Daily Market Comment – Stocks and dollar stabilize as bond chaos cools

- Stock markets and FX pairs cool down after seismic moves

- Everything revolves around the bond market - is the squeeze over?

- Gold recovery stalls, ECB minutes and Canadian jobs coming up

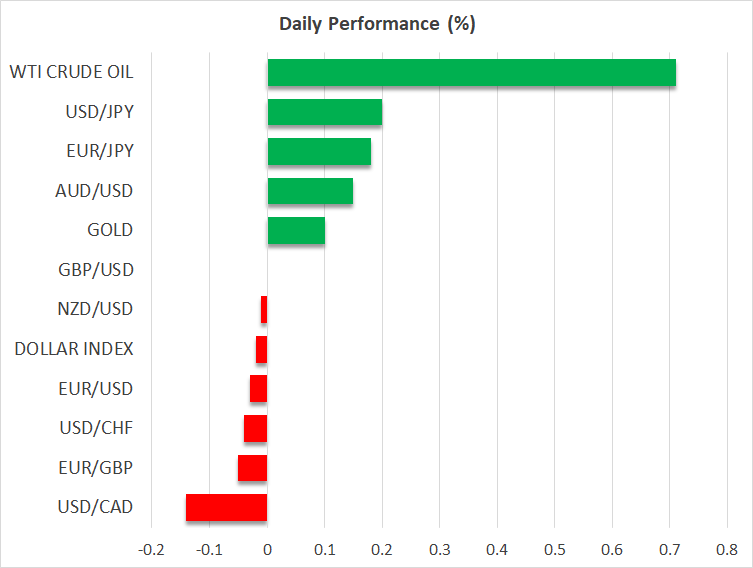

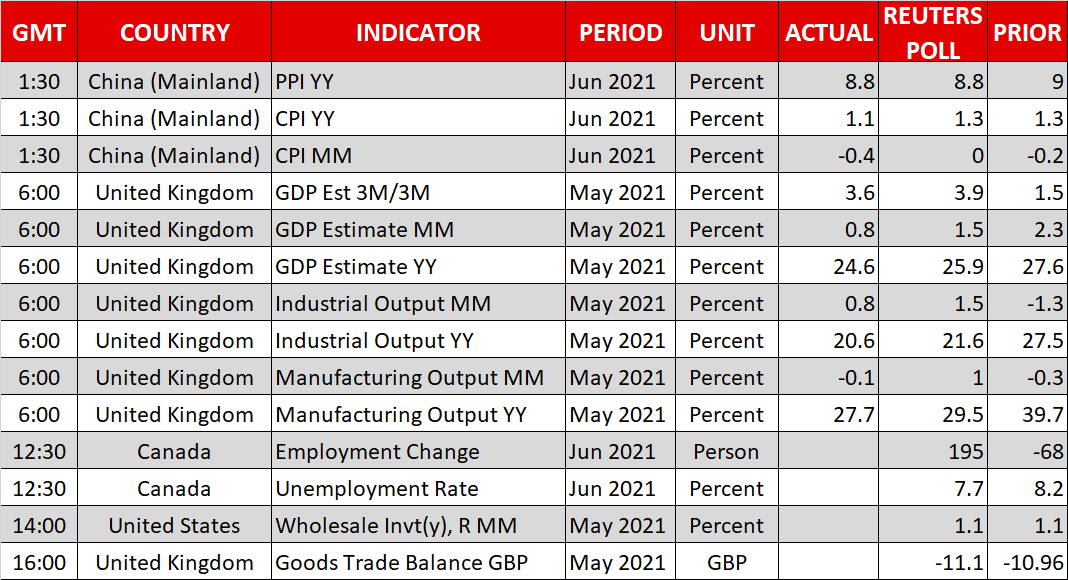

Is the bond market short squeeze done? After a week of mayhem across global markets, calmer tones are finally prevailing. The source of all the stress was the bond market, where yields started to break down. Such a move usually signals worries about weaker economic growth, which would ultimately translate into slower rate increases by central banks. When the bond market says something might be wrong, other asset classes pay attention. Stock markets came under fire yesterday and commodity currencies got hammered, while safe havens like the yen and Swiss franc shined bright. It was a classic risk-off move, with concerns around the rampaging Delta variant being blamed as the catalyst. However, that may be only half the story. The other part may be more technical in nature. Positioning in the bond market was stretched-short before this debacle, which means everyone was betting on higher yields by shorting the actual bonds. Fears around the Delta variant might have sparked the initial move, but it was likely amplified by a ferocious short squeeze in Treasuries. What does it all mean? In a nutshell, this pandemonium could fade soon as the short squeeze runs its course. We are already seeing signs of that today, with Treasury yields rebounding and Wall Street stabilizing. If that is the case, the latest gains in the yen and franc could evaporate soon. Dollar claws its way back, gold strugglesThe US dollar declined yesterday but is on track to close the week higher overall. That is impressive considering that falling Treasury yields are usually the dollar’s kryptonite, and speaks to the reserve currency’s safe-haven appeal. If the world economy - and especially emerging markets - are going to take a hit as the Delta variant spreads, then the dollar is probably the place to hide. The US is among the leaders in the global vaccination race and its economy will likely suffer the least thanks to the gargantuan spending programs. The dollar is essentially an all-weather currency. It can shine both when markets are fearful and when optimism is riding high, amid expectations of US economic exceptionalism. Over in commodities, gold could not advance yesterday even despite a softer dollar and falling real yields, which is a bad look. On the bright side, bullion is set to close the week with decent gains. Still, the big picture remains gloomy. It will be tough for gold to regain its former glory if the havoc in bonds was truly a short squeeze that will fade out. ECB minutes, Canadian jobs, and earningsAs for today, the spotlight will fall on the minutes of the latest ECB meeting and jobs numbers out of Canada. We already heard from the ECB yesterday when it raised its inflation target, so the minutes are unlikely to move the euro. The Canadian data could bring some relief to the loonie, which has been demolished by the pullback in oil prices this week. Even so, vaccination rates are high and the outlook for the economy remains bright with US spending spilling over. The Bank of Canada could be among the first central banks to raise rates this cycle. Finally, Wall Street is headed for a higher open today as the stabilization in bonds has given investors the green light to buy another dip. The recovery’s mettle will be tested next week when US banks get the earnings season rolling.

Is the bond market short squeeze done? After a week of mayhem across global markets, calmer tones are finally prevailing. The source of all the stress was the bond market, where yields started to break down. Such a move usually signals worries about weaker economic growth, which would ultimately translate into slower rate increases by central banks. When the bond market says something might be wrong, other asset classes pay attention. Stock markets came under fire yesterday and commodity currencies got hammered, while safe havens like the yen and Swiss franc shined bright. It was a classic risk-off move, with concerns around the rampaging Delta variant being blamed as the catalyst. However, that may be only half the story. The other part may be more technical in nature. Positioning in the bond market was stretched-short before this debacle, which means everyone was betting on higher yields by shorting the actual bonds. Fears around the Delta variant might have sparked the initial move, but it was likely amplified by a ferocious short squeeze in Treasuries. What does it all mean? In a nutshell, this pandemonium could fade soon as the short squeeze runs its course. We are already seeing signs of that today, with Treasury yields rebounding and Wall Street stabilizing. If that is the case, the latest gains in the yen and franc could evaporate soon. Dollar claws its way back, gold strugglesThe US dollar declined yesterday but is on track to close the week higher overall. That is impressive considering that falling Treasury yields are usually the dollar’s kryptonite, and speaks to the reserve currency’s safe-haven appeal. If the world economy - and especially emerging markets - are going to take a hit as the Delta variant spreads, then the dollar is probably the place to hide. The US is among the leaders in the global vaccination race and its economy will likely suffer the least thanks to the gargantuan spending programs. The dollar is essentially an all-weather currency. It can shine both when markets are fearful and when optimism is riding high, amid expectations of US economic exceptionalism. Over in commodities, gold could not advance yesterday even despite a softer dollar and falling real yields, which is a bad look. On the bright side, bullion is set to close the week with decent gains. Still, the big picture remains gloomy. It will be tough for gold to regain its former glory if the havoc in bonds was truly a short squeeze that will fade out. ECB minutes, Canadian jobs, and earningsAs for today, the spotlight will fall on the minutes of the latest ECB meeting and jobs numbers out of Canada. We already heard from the ECB yesterday when it raised its inflation target, so the minutes are unlikely to move the euro. The Canadian data could bring some relief to the loonie, which has been demolished by the pullback in oil prices this week. Even so, vaccination rates are high and the outlook for the economy remains bright with US spending spilling over. The Bank of Canada could be among the first central banks to raise rates this cycle. Finally, Wall Street is headed for a higher open today as the stabilization in bonds has given investors the green light to buy another dip. The recovery’s mettle will be tested next week when US banks get the earnings season rolling.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.