Daily Market Comment – Dollar takes another bullet after easing producer prices

- US producer prices barely increase in June

- Dollar extends fall as investors add to their Fed cut bets

- Euro and pound extend their uptrends; aussie and kiwi rally

- Wall Street rises on cooling inflation; bank earnings on tap

Dollar takes another dive after soft PPI data

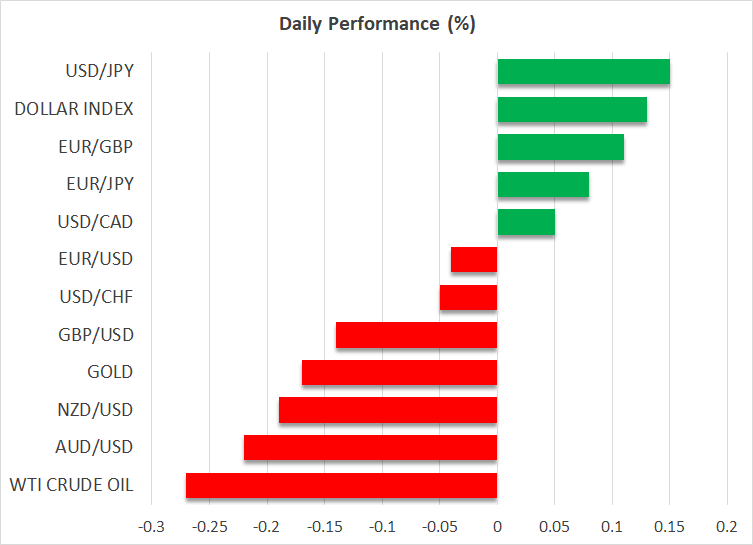

Dollar takes another dive after soft PPI dataThe US dollar extended its free fall on Thursday against all the other major currencies, taking another steep dive after more US data added credence to the view that the Fed may be closer to ending this tightening crusade than previously thought.

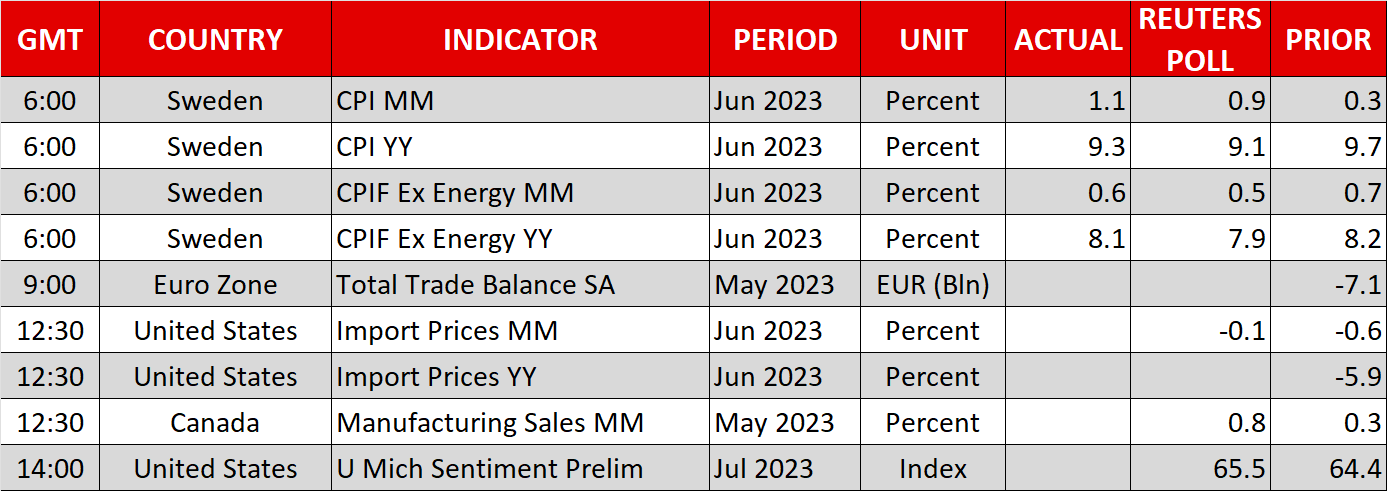

Following on the heels of Wednesday’s US CPIs, the PPI report for June revealed that producer prices barely rose in June, with the headline rate falling to 0.1% year-on-year from 0.9% in May. Although the nearly stagnant headline print could be largely attributed to the negative y/y change in oil prices, the underlying rate that excludes food, energy, and transportation, slid as well, to 2.6% y/y from 2.8%.

At the same time, the Labor Department reported that initial claims for unemployment benefits unexpectedly fell by 12k last week, which may have been the reason behind the brief positive reaction in the US dollar at the time of the release before investors fully digest the PPIs and aggressively sell the currency thereafter.

US Treasury yields also fell further as market participants added more basis points worth of rate reductions to their Fed bets. Even after Fed Governor Waller said that he could still favor two more hikes if incoming data continues to warrant this, market participants are convinced that only one more quarter-point hike may be enough, while conditional upon a July hike, they are penciling in 150bps worth of rate reductions by the end of 2024.

Euro and pound uptrends resume; aussie and kiwi benefit the mostThe latest repricing of the market’s implied Fed rate path allowed currencies whose central banks are expected to continue tightening this year and not proceed with massive rate reductions thereafter, to re-enter an uptrend trajectory against the greenback. Those currencies are the euro and the pound, with the divergence in expectations between the BoE’s and the Fed’s future course of action being the most prominent as the former is seen delivering around 115bps worth of additional hikes.

However, the currencies that gained the most yesterday were the risk-linked aussie and kiwi, despite the market expecting only one more 25bps hike by the RBA and none by the RBNZ. It seems that the two currencies are benefiting from an increase in the broader risk appetite as the latest US inflation prints encouraged an uptrend continuation in equities.

Other news related to Australia and the aussie is that during the Asian morning today, Treasurer Jim Chalmers and Prime Minister Anthony Albanese announced that Michele Bullock will be the new RBA Governor for the next seven years. She will officially take the helm when the term of incumbent Governor Lowe ends in September.

Wall Street gains ahead of bank earningsWall Street extended its gains on Thursday, with the Nasdaq leading the march north and gaining 1.58%. The fact that the Nasdaq was the main gainer suggests that the driver behind the latest two-day rally is increasing Fed rate cut bets. The Nasdaq mainly consists of high-growth tech firms that are mainly valued by discounting expected cash flows for the quarters and years ahead. Therefore, expectations of lower interest rates result in higher present values, even with many firms being considered expensive from a multiples perspective.

A setback in the foreseeable future remains a probable scenario due to the overstretched uptrends, but with expectations of rate reductions by the Fed remaining firmly on the table, it may end up being just a decent correction within the broader uptrend.

As for today, investors may want to scrutinize the earnings results from some of the largest US banks, which signal the beginning of the Q2 earnings season. Following the collapse of several regional banks in March, investors are slowly trusting the banking sector again as most banks passed the Fed’s stress tests, and market participants may now be eager to find out whether those institutions are truly in a healthy state.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.