Daily Market Comment – Dollar cools as Delta fears ease; Wall Street sets another record

- Fears over Delta variant subside slightly but soft data limit gains in Asian equities

- US shares hit fresh records but improved mood knocks dollar off highs

- Gold slips again, while oil’s rebound also falters ahead OPEC+ meeting

Markets steadier as alarm over Delta variant eases

Markets steadier as alarm over Delta variant easesStocks in Asia were mostly in the green on Wednesday as concerns about the impact of tighter restrictions across the region to combat the highly contagious Delta variant abated slightly while another record close on Wall Street yesterday also helped lift sentiment.

It’s proving to be quite a rocky week for risk assets as the rapid spread of the Delta Covid-19 strain in several countries has raised concerns about the pace of the global economic recovery from the pandemic, souring the mood.

However, US markets have so far been immune to the latest panic episode that’s mainly been felt in the Asia-Pacific region, where lockdowns are on the up. In Australia, almost half the population is under a stay-at-home order, though shares in Sydney have fared somewhat better than in other markets like Hong Kong and Tokyo.

Nevertheless, overall sentiment has held up surprisingly well as investors are hoping that the high vaccination rates in Europe and the United States will keep the contagion contained and avoid the need for fresh lockdowns. But the main reason why Wall Street has been able to ride out this storm so well is because of declining expectations that the Fed will act early to keep a lid on soaring consumer prices in the US.

The 10-year Treasury yield has taken a tumble this week, falling towards 1.47%, dragged lower by a smaller-than-expected increase in the core PCE price index on Friday. The drop in long-dated yields has boosted tech stocks, pushing the Nasdaq 100 and Nasdaq Composite to new all-time highs on Monday and Tuesday. The S&P 500 also just about managed to close in record territory yesterday, though e-mini futures were mostly flat today.

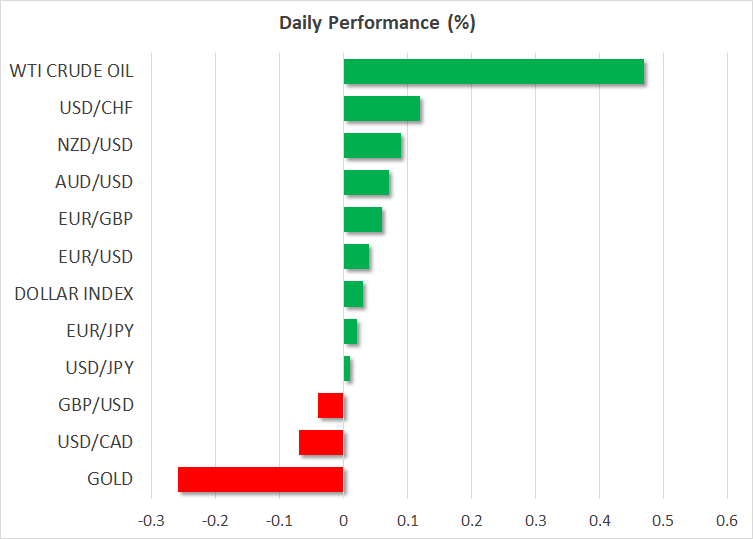

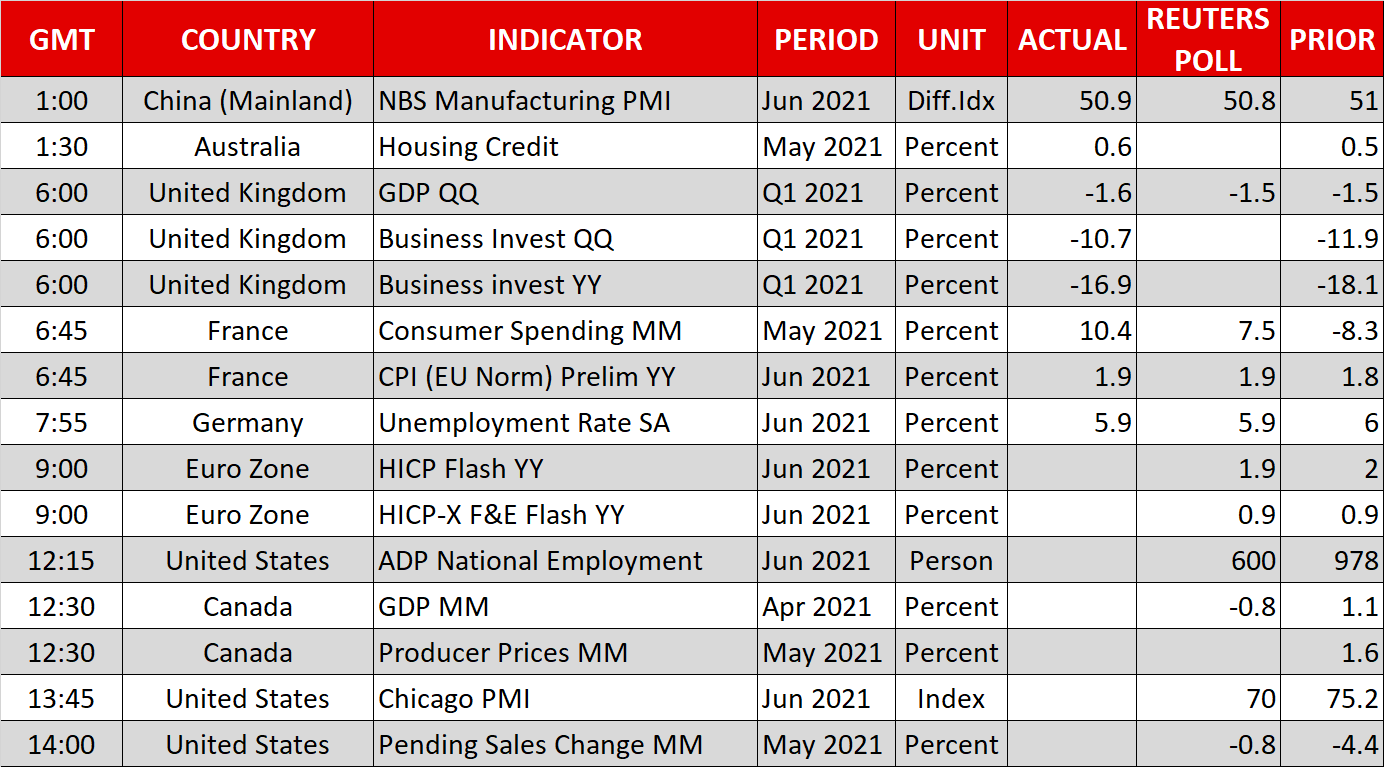

Dollar rally loses some steam but upside may not be overThe US dollar was steadier after slipping from one-week highs against a basket of currencies on Tuesday. The greenback was unable to build on its positive momentum despite robust house price data out of the US yesterday, as well as a much bigger-than-expected jump in consumer confidence in June. But the dollar does seem to be gaining some traction in European trading, perhaps boosted by overnight comments from Fed Governor Christopher Waller, who said he could not rule out a rate hike in 2022.

All eyes later today will be on the ADP employment reading for an indication as to what to expect from Friday’s nonfarm payrolls report.

In other currencies, the euro and pound were little changed but the aussie and kiwi were struggling to halt their losing streak. The safe-haven Japanese yen, meanwhile, was edging up, suggesting risk aversion could make a return through the course of the day.

Gold can’t catch a break, oil prices wobble ahead of OPEC+ decisionGold was headed for a third straight day of losses, still weighed by the resurgent US dollar and finding little support from the slump in Treasury yields. The precious metal slid to a 2½-month low of $1749.20/oz yesterday before rebounding slightly but was on the backfoot again today.

Oil prices also came back under pressure amid renewed doubts about the demand outlook following the fresh lockdowns in Asia. WTI and Brent crude futures both retreated from earlier session highs to stand mixed on the day. The major oil producers of OPEC+ are due to meet tomorrow to decide whether to increase output. If they raise production by 500,000 barrels a day as expected, it’s unlikely to threaten the oil rally and the price outlook would likely be mainly determined by how the spread of the Delta variant evolves.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.