Daily Market Comment – Stocks perk up but shaky after Biden-Xi call; dollar pares weekly gains

- Global equities in better mood, Biden-Xi call helps, but Wall Street still looking wobbly

- Euro buys Lagarde’s ‘not tapering’ depiction, stays sluggish after ECB cuts QE pace

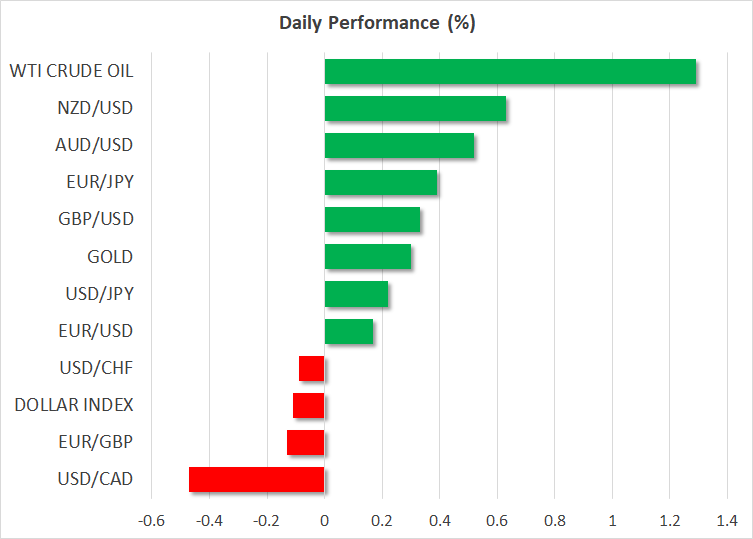

- Dollar slides again but on track for weekly gains as Fed officials reaffirm taper timeline

Stocks buoyed by hopes of improved Sino-US ties

Stocks buoyed by hopes of improved Sino-US tiesEquity markets were looking more cheery on Friday after somewhat of a tumultuous week. Renewed concerns about economic growth amid rising inflation and ongoing disruptions caused by the Delta variant, China’s broadening crackdown on private enterprises, and fears that central banks may remove stimulus too soon all came to a head this week to knock stocks off their pedestal.

However, whilst the losses were widespread across different sectors and regions, US tech stocks had a less disastrous week due to their defensive appeal. But it was Japanese stocks that bucked the global trend as they continued to rally on expectations that whoever replaces outgoing Prime Minister Yoshihide Suga will add more fiscal stimulus to Japan’s virus-stricken economy.

As for the improved mood today, investors were encouraged by signs of a thaw in relations between Washington and Beijing after President Biden had a 90-minute call with his Chinese counterpart – the first in seven months. Disputes over China’s trade practices and influence in the South China Sea have been some of the White House’s frustrations in recent years. And although it’s too early to say whether anything substantive has come out of the talks, it’s provided a much needed lift in Asian markets today, especially as worries remain about China’s tightening grip on the private sector.

The gaming industry is the latest to come under the scrutiny of Chinese regulators, though there was some relief after authorities said they will be slowing not halting the approval of online games following earlier reports that they would be suspending them.

An end-of-week bounce back for stocksChina’s CSI 300 index jumped 0.9% today, while in Tokyo, the Nikkei 225 index closed at a six-month high. In Europe, the Euro Stoxx 50 was up 0.3% in early trade and US stock futures were also pointing to solid gains, particularly the Dow Jones, which was last indicated up 0.5%.

Heading towards the September FOMC policy meeting in just under two weeks’ time, Wall Street might struggle to maintain its recent bullish momentum as the Fed looks almost certain to flag tapering for later in the year, most likely in November. Fed Governor Michelle Bowman was the latest FOMC member this week to downplay the surprise miss in the August payrolls number and call for some scaling back of the Fed’s asset purchases.

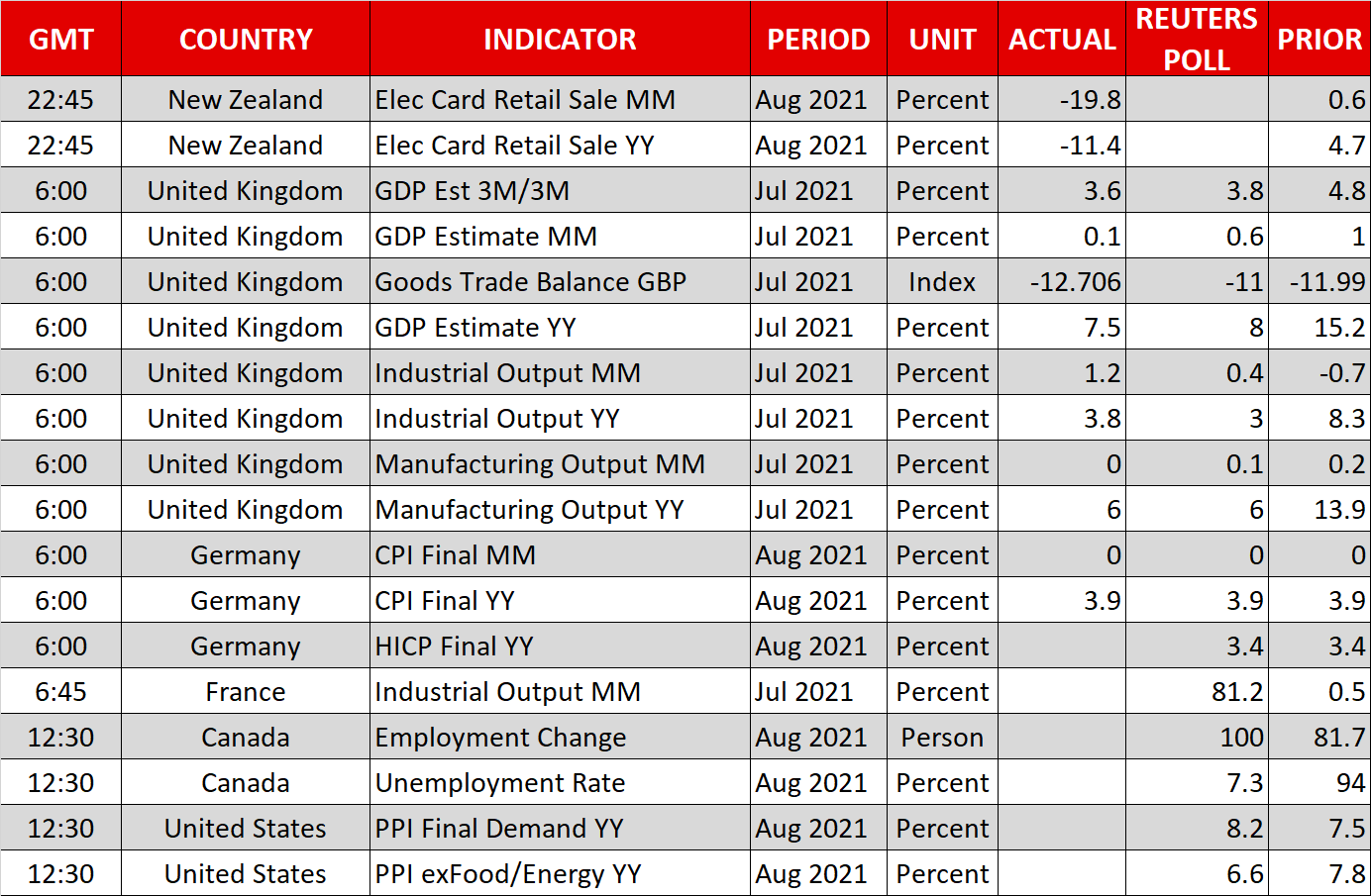

Better-than-expected jobless claims numbers on Thursday and record job openings in Wednesday’s JOLTS survey underscored the view that the US labour market remains in good shape.

Few fireworks after ECB taperHowever, as the Fed still ponders its next move, the European Central Bank has beaten the Fed to it, announcing yesterday that it will slow its bond purchases to a “moderately lower pace” as the Eurozone recovery solidifies and inflation picks up.

Not only was the decision widely expected, but so was President Lagarde’s attempt to brand the policy change as ‘recalibration’ rather than tapering. Nevertheless, investors are more likely to get hot and bothered about the ECB’s tapering strategy closer to December when policymakers will have to decide whether to use the PEPP’s full allotment and if the regular asset purchase programme should be ramped up once PEPP ends.

That might explain why the euro posted only modest gains on Thursday, while its advances today were mainly on the back of a weaker US dollar.

The euro is testing the $1.1850 level as the greenback skids again despite steadying overnight. The Japanese yen also pulled back today amid the more positive risk tone.

Kiwi leads gainers, pound shrugs off soft GDP dataThe New Zealand dollar was the best performer, shooting up towards $0.7150 to nearly wipe out its weekly losses. Aside from the stronger risk appetite today, signs that New Zealand is bringing the Delta outbreak under control, paving the way for a rate hike by the RBNZ in October, are also boosting the kiwi. The aussie wasn’t that far behind and sterling also gained, climbing to one-week highs, in spite of disappointing growth data out of the UK.

UK GDP barely expanded in July, sharply missing estimates, but the Bank of England will probably still be able to hike rates next year so this is likely to keep the pound supported.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.