Daily Market Comment – Stocks lick wounds, dollar retreats as Fed restores calm

Stocks claw back losses amid Fed reassurances and vaccine news

Commodity currencies continue to rampage, yen and franc in agony

Pound loses some steam after Chancellor warns of tax increases

Fed tranquilizer gun restores calm

All that was needed to restore order in financial markets were some soothing words from the Fed's top brass and some encouraging vaccine news. Wall Street came back to life after the Fed chief and vice-chief reassured investors that they won't overreact to any inflation episode this year and that the ocean of liquidity they've unleashed won't be withdrawn anytime soon.

Promises that cheap money will remain ample and news that Johnson & Johnson's vaccine will likely be approved for use in America soon were all the doctor ordered for global stocks to resume their ascent, even as bond yields marched higher as well.

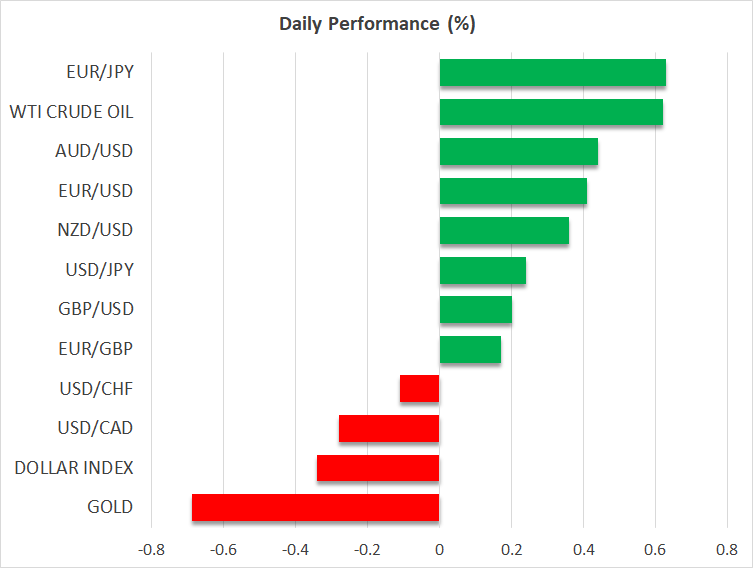

The comeback in risk appetite was even clearer in the FX playground. The commodity-linked currencies powered to fresh multi-year highs while defensive plays like the yen and franc were crushed as rate differentials became the dominant FX force again.

Bond yields are rising everywhere as investors position for a sustained global recovery, but they are rising much faster in Australia, Canada, and New Zealand. In contrast, the Bank of Japan keeps a ceiling on Japanese yields, so rate differentials between the commodity-linked economies and Japan keep widening to the yen's detriment.

Dollar caught in the middle, oil roars

The dollar was another casualty of the Fed's dismissive attitude towards normalization and the calmer market mood. It fell across the board, with the losses being heavier against its commodity-linked rivals.

The striking part is that the dollar is also losing ground against the euro, even though bond yields in the Eurozone have not risen as much as American ones. In other words, euro/dollar is marching higher despite diminishing support from relative interest rates.

This suggests that the dollar is back to behaving as a defensive asset, even though the inverse correlation with stock markets has weakened quite substantially lately. While the dollar seems to be realigning with US fundamentals overall, this is a process that takes time to play out. The link with risk appetite is unlikely to vanish overnight.

In the energy arena, crude oil continues its bullish conquest. Weekly data released yesterday showed a drop in US output as the snowstorms kneecapped production, while the positive vaccine news reaffirmed the brighter picture for demand. That said, oil prices have already come a very long way, so the risk of a corrective pullback seems elevated here, especially if OPEC+ raises its production limits next week.

Pound cools, parade of Fed speakers coming up

The British pound has been trading like a runaway freight train lately despite the wobbles in risk sentiment and relatively soft data, demonstrating that a cheerful vaccine story can work wonders for a currency.

Sterling's ability to absorb negative headlines with nothing but a scratch has been nothing short of remarkable. Even news that Chancellor Rishi Sunak is considering an increase in the nation's corporation tax rate was not enough to shoot down the high-flying pound yesterday, although the currency did surrender most of its earlier gains.

At some point, the breathtaking rally will be subject to a reality check – especially if Brexit risks relating to financial services come back to the spotlight – but that moment might not be imminent. For now, it's all about the vaccines and a booming post-covid economy.

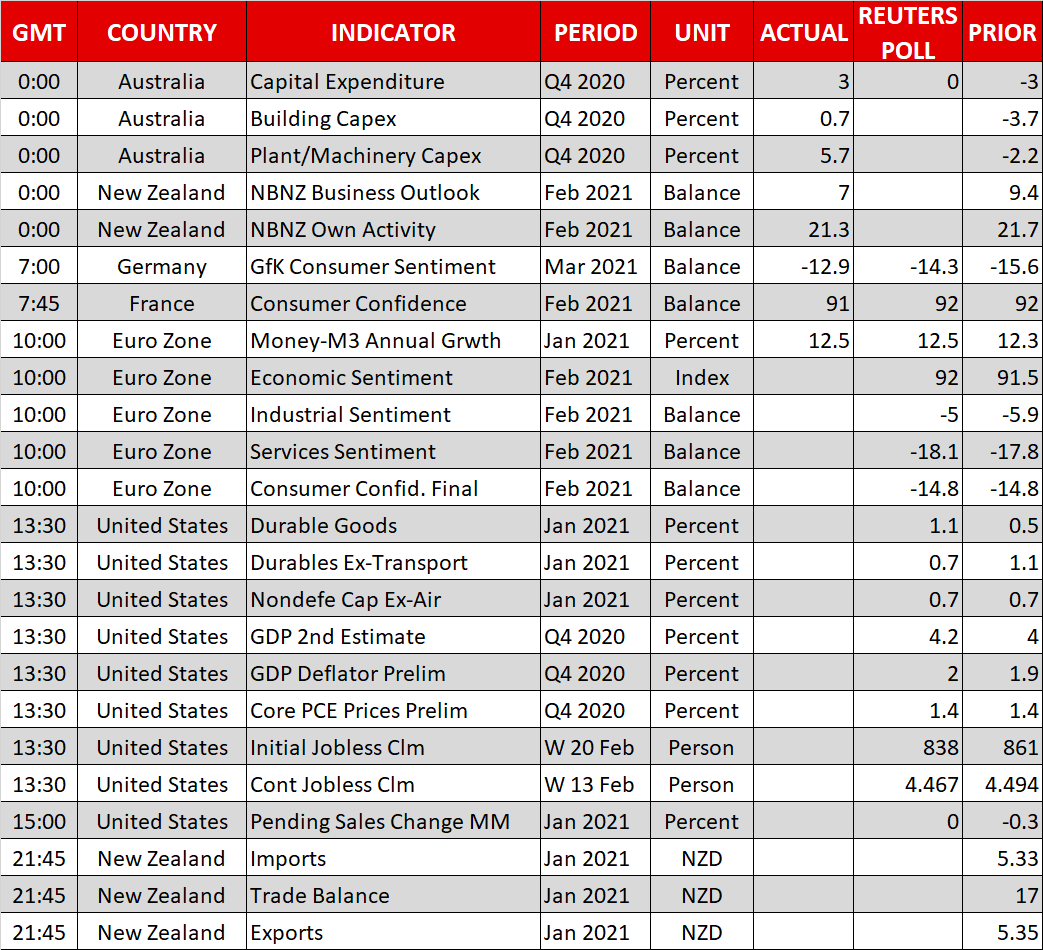

As for today, the data highlight will be US durable goods orders, which are seen as a proxy for capital expenditure. Beyond that, there's a parade of Fed speakers on the agenda, including Bostic at 13:30 GMT, Quarles at 16:10 GMT, and Williams at 20:00 GMT.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.