Daily Market Comment – Dollar extends gains as virus blues strike again

- Dollar climbs to 3-month high as worries about Delta variant weigh on markets

- But equities mixed as US jobs report awaited for more direction

- Major FX pairs steady, oil firms ahead of OPEC+ output decision

Dollar ascends as virus jitters return

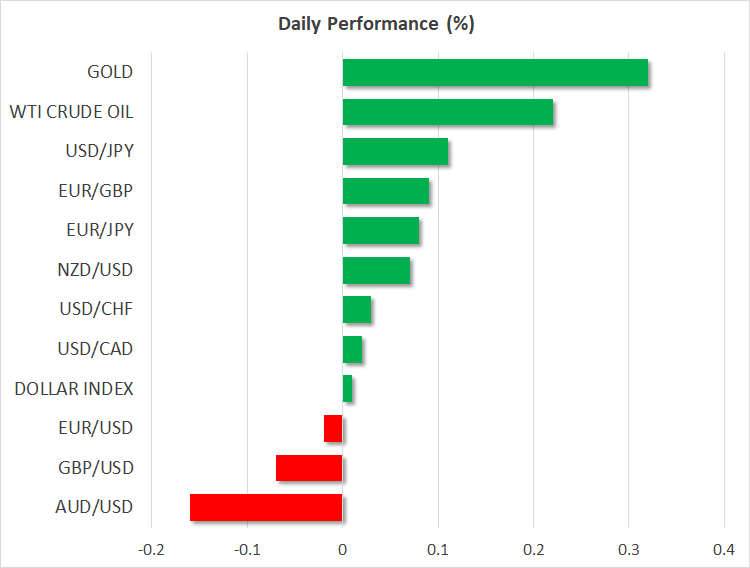

Dollar ascends as virus jitters returnFresh concerns that the Delta Covid-19 strain will undermine the recovery in Asia and possibly elsewhere too hurt sentiment on Thursday, though positioning ahead of tomorrow’s US jobs data also made for some cautious trading. The US dollar advanced to a near 3-month top against a basket of currencies towards the Asian close, building on yesterday’s impressive gains, but lost some steam as European trading got underway.

Fears that the current wave from the Delta outbreak could be the biggest yet in some Asian countries are generating some flight to safety, with the US currency being favoured over its other safe-haven peers such as the Japanese yen due to America’s much higher vaccination rate as well as of course the stronger economic rebound.

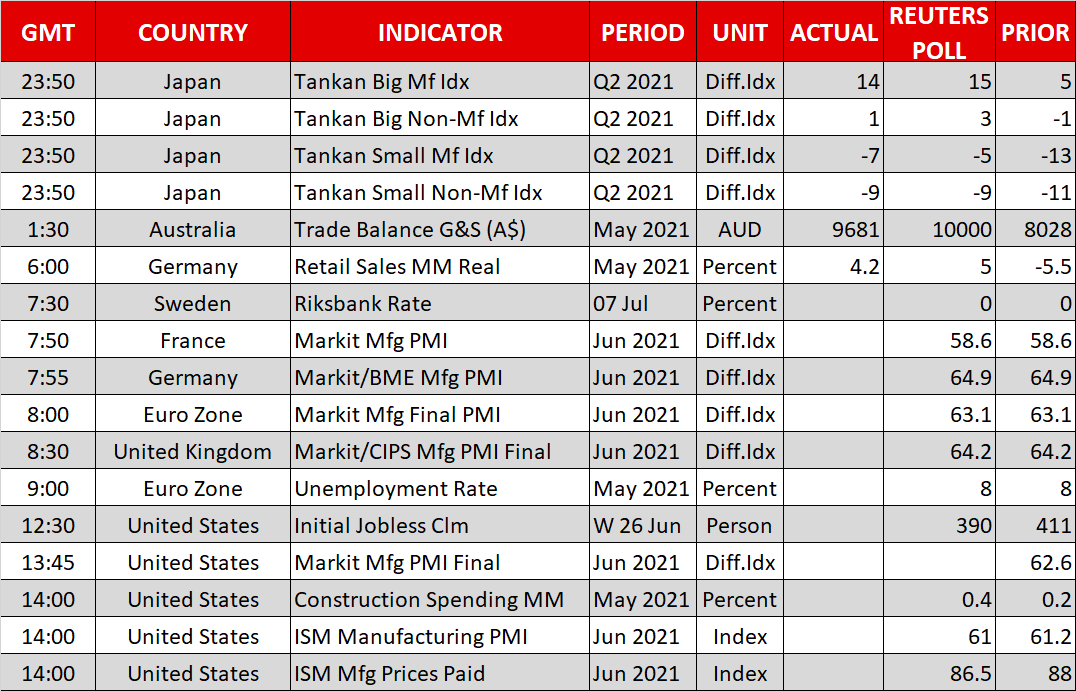

Friday’s nonfarm payrolls report will likely point to further progress in the US jobs recovery and although the numbers are not expected to be anything spectacular, they should nevertheless be strong enough to keep the Fed on track to begin withdrawing some of its stimulus later this year.

Dallas Fed President Robert Kaplan – one of the Fed’s more hawkish voices but not a voting member until 2023 – repeated on Wednesday that he would like to see tapering to start “sooner”.

Markets have slowly been adjusting to the prospect of less central bank stimulus in the coming months. But with the recovery still lagging in some major economies such as the Eurozone and Japan, and under threat in other places like Australia, the Fed could end up being one of the first to taper despite all the dovish rhetoric, so this latest dollar upside could be one of many more to come.

Contrasting mood across equity marketsAsian stocks were down in the dumps on Thursday as manufacturing PMIs for June provided the first evidence that the increased virus restrictions because of the dangerous Delta variant is impeding economic activity. The IHS Markit gauges plunged below 50 in Malaysia, India and Vietnam, while the manufacturing expansion eased in China and Japan.

Most Asian stocks ended the day in the red, but the mood appears to have brightened up in the European session with the region’s major indices jumping by 1%. US stock futures also perked up, rising by around 0.3%, putting the S&P 500 on course for a fifth consecutive record close.

Optimism about the reopening of the sectors hardest hit by the pandemic as well as expectations that easy money will remain plentiful even after tapering begins is supporting equities in North America and Europe where vaccinations are high and still rising.

Little cheer in FX markets but oil buoyant ahead OPEC+ meetingIt was a more subdued tone, however, in currency markets as the euro slipped to almost 3-month lows against the US dollar, hitting $1.1836, while sterling was testing the key $1.38 level to the downside. Yesterday’s decision by the EU to extend the grace period for checks on chilled meat products from Britain to Northern Ireland, which came hot on the heels of Monday’s announcement of an EU-UK deal on data flows, hasn’t provided much of a lift to either the euro or pound.

Commodity-linked currencies also continued to struggle against the greenback, though they were off their lows and turned positive versus the yen as sentiment improved from earlier in the day. The Canadian dollar remains overpowered by its US counterpart even as oil prices firmed from the overnight dip.

WTI and Brent Crude futures were last up more than 1% as investors don’t see a significant danger of excess supply forming in the oil market should the OPEC+ alliance decide to raise production by 500k bpd as expected at their meeting today. Oil prices slid to one-week lows earlier in the week amid concerns about the demand outlook following the fresh lockdowns in Asia. But it’s likely that OPEC and the other major producers will proceed very cautiously with their output increases, which should stave off a huge supply glut.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.