Daily Market Comment – Dollar rules the FX skies, equities undecided

- Dollar remains king as Fed shockwaves reverberate

- Stocks caught in limbo, oil prices wary of supply risks

- Second-tier data coming up today, but could be crucial

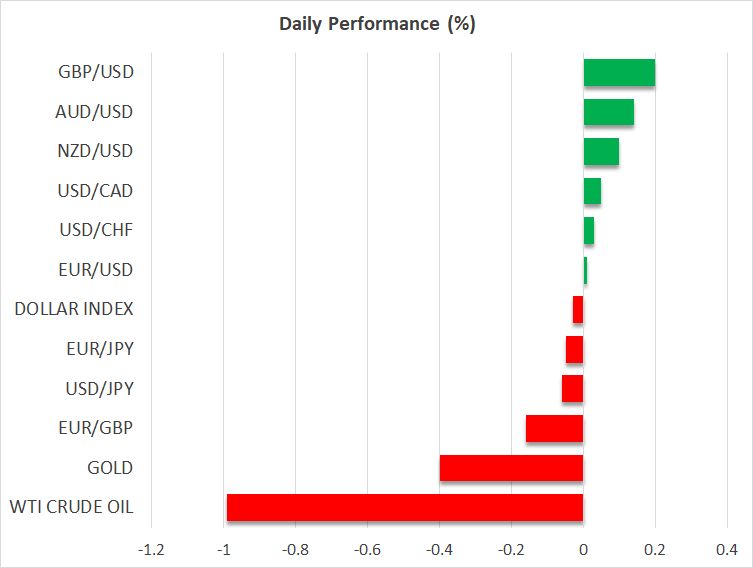

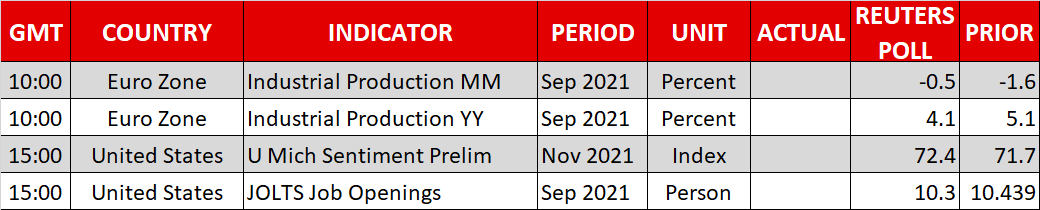

Dollar reigns supremeThe trading week is coming to a close with the dollar ruling the skies over the FX battleground, after a shocking acceleration in US inflation reignited expectations for faster Fed rate increases and served as jet fuel for the reserve currency. Markets are currently split on whether the FOMC will hike rates twice or three times next year. As such, next week’s retail sales could be crucial in tipping the scales. Credit card data from J.P. Morgan Chase points to a solid October for spending but an incredible November as some consumers may have started holiday shopping early, fearful of delayed deliveries. Therefore, there might be more good news on the way for the dollar. In contrast, the euro is still grappling with several risks that threaten growth. The spike in energy prices is squeezing consumers, China’s slowdown is bad news for demand in Europe’s largest export market, and soaring covid cases across the continent have just seen the Netherlands impose a partial lockdown. Germany might be next, as cases have skyrocketed lately. Taken together, these suggest the ECB could disappoint market expectations for a minor rate increase next year while there’s still scope for a third Fed rate hike to be priced in, keeping the risks around euro/dollar tilted to the downside. Stocks in a dilemma Wall Street didn’t do much yesterday. The Dow Jones was dragged lower by a sharp decline in Disney shares after the entertainment conglomerate reported disappointing growth in streaming, but some relief in mega-cap tech stocks pulled the Nasdaq higher. The S&P 500 was somewhere in the middle, closing almost unchanged. Equity markets seem caught between opposing forces. Record low real yields, a frenzy in corporate buybacks, and fresh fiscal stimulus are colliding with fears over fading central bank liquidity, a slowdown in earnings next year, and weaker growth in China. It’s a tough environment to navigate and sky-high valuations don’t make it any easier. The bottom line? The risk of a correction from such elevated levels is uncomfortably high, but any drawdown would likely be seen as a buying opportunity for many traders as there’s still no alternative to equities while real yields are so depressed. Oil under pressureIn the energy market, oil prices remain on the retreat. There’s growing speculation the White House could release the ‘kraken’ soon, or in other words the Strategic Petroleum Reserves, to cool oil prices and by extension inflation. Making a deal with Iran is another alternative. The Canadian dollar is feeling the heat of softer oil prices and the stronger US dollar, but admittedly, the nation’s economy is just too strong to worry about a sustained downtrend. The Bank of Canada will likely be the leader among the major central banks in this normalization cycle, an assessment that markets agree with considering the five rate increases already priced in for next year. As for today, the highlights will be the University of Michigan consumer sentiment survey and the JOLTS labor market report. These are typically second-tier US economic data, but they could attract special attention this time with the spotlight falling on inflation expectations and the job quit rate.

Dollar reigns supremeThe trading week is coming to a close with the dollar ruling the skies over the FX battleground, after a shocking acceleration in US inflation reignited expectations for faster Fed rate increases and served as jet fuel for the reserve currency. Markets are currently split on whether the FOMC will hike rates twice or three times next year. As such, next week’s retail sales could be crucial in tipping the scales. Credit card data from J.P. Morgan Chase points to a solid October for spending but an incredible November as some consumers may have started holiday shopping early, fearful of delayed deliveries. Therefore, there might be more good news on the way for the dollar. In contrast, the euro is still grappling with several risks that threaten growth. The spike in energy prices is squeezing consumers, China’s slowdown is bad news for demand in Europe’s largest export market, and soaring covid cases across the continent have just seen the Netherlands impose a partial lockdown. Germany might be next, as cases have skyrocketed lately. Taken together, these suggest the ECB could disappoint market expectations for a minor rate increase next year while there’s still scope for a third Fed rate hike to be priced in, keeping the risks around euro/dollar tilted to the downside. Stocks in a dilemma Wall Street didn’t do much yesterday. The Dow Jones was dragged lower by a sharp decline in Disney shares after the entertainment conglomerate reported disappointing growth in streaming, but some relief in mega-cap tech stocks pulled the Nasdaq higher. The S&P 500 was somewhere in the middle, closing almost unchanged. Equity markets seem caught between opposing forces. Record low real yields, a frenzy in corporate buybacks, and fresh fiscal stimulus are colliding with fears over fading central bank liquidity, a slowdown in earnings next year, and weaker growth in China. It’s a tough environment to navigate and sky-high valuations don’t make it any easier. The bottom line? The risk of a correction from such elevated levels is uncomfortably high, but any drawdown would likely be seen as a buying opportunity for many traders as there’s still no alternative to equities while real yields are so depressed. Oil under pressureIn the energy market, oil prices remain on the retreat. There’s growing speculation the White House could release the ‘kraken’ soon, or in other words the Strategic Petroleum Reserves, to cool oil prices and by extension inflation. Making a deal with Iran is another alternative. The Canadian dollar is feeling the heat of softer oil prices and the stronger US dollar, but admittedly, the nation’s economy is just too strong to worry about a sustained downtrend. The Bank of Canada will likely be the leader among the major central banks in this normalization cycle, an assessment that markets agree with considering the five rate increases already priced in for next year. As for today, the highlights will be the University of Michigan consumer sentiment survey and the JOLTS labor market report. These are typically second-tier US economic data, but they could attract special attention this time with the spotlight falling on inflation expectations and the job quit rate.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.