Daily Market Comment – Fed shockwaves reverberate

- Equities shine, dollar bruised as markets digest Fed signals

- Chinese PMIs disappoint, setting the stage for more stimulus

- European inflation data in focus as euro attempts rebound

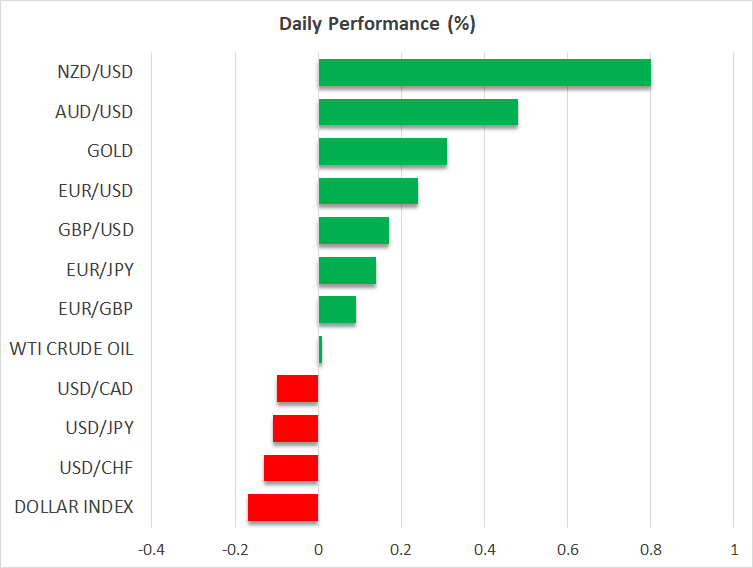

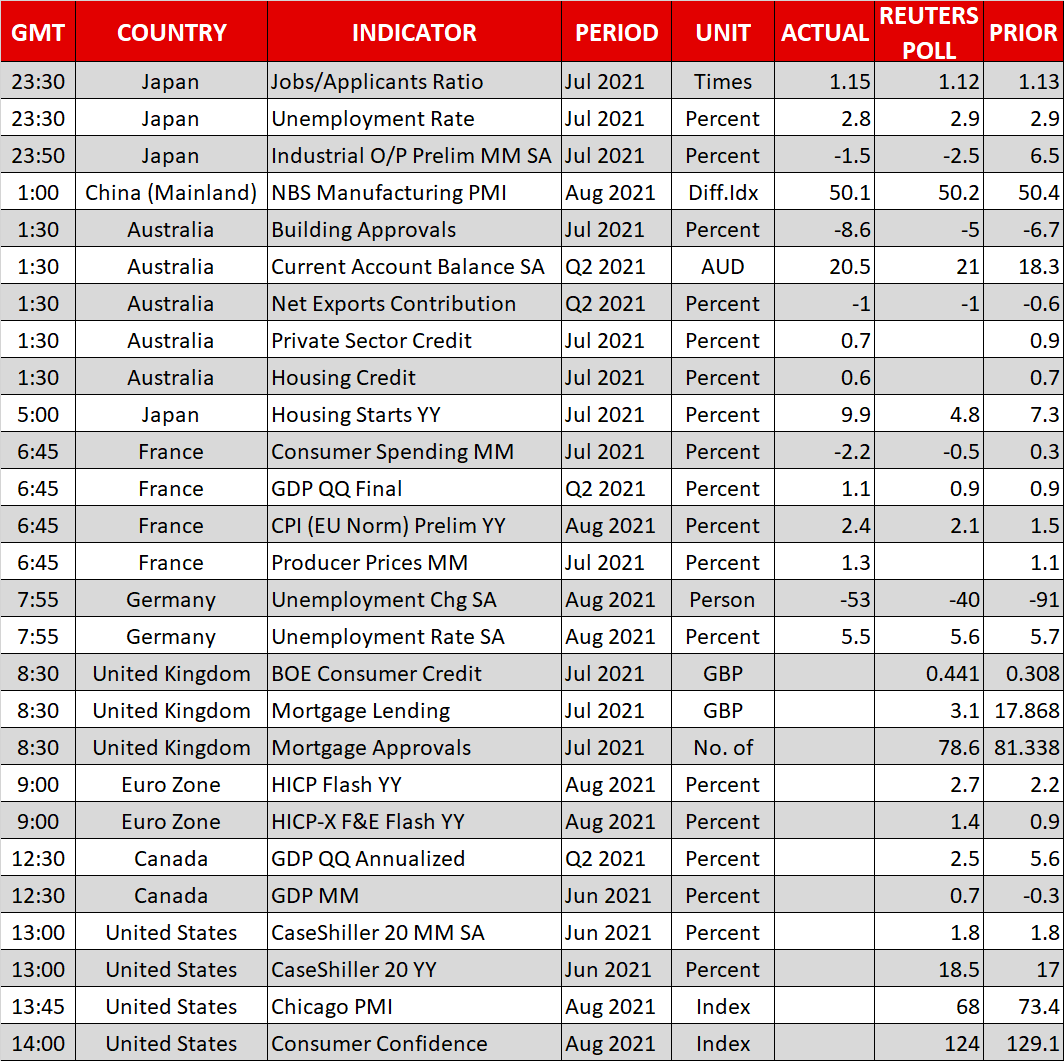

Wall Street hits fresh recordsThe party in US stock markets continues to rage. The S&P 500 and the Nasdaq hit new milestones yesterday, with tech heavyweights being at the tip of the spear after the Fed chief reassured investors that the cheap money punchbowl won’t be taken away immediately. With the Fed playing it slow and Congress set to unleash another multi-trillion spending spree to power up growth at a time when the US economic engine is already revving, the stars have really aligned for equity markets. Best of all, it seems like any corporate tax hikes will be watered down significantly as industry lobbies chip away at the massive reconciliation bill. The main worry is the Delta outbreak, but as we’ve seen time and again, markets rarely bleed because of virus developments. If anything, an escalation of the outbreak could fuel hopes for an even more patient Fed and put additional pressure on the politicians to step up their spending game. Virus worries are essentially a self-correcting dynamic for stocks, especially in the tech sector. Dollar bleeds, commodity FX capitalizesOver in the FX arena, the US dollar continues to bleed as markets price in lower chances for a September taper announcement by the Fed. The good news for dollar bulls is that this is a case of tapering being delayed, not derailed. Hence why the retreat in the greenback has been minor. Markets are now trading on whether the Fed will signal tapering in September and start the process in November, or whether it will be pre-announced in November and implemented in December. The next edition of nonfarm payrolls this week will go a long way in settling this debate, but in the big picture, it doesn’t matter much. It’s only a matter of time. Capitalizing the most on the dollar’s latest troubles have been the usual commodity FX suspects. The kiwi in particular has enjoyed a very sharp rebound as markets turn more confident that New Zealand will defeat the virus once again, allowing the RBNZ to initiate its rate hike cycle. China slowdown, euro inflationWhat’s especially striking about the recovery in commodity-linked currencies is that it is taking place despite signs that China is slowing down. The nation’s PMI surveys for August confirmed that growth is losing momentum, with the composite index crossing below the crucial threshold of 50. This raises all kinds of questions. How long can foreign stocks and currencies of nations that rely on China’s endless commodity demand stay cheerful if the economy is losing strength? Will Chinese authorities respond with an avalanche of stimulus or will they take a more measured approach, in fear of an already over-leveraged private sector?As for today, we get the latest Eurozone inflation stats and growth numbers from Canada. There’s growing chatter the ECB could also dial back its asset purchases in September. Even in this case though, it would be almost a ‘fake taper’, with the ECB slowing its emergency pandemic purchases only to increase its regular purchases later on. Rates won’t rise for several years, which is ultimately what matters for FX markets.

Wall Street hits fresh recordsThe party in US stock markets continues to rage. The S&P 500 and the Nasdaq hit new milestones yesterday, with tech heavyweights being at the tip of the spear after the Fed chief reassured investors that the cheap money punchbowl won’t be taken away immediately. With the Fed playing it slow and Congress set to unleash another multi-trillion spending spree to power up growth at a time when the US economic engine is already revving, the stars have really aligned for equity markets. Best of all, it seems like any corporate tax hikes will be watered down significantly as industry lobbies chip away at the massive reconciliation bill. The main worry is the Delta outbreak, but as we’ve seen time and again, markets rarely bleed because of virus developments. If anything, an escalation of the outbreak could fuel hopes for an even more patient Fed and put additional pressure on the politicians to step up their spending game. Virus worries are essentially a self-correcting dynamic for stocks, especially in the tech sector. Dollar bleeds, commodity FX capitalizesOver in the FX arena, the US dollar continues to bleed as markets price in lower chances for a September taper announcement by the Fed. The good news for dollar bulls is that this is a case of tapering being delayed, not derailed. Hence why the retreat in the greenback has been minor. Markets are now trading on whether the Fed will signal tapering in September and start the process in November, or whether it will be pre-announced in November and implemented in December. The next edition of nonfarm payrolls this week will go a long way in settling this debate, but in the big picture, it doesn’t matter much. It’s only a matter of time. Capitalizing the most on the dollar’s latest troubles have been the usual commodity FX suspects. The kiwi in particular has enjoyed a very sharp rebound as markets turn more confident that New Zealand will defeat the virus once again, allowing the RBNZ to initiate its rate hike cycle. China slowdown, euro inflationWhat’s especially striking about the recovery in commodity-linked currencies is that it is taking place despite signs that China is slowing down. The nation’s PMI surveys for August confirmed that growth is losing momentum, with the composite index crossing below the crucial threshold of 50. This raises all kinds of questions. How long can foreign stocks and currencies of nations that rely on China’s endless commodity demand stay cheerful if the economy is losing strength? Will Chinese authorities respond with an avalanche of stimulus or will they take a more measured approach, in fear of an already over-leveraged private sector?As for today, we get the latest Eurozone inflation stats and growth numbers from Canada. There’s growing chatter the ECB could also dial back its asset purchases in September. Even in this case though, it would be almost a ‘fake taper’, with the ECB slowing its emergency pandemic purchases only to increase its regular purchases later on. Rates won’t rise for several years, which is ultimately what matters for FX markets.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.