Daily Market Comment – Sinking dollar lifts other FX boats, Wall Street slips

April blues hit the dollar

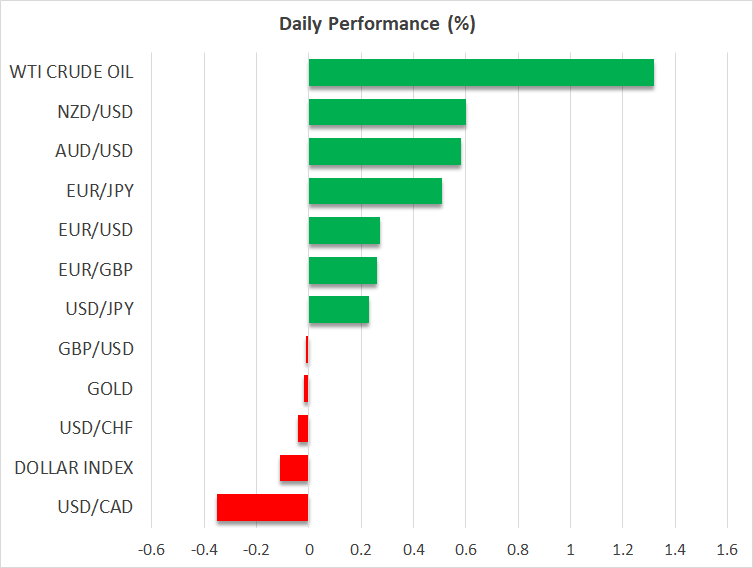

April blues hit the dollarA bad month for the US dollar keeps getting worse. The reserve currency fell through some crucial support levels across multiple charts yesterday and negative technical momentum has dominated ever since. It has really been one-way traffic downhill this entire quarter so far.

The dollar's troubles seem based on three pillars: receding bets for a Fed rate increase next year as FOMC officials insist they won't overreact to impressive economic data, the acceleration in European vaccinations, and the overall euphoric mood in equity markets.

The Fed has been adamant lately that it will keep a steady hand, forcing traders to wind back the aggressive pricing for rate increases that catapulted the dollar and Treasury yields higher last quarter. Meanwhile, Europe has finally ramped up its immunization program, allaying concerns about lockdowns making a comeback down the road and leading markets to recalibrate their expectations for economic growth.

As always, the question is how much of this narrative is already priced in and whether there's scope for euro/dollar to power even higher. In a nutshell, while the technical wind is blowing in the pair's favor right now, it's doubtful that this dynamic can last for long in an environment where America out-recovers Europe. The Fed will be faced with some scorching data soon and might be boxed into 'talking' about QE tapering by next quarter already, something the ECB won't do for a long time.

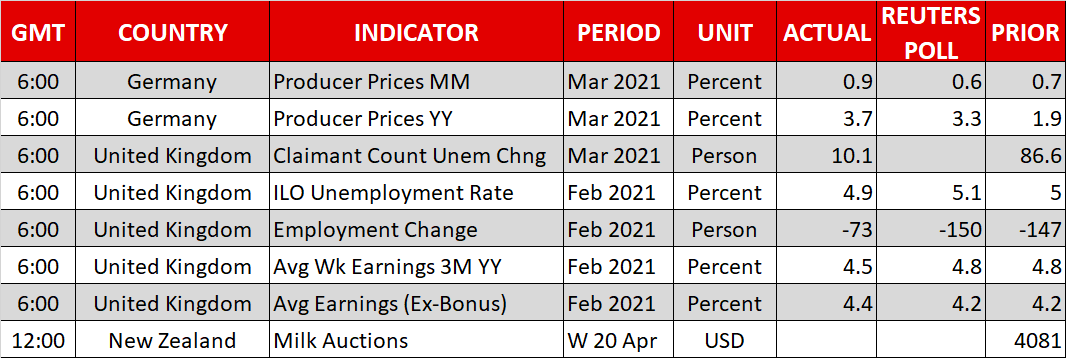

Sterling shines the brightestInterestingly enough, it was the British pound that capitalized the most on the dollar's pain. Cable rose from the ashes to hit the psychological region of $1.40, even without any UK-specific news behind the move. Looking ahead, it's a complex picture to navigate.

On the bright side, the UK economy has almost fully re-opened and about 60% of the adult population has received at least one vaccination shot. However, the quality of vaccinations is an issue. Most people have received the Oxford/Astra shot, which is less effective against new variants, implying that Britain's immunization program is not quite as 'bulletproof' as America's. There's also some political risk surrounding Northern Ireland and Scotland.

Stocks take a hit, earnings in the spotlightElsewhere, Wall Street hit a speed bump yesterday. The major equity indices retreated a shade from their record peaks, with Tesla (-3.4%) dragging the ship down amid reports of a fatal car crash and the havoc in cryptocurrencies.

Overall, market participants appear to be taking some chips off the table as the earnings season gets rolling. Optimism is running very high and the earnings outlook has likely been priced to perfection at these levels, so anything less than absolutely stellar results might be seen as a negative surprise. Hence, it's quite natural for some investors to 'play defense' here and try to sidestep a potential correction.

In this sense, all eyes will be on the string of earnings results that will be released today, most notably from Netflix, Johnson & Johnson, and Lockheed Martin.

Otherwise, the economic calendar is virtually empty today. Traders will have to wait until the Bank of Canada rate decision tomorrow for some excitement, and for the European Central Bank meeting on Thursday. Although nothing much is expected from the ECB, it will be interesting to see whether the central bank is comfortable with the continued rise in euro area yields and the euro's resurgence.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.