Daily Market Comment – Stocks fly to new records after ISM data, but dollar suffers

Promising data and tax doubts power up equities

Promising data and tax doubts power up equitiesThere's no stopping the stock market freight train. Euphoria took over financial markets on Monday after another stellar batch of US economic data, propelling the S&P 500 to new record highs. The catalyst was the ISM non-manufacturing survey, which hit an all-time high of its own in March, lighting a fire under riskier assets.

Coming hot on the heels of an impressive employment report last week, the dazzling ISM survey reaffirmed that the American economy is running like a well-oiled machine once again, empowered by a swift vaccination program and a storm of federal spending. Importantly, this might only be a taste of what's to come in the next months, as pent-up demand is unleashed and more stimulus rolls in.

But it gets even better for markets. President Joe Biden has a small mutiny on his hands, with some senators from his own party opposing the corporate tax increase he has proposed as being too high. Senator Joe Manchin said that raising the corporate tax rate to 28% is too much, but he could support a smaller hike to 25%.

The Senate is split 50-50, so Biden needs every single Democrat senator with him to pass his infrastructure agenda. Hence, it looks like the tax-raising side of this bill might be toned down, as Biden puts water in his wine and negotiates with his own party.

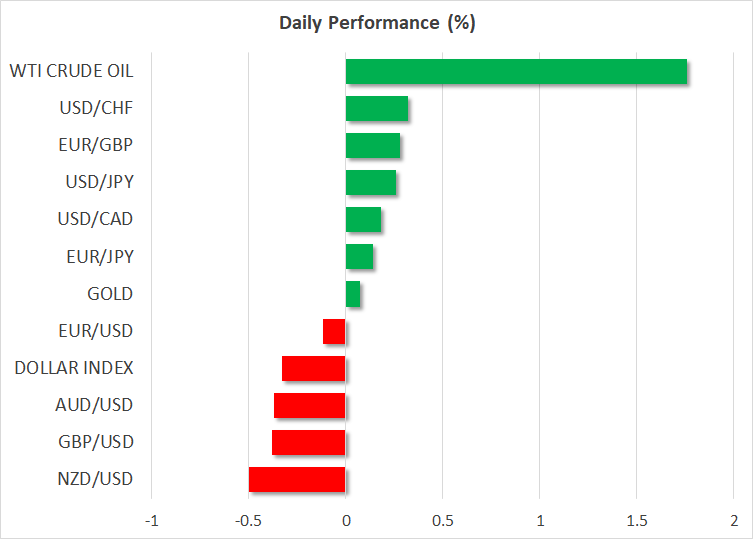

Good news is bad news for US dollarOver in the FX domain, most currencies capitalized on a retreat in the US dollar. The reserve currency took some heavy fire despite the stellar US data, as fading demand for safe-haven plays overpowered the improving economic picture. In other words, good economic news was bad news for the dollar, which often doubles as a defensive asset.

That said, this is a rare phenomenon nowadays. The greenback did behave almost exclusively like a safe-haven last year, but this year it has transformed into the US currency again. The short-term correlation with stock markets is now back to positive, after being deeply negative throughout 2020. As such, it might not be wise to draw any conclusions based on yesterday's moves.

As is usually the case, a sinking dollar lifted all others FX boats, with the euro and yen coming back to life. Even the battered Swiss franc got a shot in the arm. The question is whether all this was a minor setback in the broader US dollar uptrend, or whether the correction still has legs.

Overall, it is difficult to be pessimistic on the dollar. The US economy is already stronger than Europe's thanks to fewer lockdowns, is miles ahead in the vaccination race, and has more stimulus coming. Euro/dollar could remain heavy until one of these elements turns.

Oil prices drop, aussie yawns after RBAOil prices seem to have decoupled from market sentiment lately as supply dynamics have returned to the spotlight. Crude prices dropped sharply yesterday despite the cheerful mood elsewhere.

Markets seem to be grappling with the fact that OPEC+ will gradually raise its supply in the coming months, and that tensions between Iran and America are easing. The two nations will hold talks about resuming the nuclear deal this week, and if there is a breakthrough at some point, a flood of lost production could ultimately return to the market.

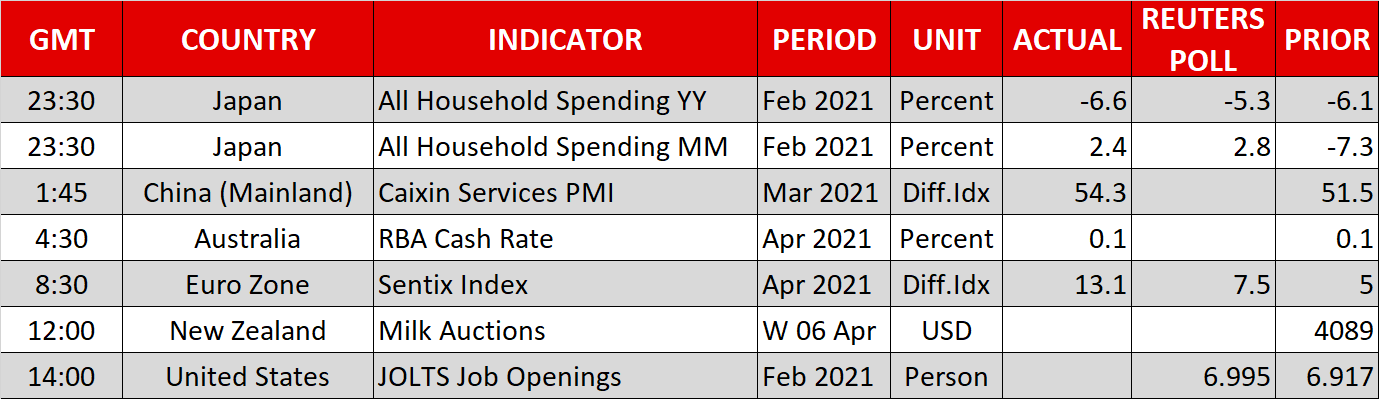

Finally, the RBA policy meeting was a non-event for the aussie.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.