Daily Market Comment – Stock selloff deepens, dollar capitalizes

- Risk aversion pummels stocks, oil, and commodity FX

- US dollar shines bright as traders seek protection

- Fed minutes don’t reveal much, gold unable to shine

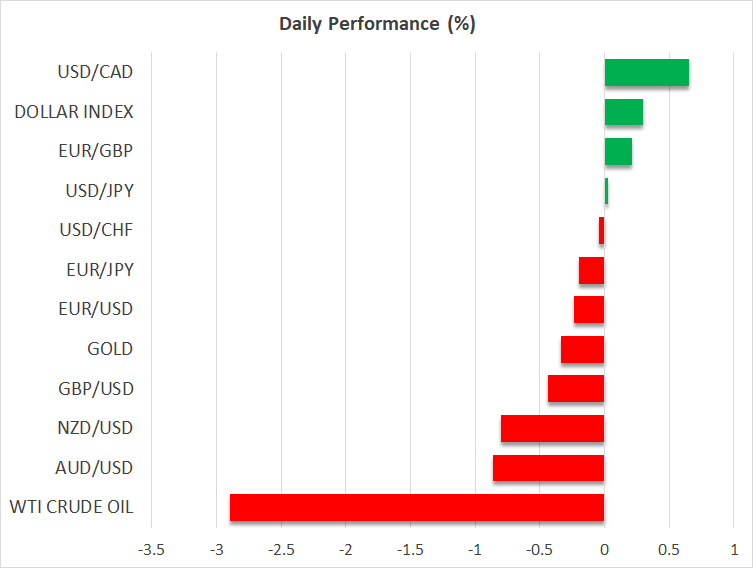

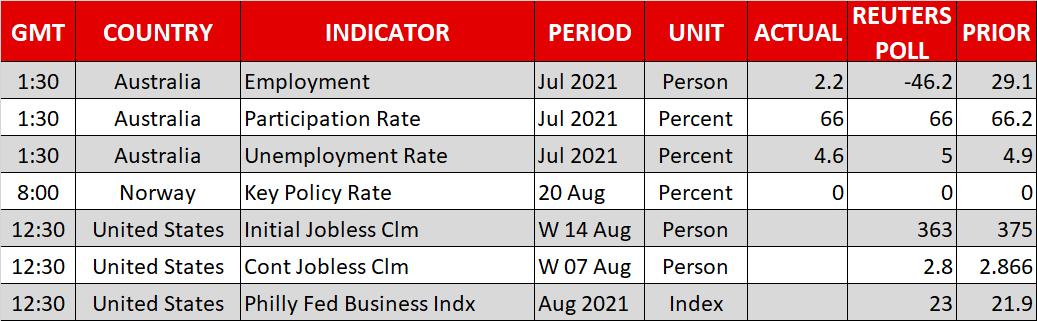

Growth fears deepenA sense of nervousness has returned to haunt financial markets. Investors are increasingly slashing their exposure to riskier assets amid concerns that the Delta outbreak will kneecap global growth, at a time when central banks are trying to take their foot off the accelerator. One by one, different charts are telling the same story. First it was the bond market that raised the alarm, next it was the commodity currencies and crude oil that started rolling over, and then the hammer fell on Chinese and small-cap stocks. Now the pain is spilling over into quality large-cap equities, which were the last bastion of optimism. The S&P 500 lost around 1% yesterday and futures point to a similarly negative open today, without any major news. The FOMC minutes overnight didn’t reveal anything new, so it is difficult to pin the blame on that. Instead, it looks like the markets simply reached a breaking point, after weeks of souring economic data and distressing virus news. Whether this selloff persists will likely depend on what the Fed says at next week’s Jackson Hole symposium. Concrete signals that a tapering move is on the table for September could provide the bears with more fuel. That said, the bigger picture remains promising. Investors will ultimately remember that equities are still the only play that provides any real returns, especially with Congress stepping up its fiscal game. Dollar slices higherIt wasn’t just stock markets that suffered, though. Crude oil also cracked below crucial levels, alongside the entire commodity FX space. Even some solid jobs numbers out of Australia overnight were unable to stop the onslaught. The only sanctuary was the US dollar. Beyond its role as the world’s reserve asset, the dollar could also be gaining traction on hopes the American economy will weather the Delta storm better than its rivals, thanks to relentless fiscal support. Meanwhile, the Fed remains committed to normalization. Minutes from the July FOMC meeting showed ‘most’ officials think tapering can begin this year, and this was before another stellar jobs report was released. Inflation is hot, the economy is now bigger than it was before the crisis, and the labor market could be near full employment by year-end. The main risk is the nation’s relatively low vaccination rate. That makes America more susceptible to another outbreak than Europe, especially if a more infectious or lethal variant comes along. Even so, this doesn’t always translate into a direct economic hit as US authorities are typically much more hesitant to enact social restrictions. Gold can’t capitalize, sterling struggles tooGold may be a shiny metal but its ability to glitter during periods of turmoil has all but evaporated since the pandemic hit, with the dollar replacing it as the market’s favorite defensive instrument. And since the dollar and bullion usually move in opposite directions, gold has started behaving like a risky asset. This dynamic is on full display today, with gold unable to capitalize on all the risk aversion or falling Treasury yields. Instead, it is being hammered lower by a resurgent dollar. Finally, another casualty of the souring mood has been sterling. There hasn’t been any massive news out of the UK, so it seems like the pound has been caught in the broader storm of risk aversion.

Growth fears deepenA sense of nervousness has returned to haunt financial markets. Investors are increasingly slashing their exposure to riskier assets amid concerns that the Delta outbreak will kneecap global growth, at a time when central banks are trying to take their foot off the accelerator. One by one, different charts are telling the same story. First it was the bond market that raised the alarm, next it was the commodity currencies and crude oil that started rolling over, and then the hammer fell on Chinese and small-cap stocks. Now the pain is spilling over into quality large-cap equities, which were the last bastion of optimism. The S&P 500 lost around 1% yesterday and futures point to a similarly negative open today, without any major news. The FOMC minutes overnight didn’t reveal anything new, so it is difficult to pin the blame on that. Instead, it looks like the markets simply reached a breaking point, after weeks of souring economic data and distressing virus news. Whether this selloff persists will likely depend on what the Fed says at next week’s Jackson Hole symposium. Concrete signals that a tapering move is on the table for September could provide the bears with more fuel. That said, the bigger picture remains promising. Investors will ultimately remember that equities are still the only play that provides any real returns, especially with Congress stepping up its fiscal game. Dollar slices higherIt wasn’t just stock markets that suffered, though. Crude oil also cracked below crucial levels, alongside the entire commodity FX space. Even some solid jobs numbers out of Australia overnight were unable to stop the onslaught. The only sanctuary was the US dollar. Beyond its role as the world’s reserve asset, the dollar could also be gaining traction on hopes the American economy will weather the Delta storm better than its rivals, thanks to relentless fiscal support. Meanwhile, the Fed remains committed to normalization. Minutes from the July FOMC meeting showed ‘most’ officials think tapering can begin this year, and this was before another stellar jobs report was released. Inflation is hot, the economy is now bigger than it was before the crisis, and the labor market could be near full employment by year-end. The main risk is the nation’s relatively low vaccination rate. That makes America more susceptible to another outbreak than Europe, especially if a more infectious or lethal variant comes along. Even so, this doesn’t always translate into a direct economic hit as US authorities are typically much more hesitant to enact social restrictions. Gold can’t capitalize, sterling struggles tooGold may be a shiny metal but its ability to glitter during periods of turmoil has all but evaporated since the pandemic hit, with the dollar replacing it as the market’s favorite defensive instrument. And since the dollar and bullion usually move in opposite directions, gold has started behaving like a risky asset. This dynamic is on full display today, with gold unable to capitalize on all the risk aversion or falling Treasury yields. Instead, it is being hammered lower by a resurgent dollar. Finally, another casualty of the souring mood has been sterling. There hasn’t been any massive news out of the UK, so it seems like the pound has been caught in the broader storm of risk aversion.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.