Daily Market Comment – Dollar slides, gold shines after nonfarm payrolls

Dollar gets knocked down by miss in US employment growth

Gold benefits, but can it sustain a rally with real yields rising?

Stock markets kick off new week with losses, Fed speakers eyed

Bruised dollar awaits inflation test

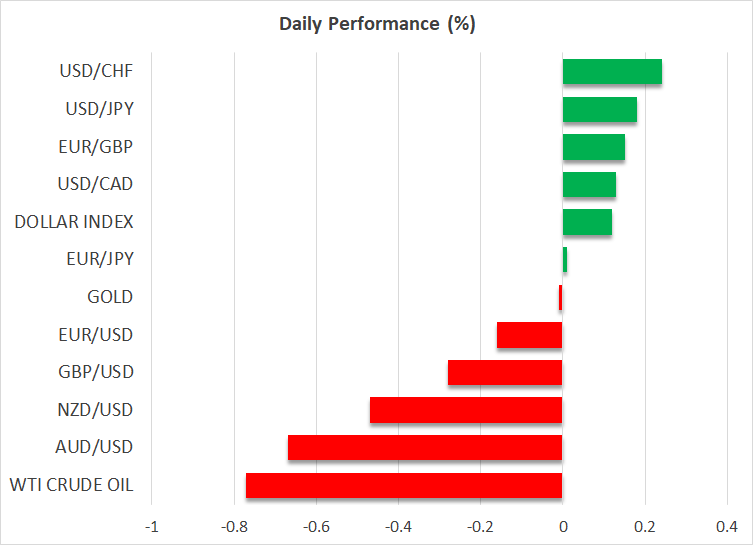

The world’s reserve currency absorbed some damage last week, in the aftermath of the latest US employment report. Nonfarm payrolls clocked in at 209k in June, which was below consensus estimates of 225k, disappointing traders who were likely positioned for a stronger number following the encouraging signals from the ADP report and the ISM services survey.

Nonetheless, the rest of the report was solid, with a decline in the unemployment rate and stronger-than-expected wage growth pointing to a labor market that is still booming. It is therefore difficult to square the healthy jobs numbers with the sharp negative reaction in the dollar, which doesn’t seem entirely justified.

Even more striking was the bond market reaction. While short-dated US yields fell, dragging the dollar down, the longer end of the curve rose with the 10-year yield moving above the 4% threshold. This has been the danger zone of this cycle, as something seems to ‘break’ in the global economy every time the 10-year crosses above 4%, most notably UK pension funds last year and US regional banks earlier this year.

All told, there was nothing shocking in this employment report. The data simply reinforced the notion that the Fed will keep rates elevated for some time, something reflected in bond markets. As for the dollar, the retreat seems excessive and may have been the product of one-sided positioning heading into the event.

This week, the main event will be the US inflation report that’s slated for release on Wednesday.

Gold resilient, but for how long?

Capitalizing the most on the dollar’s troubles was the yen. A wave of profit-taking pushed dollar/yen much lower, with the move receiving some extra fuel from a jump in Japanese yields, which are quickly approaching the Bank of Japan’s yield ceiling.

Gold was another winner. The precious metal stormed higher after the payrolls data, taking full advantage of the pullback in the dollar. However, the advance was rejected near the $1,935 region, keeping gold trapped in a well-defined range.

Looking ahead, the main threat for gold is the sharp spike in real yields. The ‘real’ US 10-year yield is currently near its highest levels since 2009, which makes non-yielding assets like bullion less appealing. While gold has been quite resilient so far, it might be hard to resist the gravity exerted by bond markets for much longer, especially if real yields break to new cycle highs.

Wall Street encounters turbulence

Equity markets have started to feel the heat of rising yields too. Futures point to some minor losses when Wall Street reopens on Monday, extending last week’s retreat. Of course, this pullback is merely a blip on the charts following the stunning rally this year.

A tsunami of liquidity after the banking episode in March, coupled with hopes that a recession can be avoided and a suppression of volatility have been the main drivers behind this rally. That said, the melt-up in stock markets has taken place despite rising yields and stagnant earnings growth, which means valuations have gone through the roof.

With liquidity flows now drying up and yields racing higher, this market seems vulnerable to a correction, depending also on the quality of the upcoming earnings season.

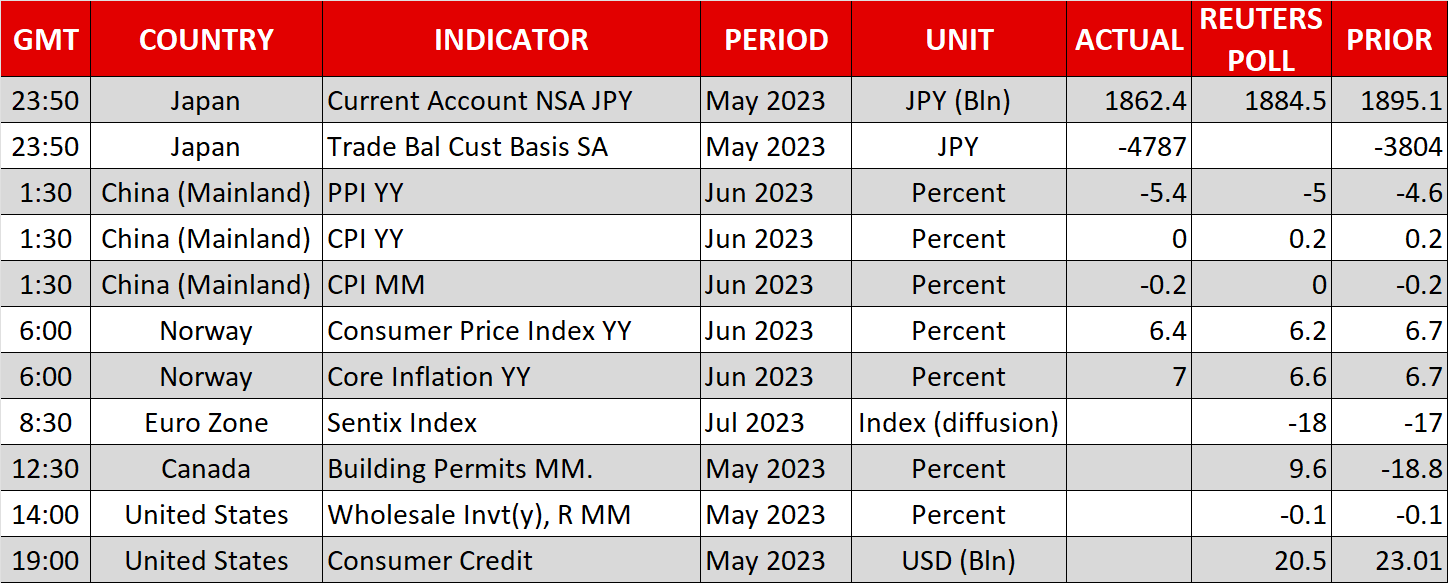

As for today, China’s inflation data has already been released. It pointed to deepening factory-gate deflation, reflecting the downturn in the manufacturing sector. There are several central bank speakers left on the calendar, with the Fed’s Daly (15:00 GMT) and BoE Governor Bailey (19:00 GMT) likely to be the highlights.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.