Daily Market Comment – ECB hawks talk tapering, euro unimpressed

- Euro barely gains despite inflation overshoot and ECB talk

- Dollar stages late session comeback, stocks hover near records

- Crucial US data and OPEC+ meeting on the agenda today

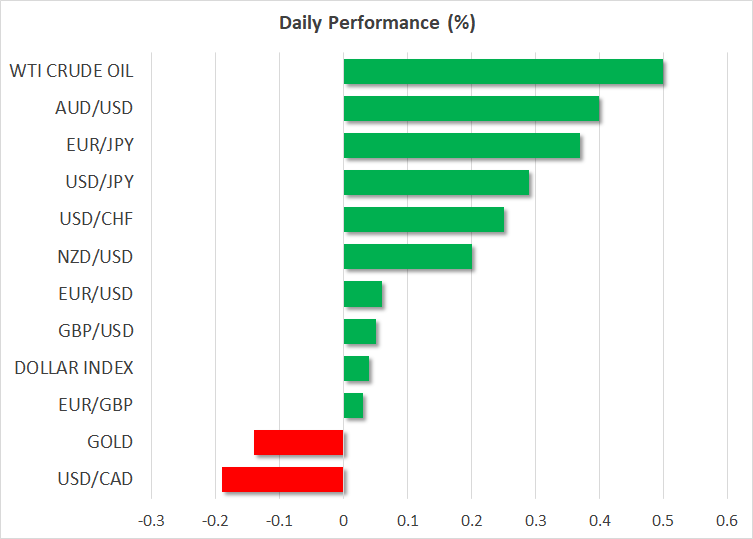

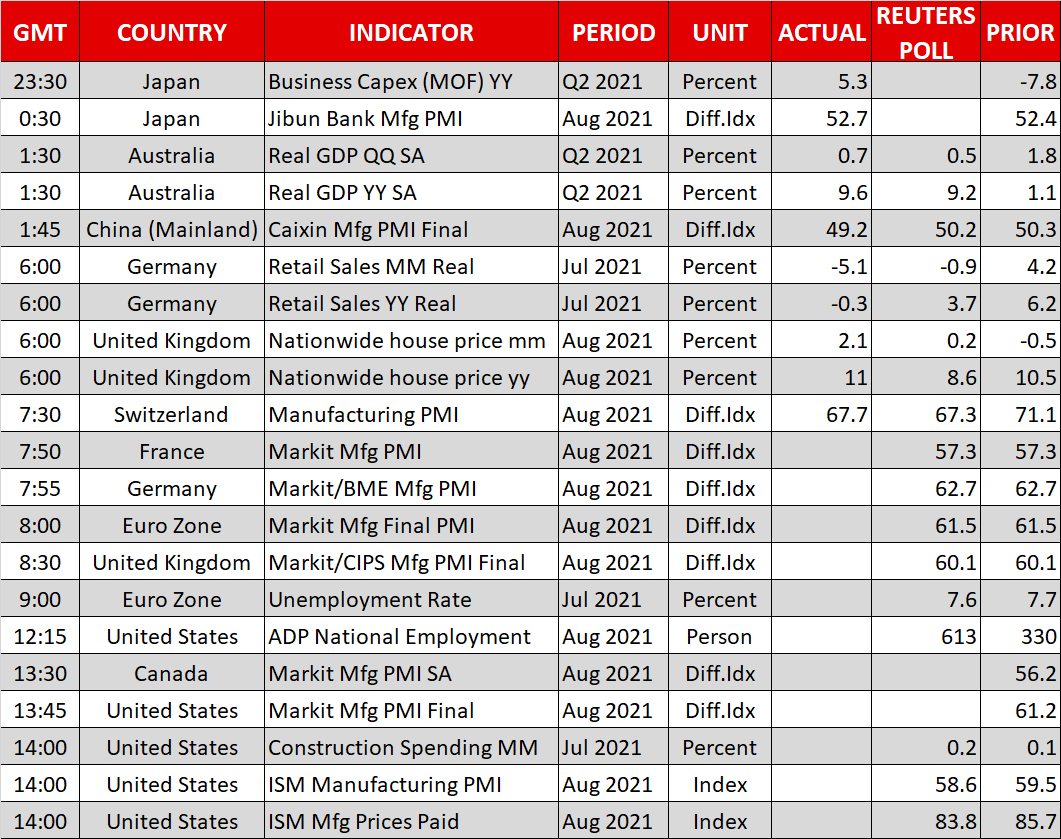

Euro brushes positive news asideThe notion that the European Central Bank will slow down its asset purchases is gaining traction. Officials from Austria and the Netherlands threw their weight behind this yesterday, highlighting the positive economic surprises lately. That was soon echoed by ECB vice chief Luis de Guindos. Their hawkish remarks were reinforced by an upside surprise in the Eurozone’s inflation rate, which jumped to 3% in August as supply chain disruptions continued to rage and summer demand kicked in. Another encouraging element is the elevated vaccination rate across Europe, which minimizes virus risks. That said, all this talk about slashing purchases is mostly technical shenanigans, not a real taper. The ECB essentially has two QE programs in place right now, the crisis-era and the regular asset purchases. Policymakers want to slow their crisis-era interventions, but the total envelope of that program wouldn’t change. It was always fixed in size. In other words, the ECB is about to tweak the speed, but not the total size of its crisis-fighting asset purchases. And there’s a strong chance that regular purchases are beefed up once that envelope is exhausted. Therefore, this wouldn’t be a real normalization of monetary policy, like the Fed is about to execute. The Eurozone economy is doing better but there’s a risk this is mostly a reopening boom, as Germany’s disappointing retail sales suggested today. And the Recovery Fund is too small to make a real difference. Interest rate increases are not on the horizon, so the euro could struggle as the ECB is left behind in the central bank normalization race. Dollar fights back, stocks hang onIn the broader market, it was a relatively quiet session as August came to a close. The dollar battled through some early adversity to close almost unchanged, drawing power from a rebound in US Treasury yields. Markets are still grappling with when the Fed will push the taper button. The consensus seems to have settled around a November announcement, although that could be brought forward if Friday’s jobs report is sensational. We’ll get a taste of what to expect today when the ADP employment report and the ISM manufacturing PMI for August are released. Meanwhile, Wall Street ended a volatile session marginally lower. The major indices remained just a shade away from record highs, as hopes for a super-slow Fed normalization and more fiscal juice from Congress eclipsed concerns that consumer spending may be cooling down. Indeed, the American consumer has gone on such a rampage this past year that some deceleration now is more than natural. OPEC meeting in the spotlightBeyond the US data releases today, markets will also keep a close eye on the OPEC+ meeting. The question is whether the cartel will stick to its plans to steadily raise production through the end of the year or whether the damage the Delta outbreak has inflicted on global demand will be enough to put those plans on ice. It’s a close call, but ‘sources’ suggest OPEC and its allies will forge ahead with output increases. In this case, oil prices could come back under pressure as markets price in a less favorable supply/demand balance in the coming months. That could also hit the oil-sensitive Canadian dollar. Of course, any negative reaction in both oil prices and the loonie may be relatively minor as this is the market’s baseline scenario already. The surprise would be if the producers shelved their plans to raise output, in which case the upside reaction in oil could be much bigger.

Euro brushes positive news asideThe notion that the European Central Bank will slow down its asset purchases is gaining traction. Officials from Austria and the Netherlands threw their weight behind this yesterday, highlighting the positive economic surprises lately. That was soon echoed by ECB vice chief Luis de Guindos. Their hawkish remarks were reinforced by an upside surprise in the Eurozone’s inflation rate, which jumped to 3% in August as supply chain disruptions continued to rage and summer demand kicked in. Another encouraging element is the elevated vaccination rate across Europe, which minimizes virus risks. That said, all this talk about slashing purchases is mostly technical shenanigans, not a real taper. The ECB essentially has two QE programs in place right now, the crisis-era and the regular asset purchases. Policymakers want to slow their crisis-era interventions, but the total envelope of that program wouldn’t change. It was always fixed in size. In other words, the ECB is about to tweak the speed, but not the total size of its crisis-fighting asset purchases. And there’s a strong chance that regular purchases are beefed up once that envelope is exhausted. Therefore, this wouldn’t be a real normalization of monetary policy, like the Fed is about to execute. The Eurozone economy is doing better but there’s a risk this is mostly a reopening boom, as Germany’s disappointing retail sales suggested today. And the Recovery Fund is too small to make a real difference. Interest rate increases are not on the horizon, so the euro could struggle as the ECB is left behind in the central bank normalization race. Dollar fights back, stocks hang onIn the broader market, it was a relatively quiet session as August came to a close. The dollar battled through some early adversity to close almost unchanged, drawing power from a rebound in US Treasury yields. Markets are still grappling with when the Fed will push the taper button. The consensus seems to have settled around a November announcement, although that could be brought forward if Friday’s jobs report is sensational. We’ll get a taste of what to expect today when the ADP employment report and the ISM manufacturing PMI for August are released. Meanwhile, Wall Street ended a volatile session marginally lower. The major indices remained just a shade away from record highs, as hopes for a super-slow Fed normalization and more fiscal juice from Congress eclipsed concerns that consumer spending may be cooling down. Indeed, the American consumer has gone on such a rampage this past year that some deceleration now is more than natural. OPEC meeting in the spotlightBeyond the US data releases today, markets will also keep a close eye on the OPEC+ meeting. The question is whether the cartel will stick to its plans to steadily raise production through the end of the year or whether the damage the Delta outbreak has inflicted on global demand will be enough to put those plans on ice. It’s a close call, but ‘sources’ suggest OPEC and its allies will forge ahead with output increases. In this case, oil prices could come back under pressure as markets price in a less favorable supply/demand balance in the coming months. That could also hit the oil-sensitive Canadian dollar. Of course, any negative reaction in both oil prices and the loonie may be relatively minor as this is the market’s baseline scenario already. The surprise would be if the producers shelved their plans to raise output, in which case the upside reaction in oil could be much bigger.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.