Daily Market Comment – Dollar firms, stocks slip amid US stimulus doubts

- Talks on US stimulus package continue but deal in doubt after Trump slams Democrats

- Dollar regains some footing, equities drift lower as final presidential debate eyed

- Brexit progress supports euro and pound as virus cases spiral out of control

Stimulus setback after Trump throws a tantrum

Stimulus setback after Trump throws a tantrumHopes for a quick deal on a new coronavirus aid package in the United States have faded somewhat as negotiations between the White House and the Democrats drag on. Disagreement over funding for state and local governments seems to be a major sticking point, which sparked another angry tweet by the President on Wednesday, accusing the Democrats of wanting to bail out poorly run cities and states that are under Democratic control.

The latest spat comes as House Speaker Nancy Pelosi signalled the two sides were “closer to being able to put pen to paper to write legislation”. The White House is now aiming on getting a deal done within the next 48 hours. But it is looking increasingly unlikely that an agreement can be reached before Election Day on November 3.

Even if a deal is struck before then, the new bill would face great difficulty in passing through the Senate where the Republicans have a majority, especially as the size of the stimulus keeps getting bigger – the latest figure is $1.9 trillion.

Growing concern about rising virus casesThe prospect of a delay in more fiscal support to the US economy weighed on equity markets on Thursday. Asian and European shares were sharply lower following losses on Wall Street yesterday.

Although investors are still holding out for substantial fiscal stimulus at some point in the coming weeks, the unclear timing is adding to the uncertainty when the presidential election is just around the corner and soaring COVID-19 infection rates in Europe and America are threatening to derail the economic recovery.

European stock markets in particular have been underperforming lately as more and more cities and regions come under stricter virus restrictions. There’s been no let-up in the surge in the number of daily virus cases in Europe and the UK, fuelling concerns that growth in the fourth quarter will turn negative again.

Infection and death rates in several US states are on the up too, but it remains to be seen whether this will turn voters against Trump as his campaign has been making some inroads recently, narrowing Joe Biden’s lead in some key battleground states.

The focus later today will very much stay on the election campaign as Trump and Biden will face off for the second and final time in a debate at 21:00 ET (Friday, 01:00 GMT).

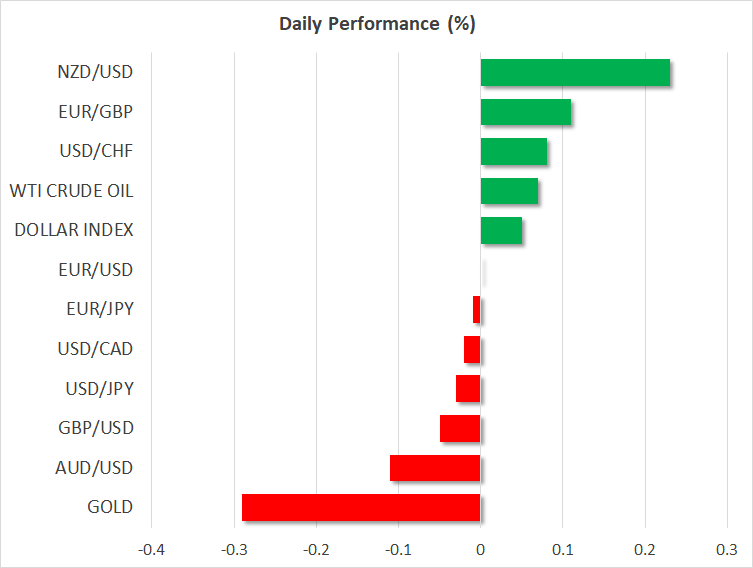

Dollar off lows, euro and pound hold near highsAhead of the debate, the US dollar edged higher, finding support from the slightly gloomier mood, though the yen was mixed.

The euro was softer after four straight sessions of gains that took the single currency back above the $1.18 level. Sterling was also slightly weaker after skyrocketing above $1.31 yesterday on news that the UK and EU have agreed to resume Brexit talks later this week.

Despite all the recent tensions and stand-offs, investors are still putting their money on the two sides settling their differences and agreeing to a post-Brexit trade pact, with mid-November now seen as the new deadline.

The Canadian dollar was licking its wounds following a sharp reversal from yesterday’s 6-week peak of C$1.3077 to the greenback. Disappointing retail sales data out of Canada yesterday and a worsening outlook for oil demand are weighing on the loonie, though steadier oil prices on Thursday helped the currency to pare some losses.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.