Daily Market Comment – Equities perk up but Delta casts shadow over Jackson Hole

- Trading gets off to a somewhat more positive start as stocks and commodities rise, dollar slips

- But Delta surge forces Jackson Hole to go virtual again, taper clues in doubt

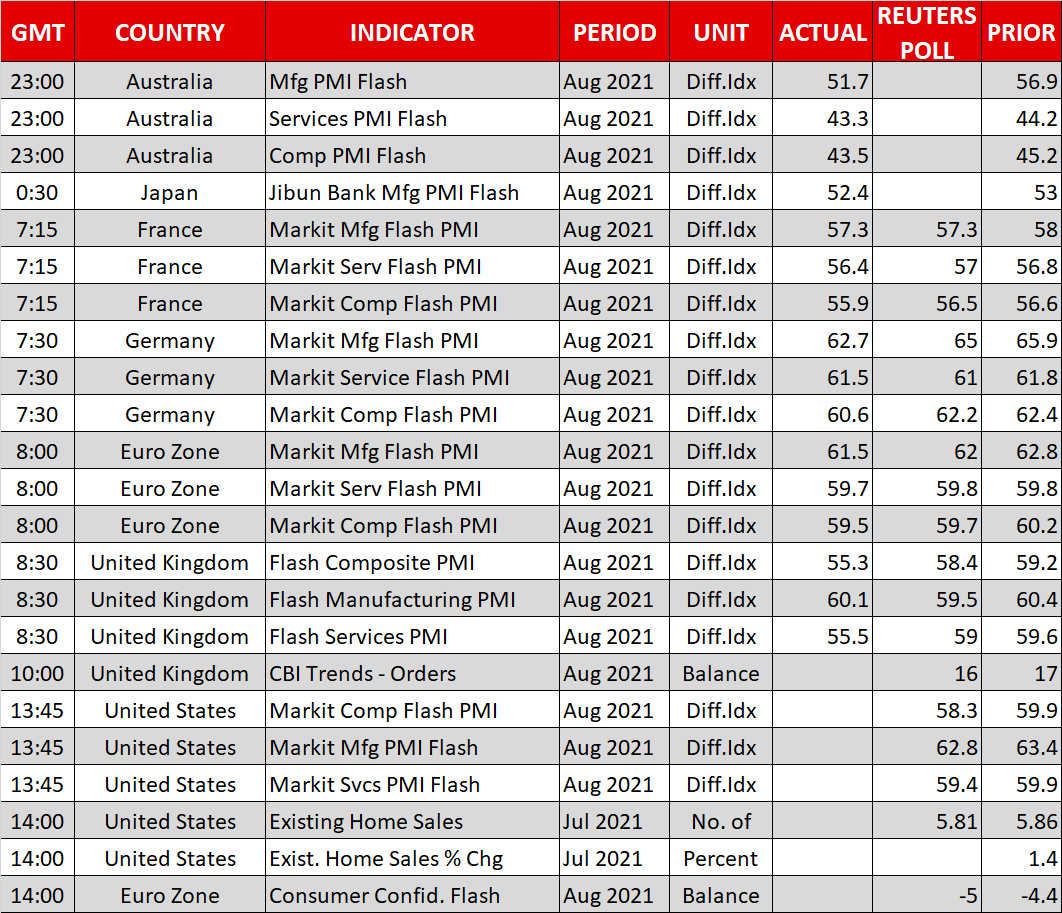

- Flash PMIs in focus amid recovery fears as Delta variant rages on

Panic subsides but could be the Fed’s turn to get jittery

Panic subsides but could be the Fed’s turn to get jitteryAfter a tumultuous week, the market mood brightened somewhat on Monday after stocks on Wall Street extended their rebound on Friday. Bargain hunting appears to be reviving equity markets even though concerns about the economic damage from the Delta variant have not really gone away, proving that “buy the dip” mentality is far from being dead as markets remain awash with liquidity.

Dip buyers got some encouragement on Friday from hints of a dovish tilt by one of the Fed’s staunchest advocates of early tapering. Dallas Fed President Robert Kaplan on Friday told Fox Business Network that he may have to “adjust” his views on tapering if the Delta variant starts to have a more “material impact” on the US economy.

Kaplan is one of a growing number of Fed officials who in recent weeks have voiced support in favour of a taper move in September. But with some signs that Americans are becoming more anxious about the worsening Delta outbreak sweeping the country, some market participants think the Fed might have to tone down its hawkish rhetoric.

The hotly anticipated Jackson Hole symposium has already been forced to switch to a virtual event so it will be hard for the Fed to ignore the latest virus escalation. More importantly, the cancellation of an in-person gathering makes it less likely that policymakers will be able to reach a decision about the timing and pace of tapering as early as this week and this may be contributing to the uptick in risk sentiment.

Wall Street eyes more gains, Asia could be turning a cornerUS stock futures were last trading around 0.2% higher following a second day of gains for the S&P 500 and Nasdaq Composite on Friday. European shares were all in positive territory in morning trade, boosted additionally by a solid session in Asia, led by a strong rebound in China and Japan.

The combination of tightening restrictions in the region due to the Delta wave and a crackdown by China on its tech giants had clobbered Asian stock markets in recent weeks, with the instability in Afghanistan adding to the downside risks. But there was some good news on Monday from China when authorities reported no new Covid-19 cases from local transmission for the first time since July, signalling the latest outbreak may be easing.

The encouraging development was in stark contrast to New Zealand where the prime minister just extended the country’s lockdown until Friday. However, investors appear to be focusing on the positives, such as less disruption to global supply chains from Chinese lockdowns and a potentially not-so-hawkish Fed at the Jackson Hole this week, even though there are plenty of dangers still lurking around.

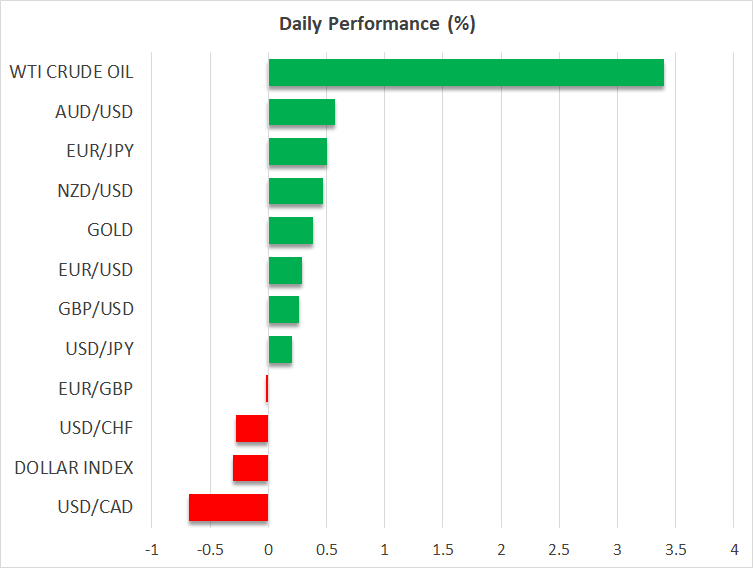

Dollar on the retreat, loonie shines, pound lagsIn typical fashion, the US dollar fell back on Monday as some of the risk aversion faded. The Japanese yen and Swiss franc were broadly weaker too. The dollar index is down almost 0.3% today, stepping back from Friday’s 9½-month peak. With the week only just starting, it’s too early to draw any conclusions about the latest dollar rally being over. But if the improvement in sentiment holds up, the only thing that will be able to put the dollar back on the front foot is if the Fed sends clear tapering signals at the Jackson Hole event.

The dollar’s pullback lifted the commodity-linked currencies the most on Monday as the euro and pound lagged somewhat. The Canadian dollar was the biggest winner, jumping about 0.6% to around C$1.2740 to the greenback as oil prices surged by more than 3% along with metal prices such as copper, boosted by China reporting no new virus cases today, which bodes well for demand.

The aussie was the second biggest gainer (0.5%) followed by the kiwi (0.35%). The euro had a more sluggish start but gained some traction after Eurozone flash PMIs in August were more or less in line with expectations, which helped it reclaim the $1.17 level. But the pound looked nowhere near being able to significantly recoup its heavy losses from last week and struggled as it edged up to $1.3650, weighed by an unexpectedly sharp slowdown in services activity in August according to the IHS Markit PMI survey.

The focus will next turn to the US PMIs.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.