices erasing some early losses to close virtually unchanged, propped up by tech heavyweights like Microsoft. However, futures are pointing lower again on Friday. While indices like the S&P 500 haven’t fallen much, there is a major sector rotation taking place under the hood. Small caps and many unprofitable ‘growth’ stocks have been demolished lately whereas tech titans have stood their ground, highlighting that quality tech has almost transformed into a defensive play during this crisis. The overall message seems clear. Small caps will either suffer from a global slowdown or from a withdrawal of Fed liquidity, as investors move higher along the quality spectrum. Neither will be as damaging for mega-cap US tech. Of course, China is a different beast. Tech stocks have taken heavy damage lately as Beijing continued its regulatory crusade, with the pain now spilling over into other sectors like healthcare and alcohol producers amid concerns the hammer will fall on those next. Hong Kong’s Hang Seng index lost almost 2% today to touch new lows for the year. Dollar awaits Powell’s signalsThe calendar is almost empty today, with the only noteworthy release being Canada's retail sales for July. It's been a tough week for the loonie despite the nation’s inflation rate rising further, as the currency realigned itself with suffering oil prices. On the other hand, all this pessimism has put the wind back into the dollar’s sails, which won the battle against some crucial technical levels across multiple charts and is now headed for a healthy weekly gain. Whether this lasts will depend on next week’s speech by Fed Chairman Powell at the Jackson Hole economic symposium. Will he lay the groundwork for a September taper announcement or will he play it slow? The answer will likely drive the dollar for now, even though in the big picture, it doesn’t matter much whether tapering is announced in September or November.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.