Daily Market Comment – New batch of vaccine hopes and the Brexit endgame

- Fresh vaccine news boosts risky assets, but only barely

- Vaccines losing their mojo in lifting markets?

- Sterling cruises higher as speculation around a Brexit deal grows

- European PMIs not quite as dismal as feared

Diminishing positive returns from vaccine news?

Diminishing positive returns from vaccine news?The vaccine hype train keeps on rolling. AstraZeneca was the latest drug maker to announce its late-stage trial results and even though the efficacy rate was only 70% - much lower than that of Pfizer or Moderna – the news still injected another dose of relief into global markets on Monday. The logic seems to be that the more vaccines we have available, the better for the global economy, even if not all of them are completely efficient.

What’s striking is the diminishing positive effect each new batch of vaccine news has on financial assets. This is the third Monday in a row when encouraging vaccine news has hit the markets, and each time the positive impact on equities and other risk-linked assets has been getting smaller.

What’s worse, the playbook so far has been that the initial boost typically fades by the next day, as the brightening prospects for next year are not quite enough to eclipse the grim lockdown reality that investors have to grapple with right now. A vaccine is great news, but the global economy has to get through a long winter first.

Markets cheerful, but watch the FedThis battle between vaccine enthusiasm and the current lockdown reality will likely remain the dominant theme for a while longer. The raging question is whether all the ‘good news’ has been priced in by now, leaving markets vulnerable to any negative headlines as we go forward.

In this sense, much of the price action could depend on whether the Fed signals it will pull the QE trigger again in December. Policymakers have kept their cards close to their chest thus far, but frankly with tightening restrictions across America and Congress unlikely to deliver any substantial fiscal relief soon, they might not have much of a choice. The minutes of the latest FOMC meeting are out on Wednesday.

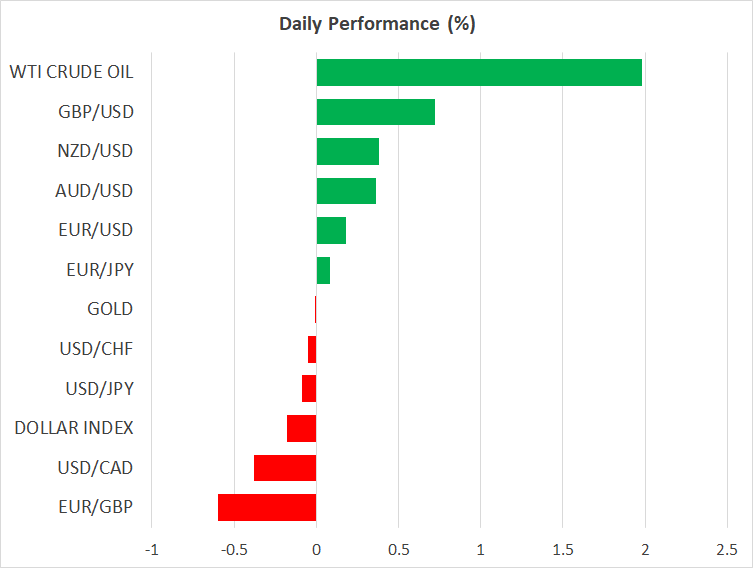

For now, markets are in a sanguine mood. Futures point to a ~0.6% higher open on Wall Street and commodity currencies are shining, with kiwi/dollar hitting a two-year high. Meanwhile, crude oil is cruising higher as the brighter outlook for demand next year has joined forces with expectations OPEC won’t raise its production levels after all.

It remains to be seen whether this cheerfulness will be sustained, or whether it will all unravel before long as has been the pattern this month.

Sterling turbocharged by Brexit exuberanceYet, the real outperformer in the FX market is the British pound, which is off to the races today amid growing hopes that a Brexit deal is finally within reach. There haven’t been any fresh headlines surrounding the talks, though the latest updates are that 95% of the treaty has been completed, with gaps remaining on the classic issues of competition rules, fisheries, and the policing of the deal.

Nothing is agreed until everything is agreed, but the price action suggests investors are growing more confident that an agreement is imminent as neither side can afford to sink its locked-down economy into an even deeper recession. Reports that the lockdown restrictions could be relaxed soon now that infections have plateaued may be further increasing sterling's allure.

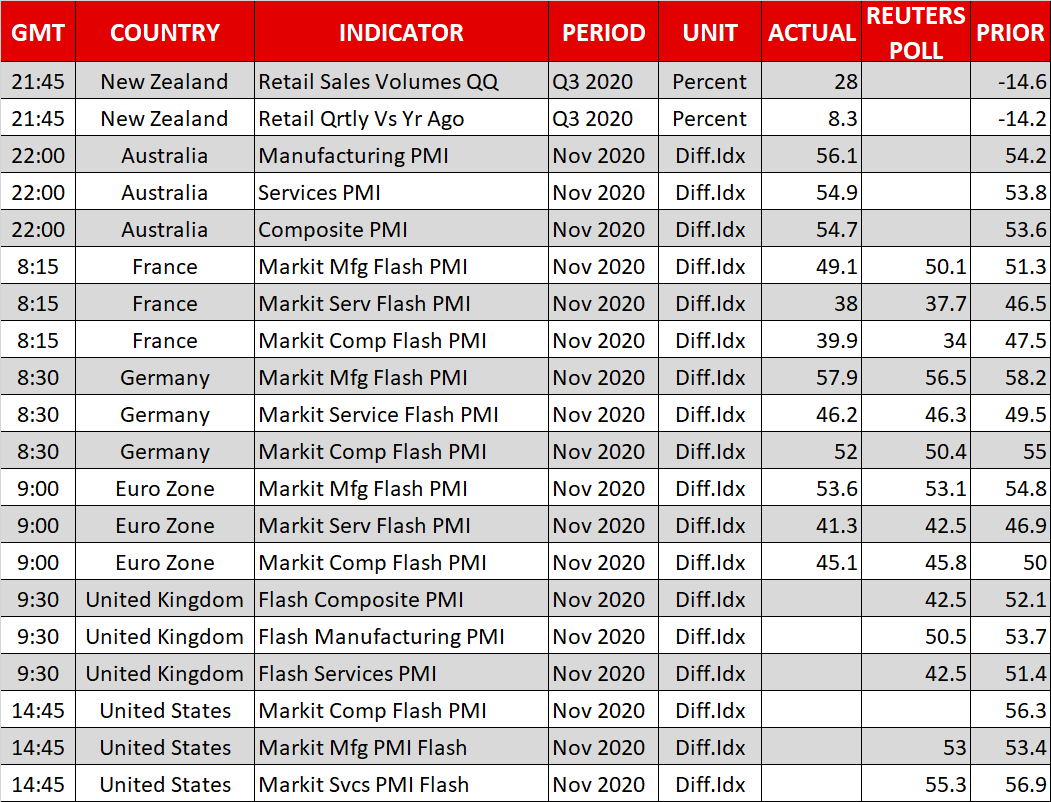

The euro is also moving higher. The Eurozone’s PMIs for November fell substantially, reflecting the lockdown damage, but traders may be feeling relieved the numbers at least were mostly in line with the forecasts, and not much worse.

Finally, the US Markit PMIs will be in focus today as well, alongside some remarks by the ECB’s Schnabel at 13:10 GMT and the Fed’s Daly at 18:00 GMT.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.