Daily Market Comment – Dollar finds footing as Jackson Hole awaited, stocks fly again

- Markets turn to Jackson Hole for direction amid uneasy optimism

- Dollar edges up after three-day slide, while Wall Street climbs to fresh records

- China cash injection, House infrastructure vote lift sentiment, but Delta still a worry

Calm sets in before possible Fed storm

Calm sets in before possible Fed stormAfter a volatile week, markets were in much steadier waters on Wednesday, with the US dollar halting its losing streak and equities holding onto their gains. Optimism that the global economic recovery from the pandemic will only be slightly dented by the Delta variant and central banks will continue to pump plenty of stimulus to support growth is the primary reason for this turnaround.

Fears of aggressive Fed tightening have receded somewhat after Kaplan – one of the Fed’s biggest hawks – expressed some doubts about the outlook. In the meantime, Congress is making progress with advancing President Biden’s economic agenda.

The House of Representatives on Tuesday voted to move forward with the $3.5 trillion budget blueprint. Although the process is almost certain to drag on well into the fall, there’s growing confidence that the Democrats will be able to resolve their differences and pass both the budget and infrastructure bills in due course.

Equities not too fussed about Delta strainSentiment was additionally aided on Wednesday by China’s central bank boosting its daily cash injection into the financial system, easing interbank lending rates. The move helped local stocks post a third straight day of strong gains following a rebound in Chinese tech shares.

The recent regulatory crackdown had pummelled popular tech stocks in Hong Kong and China but upbeat earnings by JD.com this week have allayed worries that the measures would become a significant drag on revenue.

The SSE Composite index closed 0.7% higher, though Hong Kong’s Hang Seng index slipped today. Japan’s Nikkei 225 index also bucked the trend, giving up earlier advances to close marginally lower. The losses came after a Bank of Japan policymaker warned chip shortages may continue to serve as a source of uncertainty for the global economy, while the Japanese government looks set to place more regions into a state of emergency amid still soaring virus cases.

However, for investors on Wall Street, lockdowns in Australia, Japan and other Asian-Pacific countries are of minor concern. With China appearing to have contained an outbreak of the Delta variant in the country, therefore averting a major disruption to global supply chains, regional woes won’t have a material impact on US equities.

Meanwhile, easing Fed taper expectations have boosted Wall Street’s tech behemoths, which had already benefited from defensive plays during the bout of risk aversion. The Nasdaq 100 and Composite, as well as the S&P 500 all closed at all-time highs on Tuesday.

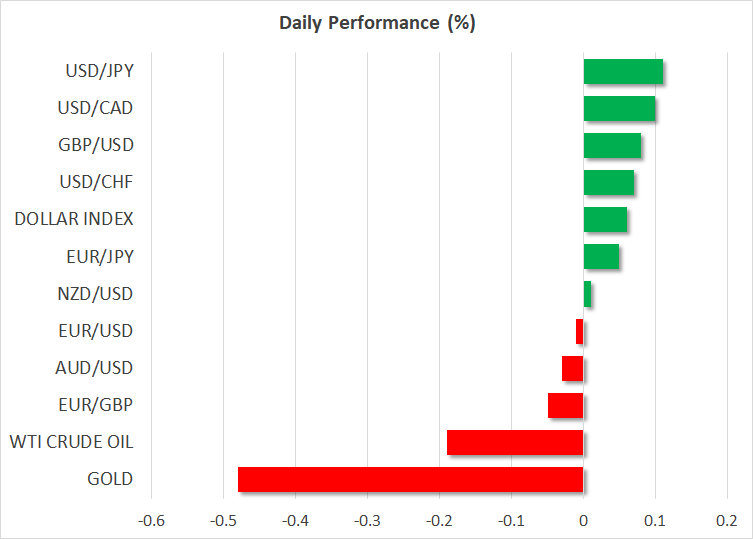

Dollar selloff takes a breather ahead of Jackson HoleBut the bounce in risk appetite may be cooling as US stock futures were barely in positive territory today and the US dollar was slightly firmer. There’s no doubt that the greenback’s downside correction has breathed some life into the battered commodity-linked currencies. But whether the rebound can be extended will likely depend on what Fed Chair Powell signals about tapering when he speaks on Friday from the Jackson Hole conference.

The aussie was last trading flat versus its US counterpart, while the loonie and kiwi were 0.1% higher. The euro and pound were also flat.

In commodities, gold fell back after failing to crack above the $1,800/oz level and as the dollar steadied. Oil prices were weaker too on Wednesday, having surged about 8% from Monday’s lows.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.