Daily Market Comment – Markets drift sideways as US stimulus deal awaited

- US stimulus deal edges closer as talks continue, investors hold tight

- No clear winner from final presidential debate; uncertainty adds some support to dollar

- Euro bounces from lows as strong manufacturing shores up flagging Eurozone recovery

No deal yet but high hopes for more stimulus

No deal yet but high hopes for more stimulusMarkets remain fixated on the stimulus talks in Washington as the week draws to a close, with the window for a deal to be struck before the November 3 election closing fast. Positive signals about the prospect of a deal from House Speaker Nancy Pelosi and the White House are eclipsing doubts about whether Republican deficit hawks that dominate the Senate would ever approve the bill being negotiated, which is thought to be in the region of $1.9 trillion.

The latest soundbites coming from Pelosi are encouraging, with the House Democratic leader yesterday saying they are “just about there” on a COVID relief deal. But Trump’s top economic advisor Larry Kudlow was less optimistic, telling reporters that there were still “significant policy differences” between the two sides.

What is clear though is that even if an agreement is reached in the next day or two, it could take a while for the bill to be drafted and then voted on – something that Pelosi herself has indicated – so it’s looking less and less likely that a new stimulus package will be passed before the election.

However, markets appear unfazed by the prospect of a delay and have been steadily pricing in such a scenario. As long as the two sides keep talking and the size of the package stays close to $2 trillion, risk assets should remain supported.

US stock futures inched higher on Friday on the back of those hopes, adding to yesterday’s modest gains. European shares, meanwhile, opened sharply higher, as they played catchup after a sluggish week.

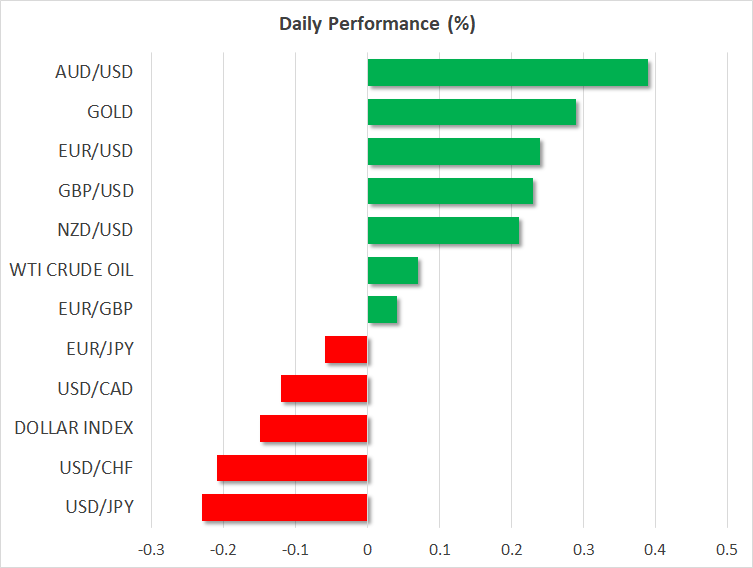

Dollar eases from highs but election uncertainty lingersThe US dollar recovered substantial lost ground yesterday and overnight but was still on track to end the week about 1% lower against a basket of currencies as stimulus hopes have been revived. The greenback’s slide comes even as Treasury yields have rallied sharply over the past week on the prospect of a ballooning US national debt.

The soaring yields got an additional boost from better-than-expected jobless claims and housing data out of the US yesterday, which may have temporarily restored the positive relationship between the dollar and Treasury yields. Election anxiety and doubts about the stimulus deal yesterday helped the greenback climb off 7-week lows brushed mid-week.

The dollar was back under pressure on Friday, though, even if the mood continues to improve, caution ahead of the upcoming presidential election is likely to curb sharp losses.

The final debate between the presidential candidates that took place yesterday gave neither Trump nor Biden a clear edge. Hence, even though Biden is well ahead in the opinion polls and a Democratic win would guarantee a large fiscal stimulus, many traders are being forced into wait-and-see mode out of fear of being caught off-guard by another election shock.

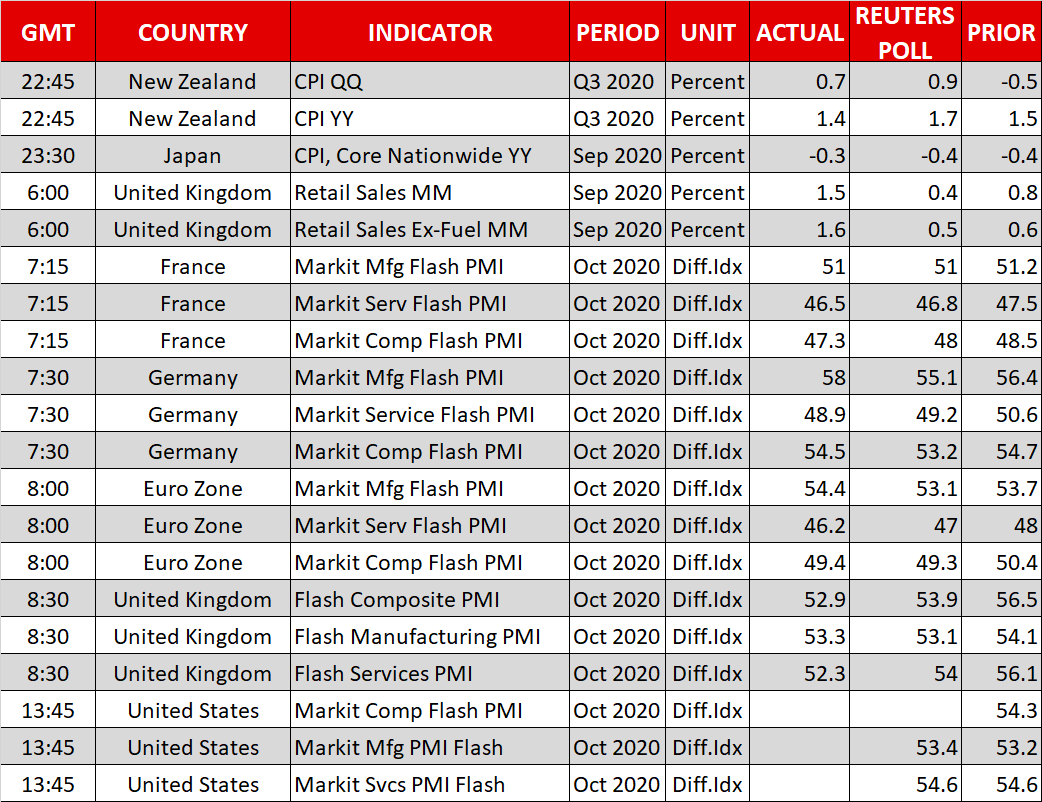

Euro lifted despite PMIs that are nothing to shout aboutAfter slipping earlier in the session, the euro bounced higher following the flash PMI releases, which showed the Eurozone recovery is not totally out of fuel. Manufacturing activity accelerated rapidly in October, somewhat offsetting a deeper-than-anticipated slump in services activity.

Still, overall economic activity contracted in October, suggesting the second virus wave engulfing Europe is significantly hurting businesses. But the strong performance of the manufacturing sector, which is less impacted by virus restrictions, does add hope that the recovery won’t be completely derailed and that could be what is aiding the euro.

The single currency was last trading 0.2% higher, outperformed by the aussie (0.4%), which was also boosted from upbeat PMIs.

The pound was flat, however, as investors ignored robust retail sales data out of the UK while they await an update on the Brexit negotiations.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.