Daily Market Comment – Dollar and yields retreat as S&P 500 smashes 4,000 level

- Biden’s tax increases dampen Treasury yields, dollar slips back

- S&P 500 hits new record above 4,000 amid recovery hopes, NFP eyed

- Oil likes OPEC+ plans to gradually ease supply curbs

Dollar on the backfoot ahead of NFP

Dollar on the backfoot ahead of NFPThe US dollar was struggling to hold onto to its weekly gains after falling sharply on Thursday on the back of the slide in Treasury yields. The retreat in long-dated yields comes after President Biden said his $2 trillion infrastructure plan would be paid for entirely by increases in corporate taxes, alleviating fears that the massive spending would stoke inflation and overburden the US economy with debt.

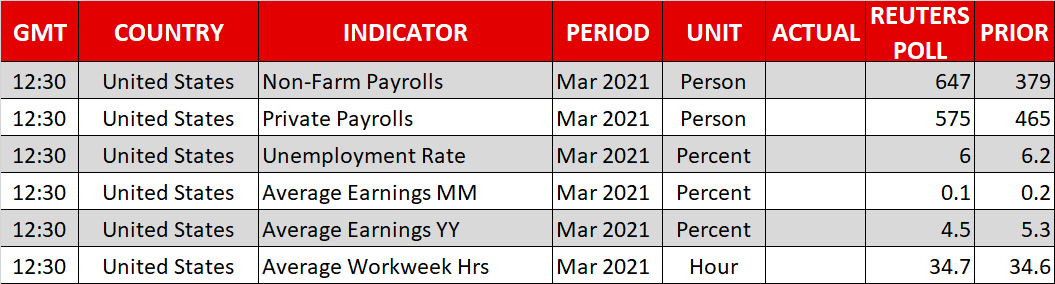

The 10-year yield had dropped to 1.67% on Friday, though the dollar was attempting to move off its lows and its index against a basket of currencies was almost flat after the Asian close. The greenback could get a chance to bounce back later in the session if the March nonfarm payrolls report (due at 13:30 GMT) smashes expectations amid some predictions of a bumper month for America’s labour market. Otherwise, the dollar is on track to finish the week with only marginal gains.

Optimism lifts S&P 500 to new all-time highAlthough the scope of Biden’s proposed tax hikes was far greater than what many investors were anticipating, the infrastructure plan should nevertheless provide a substantial boost to the United States’ long-term economic prospects. This could be one explanation as to why equity traders appear to have taken the planned increase in the corporate income tax rate from 21% to 28% in their stride. But a more likely reason is that markets think it will be difficult for the Democrats to push ahead with big tax hikes given the scale of opposition by the Republicans as well as many business groups.

In the meantime, yesterday’s upbeat manufacturing data has added to the optimism about the recovery, while softer-than-expected weekly jobless claims have eased fears about an overheating economy that would prompt the Fed to start tapering early. The ISM manufacturing PMI hit a 37-year high in March even as initial jobless claims unexpectedly rose in the week ending March 27.

Stocks revelled in the optimism, with the S&P 500 soaring to record highs to close above the 4,000 level for the first time ever. The Nasdaq Composite also rallied, closing 1.8% higher. But the Dow Jones was up just 0.5% amid signs of some unwinding of the recent rotation out of tech and into value and cyclical stocks.

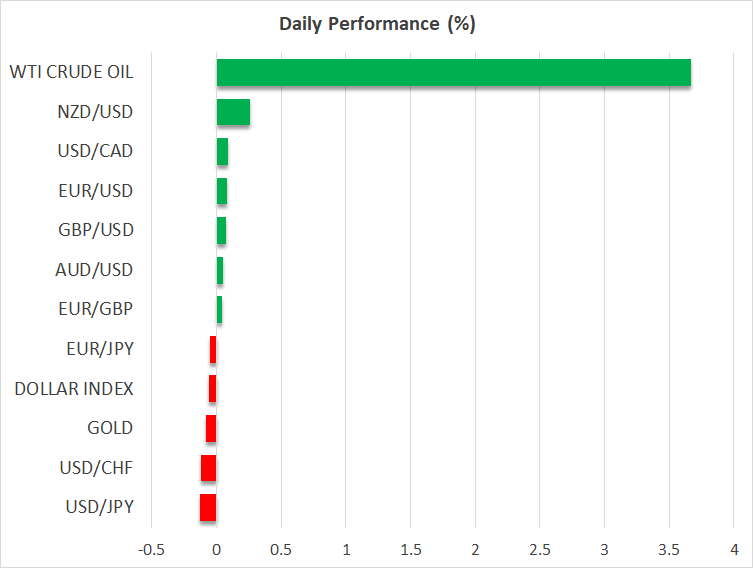

Oil surges, but all calm in FX sphereWith stock markets across Europe and North America closed today for Good Friday, FX markets were in a calm mood. The Australian dollar was steadier after yesterday’s powerful rebound from 3-month lows. The euro and pound also benefited from the dollar’s pullback but were flat today and only the kiwi managed to extend its gains.

In commodities, gold lost some steam after two days of strong gains when it rallied back above the $1,700/oz level. But oil posted a surprise reversal on Thursday, jumping by more than 3%, after OPEC and its allies announced a gradual lifting of output quotas. OPEC+ producers decided to keep April output at March levels but raise it by 350,000 bpd in May and June, and by a further 450,000 bpd in July.

Although the production boost was not expected to be agreed at the April meeting, especially as Europe is facing a prolonged period of national lockdowns, the announcement seems to have brought some certainty to the supply outlook even though the demand picture remains clouded. But judging by the reaction in oil markets, investors are betting that demand will recover strongly in the second half of the year and more than offset the planned increases in supply.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.