Daily Market Comment – Lockdown fears running wild

- Dollar comes back to life as euro and sterling feel the lockdown blues

- Little progress in US stimulus talks also supports dollar, pressures stocks

- Overall, plenty of risks out there being ignored by investors?

Lockdown blues hammer euro and pound

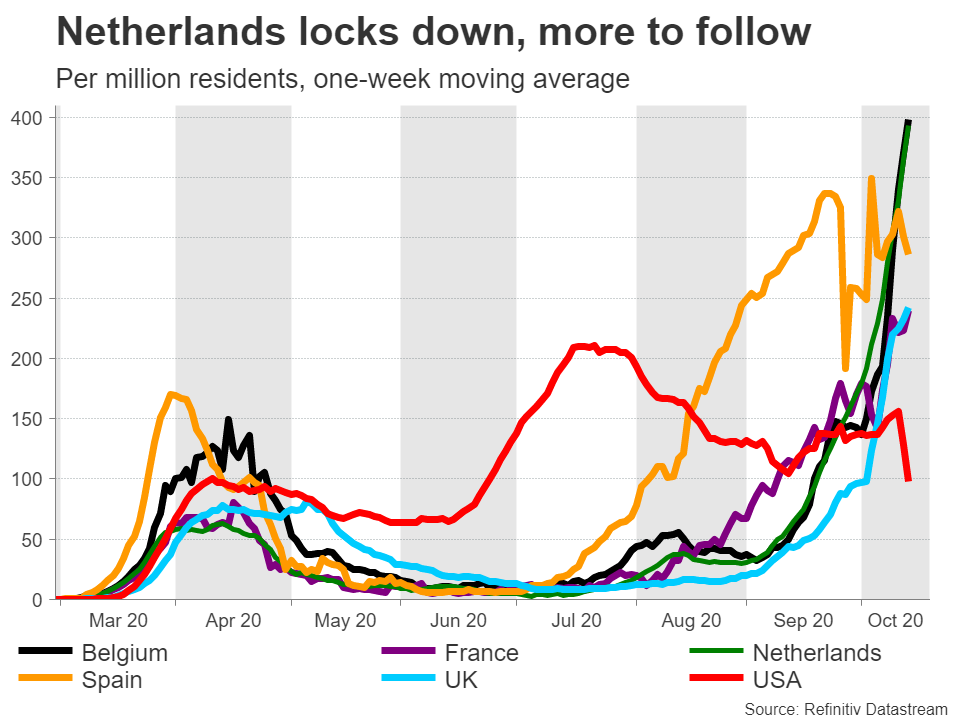

Lockdown blues hammer euro and poundThe European virus situation is getting worse by the day, with a surge in new cases and hospitalizations across the continent forcing many nations to go back into partial lockdown so that healthcare systems are not overwhelmed. The Netherlands announced it will shut down cafes, bars, and restaurants, there is chatter that French President Macron could announce a national curfew later today, and UK opposition leader Keir Starmer is calling for a ‘circuit-breaker’ shutdown for England.

Sadly, if so many businesses shut down again or operate at minimal capacity, that is likely to derail the already-fragile economic recovery, spelling bad news for fourth-quarter growth and putting the prospect of a double-dip recession on the map. The real fear is that this time, governments might not roll out the heavy stimulus guns, because the lockdowns won’t afflict the entire economy and public debts have already skyrocketed. There is simply less appetite for enormous relief packages if it is only a partial lockdown.

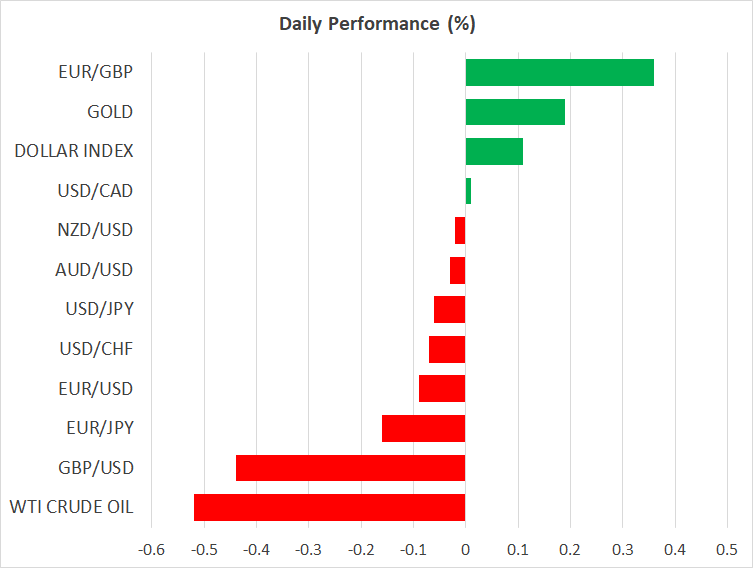

No wonder then that both the euro and sterling came under fire on Tuesday, with the defensive dollar and yen capitalizing most on their troubles. Adding further fuel to these moves were reports that not enough progress has been made in Brexit talks and that the EU won’t move on its red lines, raising the risk that Boris Johnson throws another ‘hardball’ and walks away from the talks to regain leverage.

Stocks ride the stimulus rollercoasterIt was a similar risk-off story in the equity market, where the S&P 500 closed 0.6% lower, discouraged by the lack of progress in the US stimulus talks. In fact, one could say that those negotiations are going backwards as Senate Republicans revived their proposal of a tiny $500bn relief package, which was immediately shot down by Democrats.

Rubbing salt into the wound was news that another late-stage vaccine trial has been put on halt, this time from pharmaceutical firm Eli Lilly. While there are plenty more clinical trials still on track, this is the second one that’s been put on ice this week.

Are markets too complacent about the risks?In the big picture, the global economic situation has deteriorated drastically over the past few weeks, but markets have not paid much attention – at least not yet. Europe is on the verge of new lockdowns but is unlikely to get the stimulus antidote to offset that pain, the prospect of a successful vaccine in the next months seems less likely, and US relief talks are going nowhere fast.

Perhaps markets are taking solace in the rising chances of a decisive Biden victory that could bring huge stimulus with it. Even on that subject though, the Senate is still a toss-up race and the worst-case scenario for markets may be Biden winning the White House but the Republicans keeping the Senate, setting the stage for persistent government gridlock.

The bottom line is that equity markets have been priced for perfection and look vulnerable here, alongside the lockdown-stricken euro that may suffer from economic growth downgrades soon. The joker in all this is of course the US election, which may overshadow everything else over the next three weeks.

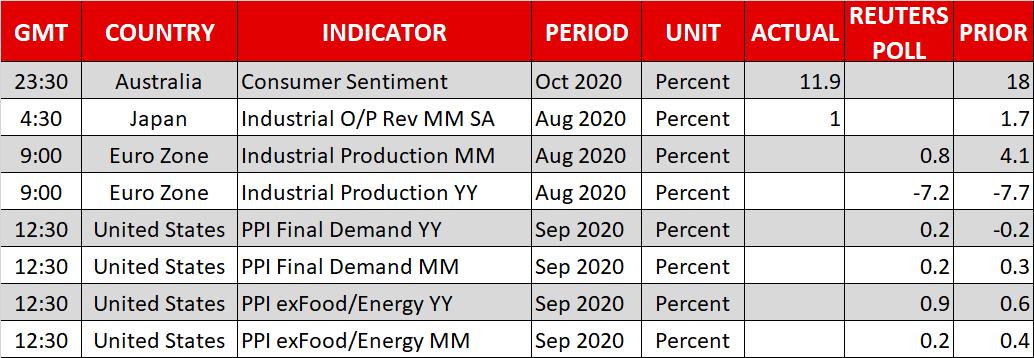

As for today, there’s a horde of central bank speakers on the agenda, including ECB chief economist Lane at 12:00 GMT and Fed Vice Chairman Clarida at 13:00 GMT. In earnings, Bank of America, Wells Fargo, and Goldman Sachs all report today before Wall Street’s opening bell.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.