Daily Market Comment – Dollar catches a bid; Johnson’s tax plan spooks pound

- Dollar stretches post-NFP rebound as yields creep up

- UK looks to tax hikes to cover Covid costs, pound slips to one-week low

- Loonie struggles ahead of Bank of Canada decision

Dollar firms as November taper bets intensify

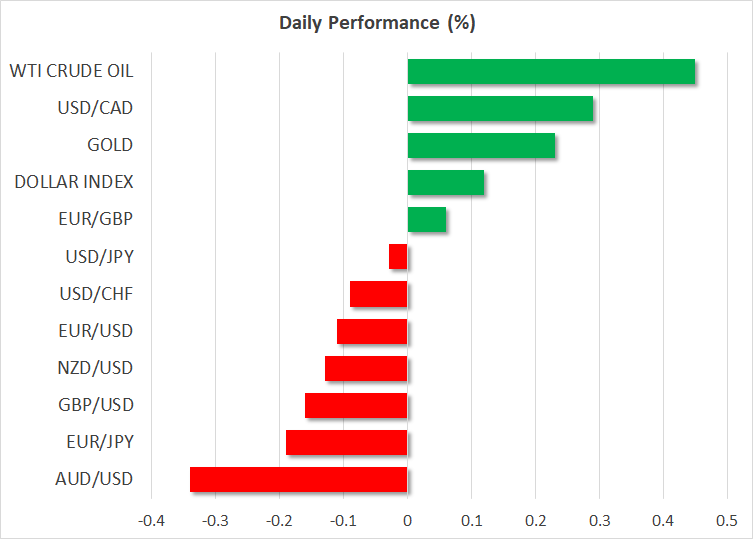

Dollar firms as November taper bets intensifyThe US dollar recouped more lost ground from the late August selloff as investors grew increasingly doubtful about whether Friday’s softer-than-expected jobs report would derail the Fed’s taper timeline. However, even though the Fed will likely still go ahead with tapering its monthly asset purchases later this year, markets are a little more worried about the inflation outlook.

Not only do the supply bottlenecks and shortages not seem like they will get resolved anytime soon, meaning high inflation becomes stickier over time, but a slower recovery of the labour market might keep the Fed active in the bond market for longer, further fueling price pressures.

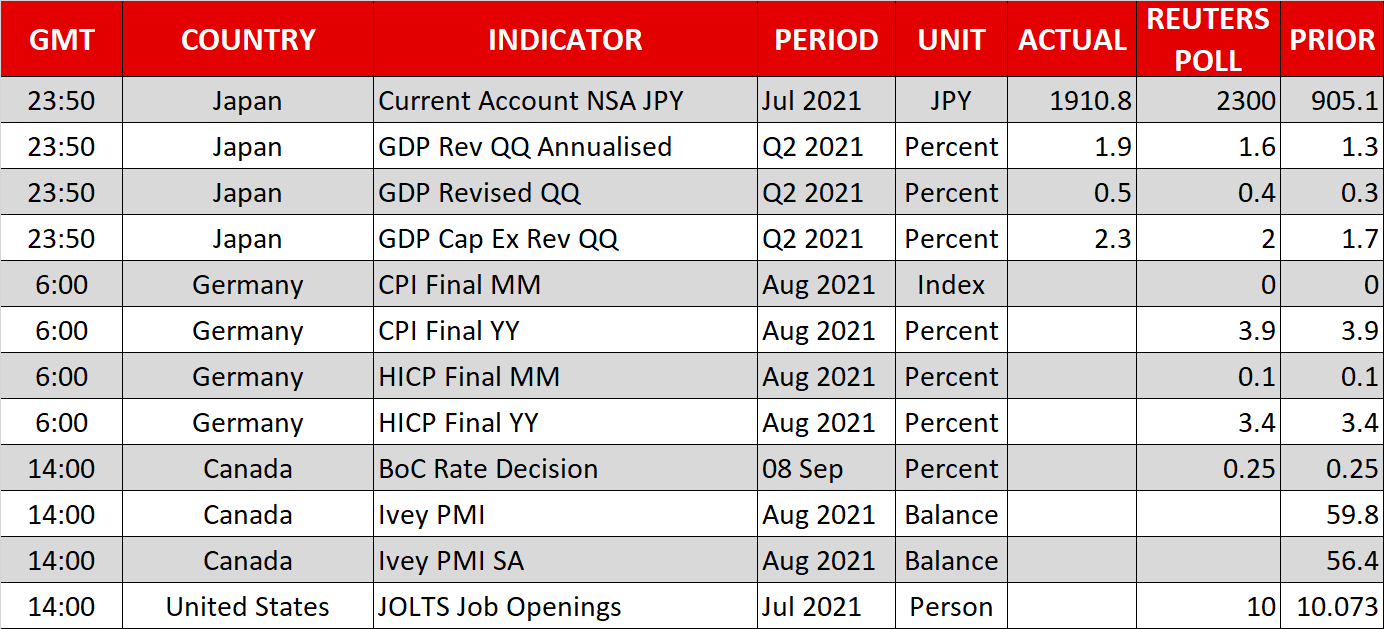

Inflation fears could be behind the unexpected pickup in Treasury yields since Friday. The 10-year Treasury yield scaled an eight-week high of 1.3850% on Tuesday but had eased to around 1.35% today.

The dollar index also pulled back slightly after touching one-week highs in Asian trade. It was last quoted at 92.66. Investors will be keeping an eye on Fed speakers over the next 48 hours, starting with the New York Fed’s Williams later today. Earlier, Bullard reiterated his call for the Fed to begin tapering in an interview with the Financial Times.

Gold tumbles, oil steadies but loonie slips ahead of BoCHigher yields and the resurgent dollar weighed heavily on gold on Tuesday, which slumped to a 1½-week low of $1791.90/oz. The precious metal was attempting to reclaim the $1,800 level today but whether it succeeds might depend on how strongly Fed officials back an immediate start of tapering.

Oil prices were heading higher too on Wednesday, supported by a sluggish restart of operations of oil producers in the Gulf of Mexico following the shutdowns caused by Hurricane Ida. However, this failed to lift the Canadian dollar, which slid further today, breaching the C$1.27 per US dollar level.

The Bank of Canada is expected to keep policy unchanged when it announces its decision at 14:00 GMT. Although the Canadian recovery has picked up speed lately and Friday’s employment data will likely confirm this, expectations of a more cautious BoC due to the global headwinds from the Delta variant could be holding the loonie back.

However, if the BoC reaffirms its tightening cycle and signals further tapering in October, the loonie could bounce back, potentially aiding the aussie and kiwi as well, which have also been struggling this week.

Pound’s woes worsen on Boris’ tax hikeIn European currencies, both the euro and pound remained on the backfoot versus the greenback. There is heightened speculation the European Central Bank will pare back its asset purchases when it meets tomorrow but the boost to the euro has been modest as the Fed is still expected to end its pandemic stimulus long before the ECB.

The single currency was last trading near intra-day lows at $1.1816, while cable hovered at one-week lows around $1.3750, on track for its third straight day of declines.

Signs that UK growth following the reopening of the economy has already peaked have been somewhat weighing on sterling lately. But there was another blow to the pound’s bullish prospects on Tuesday after Prime Minister Boris Johnson set out plans to raise taxes, making the UK the first Western country to turn to higher taxes to fill the growing budget gap that’s resulted from the virus crisis.

Whilst Johnson’s ambition of significantly boosting funding for health and social care by hiking national insurance contributions has divided his party, he is likely to get the backing he needs in a parliamentary vote later today. However, there are concerns the tax hikes could hamper Britain’s recovery from the pandemic and this could prove to be a major drag on sterling in the medium term.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.