Daily Market Comment – ECB to commit to negative rates

- ECB meets, likely to lock itself into cheap money for longer

- Wall Street approaches record highs again as Delta scare fades

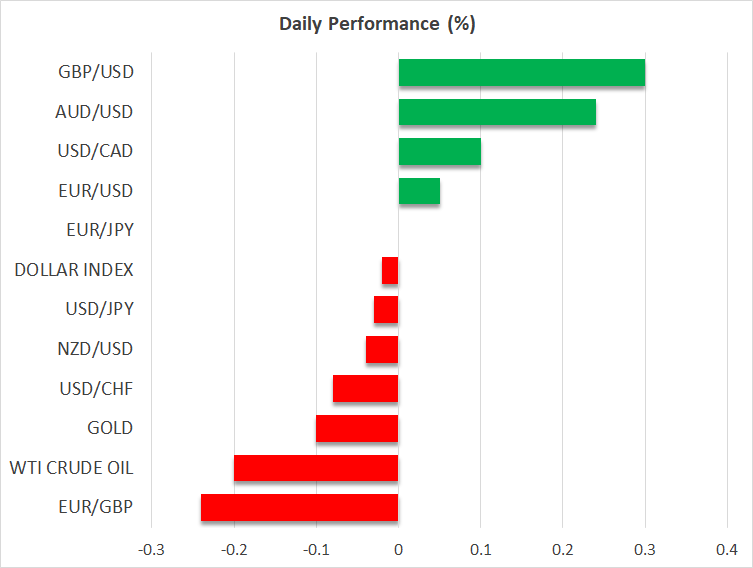

- Dollar pulls back, commodity FX recovers, gold can't catch a break

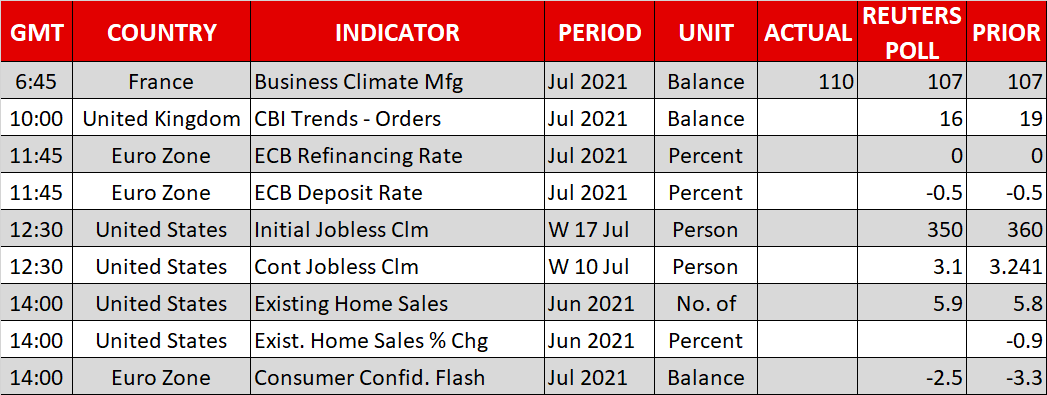

ECB to strengthen forward guidanceThe main event today will be the European Central Bank meeting, which should be interesting after President Lagarde promised to deliver new policy signals. The central bank recently raised its inflation target and it wants to demonstrate that it is serious about hitting it, after failing to do so for a decade. This means committing to negative interest rates for longer and perhaps signaling that asset purchases won’t be dialed back anytime soon. The bottom line is that the ECB doesn’t want markets to think it is heading towards the exit, like the Fed or the Bank of England are doing. It wants to stress that it will remain in cheap money policies far longer. The market reaction today is tricky to call. The ECB will definitely take a step in a more dovish direction, which would normally be negative for the euro, but markets already expect as much. Ergo, the reaction will boil down to whether the ECB’s message is more dovish than what investors anticipate. If not, the euro could even enjoy a relief bounce. In the bigger picture though, this is bad news for the euro. The ECB is locking itself into negative rates while the Fed and other major central banks are moving towards higher rates, crystalizing the divergence in monetary policy. This could cement euro/dollar at lower levels, as the euro remains the market’s favorite funding currency for carry trades. Stocks storm higher The panic that gripped Wall Street earlier in the week has all but vanished, with the major US indices heading back towards their record highs. There’s been no real catalyst behind this sudden change of heart. The strong earnings and cheerful guidance by several heavyweights might have dispelled some Delta blues, but probably didn’t move the needle much. Instead, investors seem to be falling back to the only trade that keeps on delivering - long stocks. The only real risk on the horizon is a Fed tapering decision, although even that might prove to be a mere speed bump in this incredible rally. Monetary stimulus will be dialed back extremely slowly and cautiously, with the Fed holding the market’s hand at every step. That could keep the party going, especially if Congress delivers more fiscal juice soon. Dollar takes a breather, commodity FX recoversThe newfound calmness in stock markets was also evident in the FX sphere. The US dollar took a step back as traders rotated away from defensive plays, allowing risk-sensitive currencies like the aussie, kiwi, and loonie to recover. Oil prices also bounced back powerfully as the mood improved, helping the loonie further. But gold prices remain under pressure. Bullion has drawn the shortest straw in this latest market rotation, unable to rally during the brief panic as the dollar strengthened, and now getting hammered by rising Treasury yields as the bond market calms down. The dollar has essentially replaced gold as the market’s favorite defensive instrument since the crisis started. And the future doesn’t seem bright either. The Fed will be phasing out cheap money policies, which ultimately argues for higher real yields and a firmer dollar, spelling trouble for gold.

ECB to strengthen forward guidanceThe main event today will be the European Central Bank meeting, which should be interesting after President Lagarde promised to deliver new policy signals. The central bank recently raised its inflation target and it wants to demonstrate that it is serious about hitting it, after failing to do so for a decade. This means committing to negative interest rates for longer and perhaps signaling that asset purchases won’t be dialed back anytime soon. The bottom line is that the ECB doesn’t want markets to think it is heading towards the exit, like the Fed or the Bank of England are doing. It wants to stress that it will remain in cheap money policies far longer. The market reaction today is tricky to call. The ECB will definitely take a step in a more dovish direction, which would normally be negative for the euro, but markets already expect as much. Ergo, the reaction will boil down to whether the ECB’s message is more dovish than what investors anticipate. If not, the euro could even enjoy a relief bounce. In the bigger picture though, this is bad news for the euro. The ECB is locking itself into negative rates while the Fed and other major central banks are moving towards higher rates, crystalizing the divergence in monetary policy. This could cement euro/dollar at lower levels, as the euro remains the market’s favorite funding currency for carry trades. Stocks storm higher The panic that gripped Wall Street earlier in the week has all but vanished, with the major US indices heading back towards their record highs. There’s been no real catalyst behind this sudden change of heart. The strong earnings and cheerful guidance by several heavyweights might have dispelled some Delta blues, but probably didn’t move the needle much. Instead, investors seem to be falling back to the only trade that keeps on delivering - long stocks. The only real risk on the horizon is a Fed tapering decision, although even that might prove to be a mere speed bump in this incredible rally. Monetary stimulus will be dialed back extremely slowly and cautiously, with the Fed holding the market’s hand at every step. That could keep the party going, especially if Congress delivers more fiscal juice soon. Dollar takes a breather, commodity FX recoversThe newfound calmness in stock markets was also evident in the FX sphere. The US dollar took a step back as traders rotated away from defensive plays, allowing risk-sensitive currencies like the aussie, kiwi, and loonie to recover. Oil prices also bounced back powerfully as the mood improved, helping the loonie further. But gold prices remain under pressure. Bullion has drawn the shortest straw in this latest market rotation, unable to rally during the brief panic as the dollar strengthened, and now getting hammered by rising Treasury yields as the bond market calms down. The dollar has essentially replaced gold as the market’s favorite defensive instrument since the crisis started. And the future doesn’t seem bright either. The Fed will be phasing out cheap money policies, which ultimately argues for higher real yields and a firmer dollar, spelling trouble for gold.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.