Daily Market Comment – Post-election rally eases as Biden advances in swing states

- White House race remains too close to call but Biden win becoming more likely

- Equity rally cools as markets give Washington gridlock a thumbs up

- Dollar steadies with Treasury yields as Fed keeps policy on hold

- NFP up next but US election and record virus cases to stay in focus

Biden inches towards victory in knife-edge election

Biden inches towards victory in knife-edge electionThe US presidential election remains an open race as counting enters day four, though the odds appear to be moving in favour of Joe Biden. The Democratic nominee is projected to win the key states of Nevada and Arizona but has also been making inroads in the battleground states of Georgia and Pennsylvania, with incumbent President Trump seeing his leads narrow significantly.

But whilst the next few hours could prove decisive for the world of politics, financial markets seem to have already settled for the prospect of Biden as president and a Republican-controlled Senate. It wasn’t that long ago when such a composition was seen as the worst-case scenario by investors as it would diminish the chance of either big tax cuts or a generous fiscal stimulus package.

A split Congress not such a bad thing for equitiesHowever, political gridlock on Capitol Hill does bring with it some advantages. For one, it would make it difficult for the Democrats to press on with their agenda of higher taxes and increased regulation. The receding fears of tax hikes and regulatory curbs for America’s tech giants have been fuelling the post-election rally on Wall Street and in stock markets around the world.

Investors also appear to have overcome their disappointment that the next virus relief bill is unlikely to match the CARES Act in size. But there is no doubt that, if needed, the Fed would compensate for the lack of fiscal action with additional monetary easing even as Fed officials are reluctant just yet to commit to any new measures.

US stock futures headed lower on Friday as traders paused for breath after four days of impressive gains that pushed the S&P 500 up by more than 7% and the Nasdaq Composite by almost 9%. European shares were mostly negative, trailing a mixed session in Asia where the Nikkei 225 stood out for hitting a 29-year high.

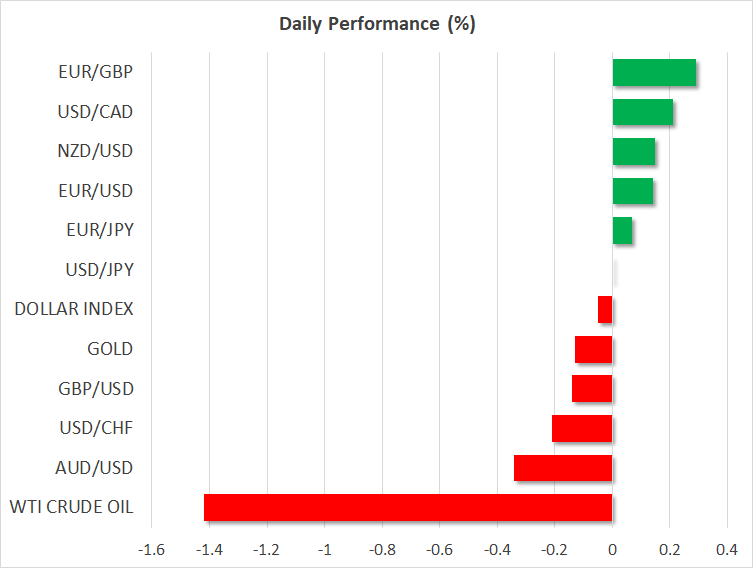

Dollar on steadier footing as election excitement ebbsFX markets were also calmer as currencies that had trounced on the US dollar’s pullback this week eased off slightly on Friday. The greenback was trading flat against a basket of currencies, while the yen was mixed.

Treasury yields stabilized following Wednesday’s dramatic downward reversal as expectations of big government spending by a Democratic-run Congress dwindled.

But although substantial fiscal stimulus may now be off the table, markets are anticipating further easy money by central banks around the world and this is likely to keep gold prices supported over the coming months. Gold slid today but held close to yesterday’s 6½-week high, having gained more than 4% since the end of October.

More central bank stimulus eyed as growth outlook bleakThe RBA and the Bank of England both increased their asset purchases this week and the ECB is expected to do the same next month. So there was some disappointment that the Fed offered no fresh clues on future stimulus after keeping policy unchanged yesterday as widely anticipated.

Fed Chair Jerome Powell talked down the prospect of any major changes to the current programme in his press conference and only hinted that they will decide in December on whether to extend the various emergency lending facilities.

Still, the Fed’s current pace of purchases of $120 billion per month is significant and is unlikely to be scaled back anytime soon. However, policymakers may yet be forced to do more if the US recovery falters.

The country recorded its highest daily tally of new COVID-19 infections on Thursday, topping 116,000 cases, and the resurgence in Europe also continues to get only worse.

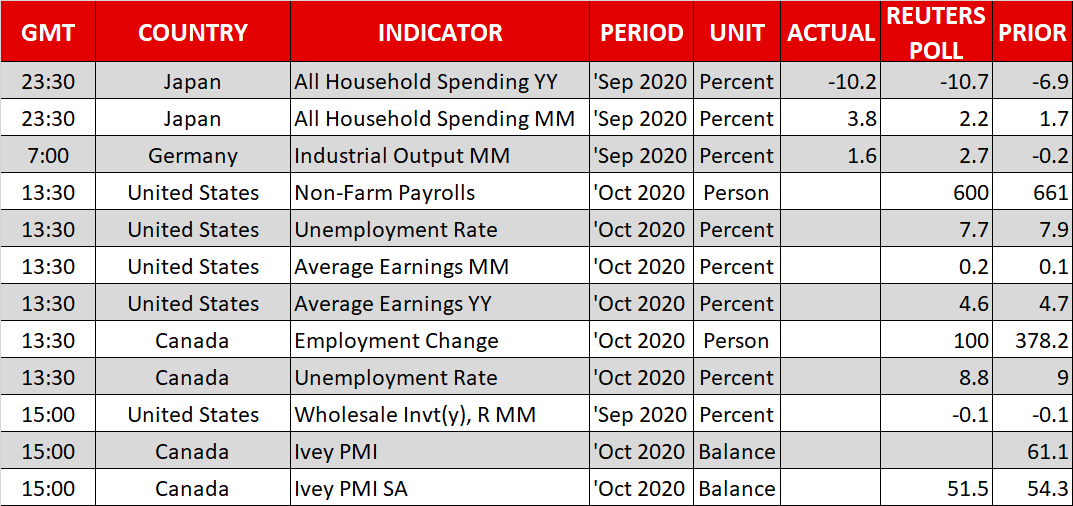

So far, the US economy is proving more resilient than its European counterparts and the October nonfarm payrolls report due later today is expected to confirm this. Nevertheless, any negative surprises in the report could help change this narrative.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.