Daily Market Comment – Stocks tank, dollar roars as inflation shows its teeth

Inflation wins this round

Inflation wins this roundWorries around higher interest rates being on the horizon have returned to torment Wall Street once again after some shockingly strong inflation numbers out of America. Consumer prices clocked in at 4.2% on an annual basis in April, exceeding the wildest forecasts among economists and reigniting the debate over when the Fed will begin to turn the cheap-money ship around.

Much of the spike comes down to base effects after last year's collapse in inflation, but even stripping those out, prices are still rising at an alarming clip as booming commodity prices and supply shortages meet roaring demand.

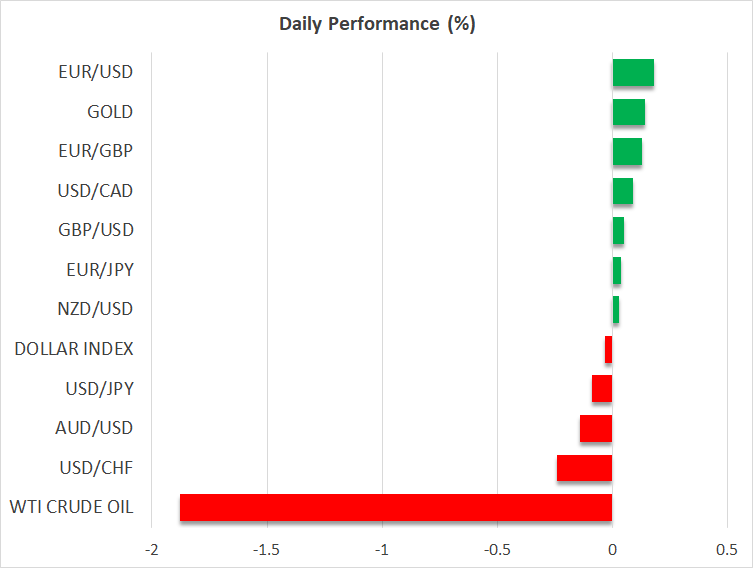

Markets were blindsided and the response was fierce. The dollar got its magic back while stocks were steamrolled as investors recalibrated the timeline for monetary policy normalization, with eurodollar futures contracts pointing to an almost 80% chance for a rate increase by December next year.

It's all about retail sales nowBut for all the enthusiasm, this isn't quite enough to jolt the Fed into action. Inflation might be showing its teeth but the labor market is still stuck in low gear. Ultimately, we are back to where we were last week in terms of narrative.

We had a massively disappointing jobs report and then a scorching hot inflation print, which in a sense cancel each other out in the Fed's eyes. The casting vote will be tomorrow's edition of retail sales. It will either calm some nerves or truly open the trap doors for a summer 'Fed-ache'.

All told, it's probably too early for the tapering discussion to begin in the summer even if inflation accelerates further. It's a delicate process that requires subtle hints over some time and a continued endorsement from incoming data, especially from the labor market.

The turning point might be in late August at the Jackson Hole or the September FOMC meeting. Until we get closer to that point, it's difficult to envision any tremendous dollar strength or a real implosion in stocks. The liquidity taps are still wide open.

Wall Street still in a sour mood, gold pressured by yieldsThe shock waves continue to reverberate, with futures pointing to another lower open on Wall Street today. And with yields on Treasuries rising as investors dump bonds to shield their portfolios from the inflationary nova, it seems that many players are simply moving to cash.

Even commodities are trading lower, which implies there's no place to hide for now. Gold got hit by the spike in real yields yesterday and the resurgent dollar. Still, an environment of rising inflation and still-loose monetary policy is great news for the yellow metal, which could continue to sparkle until the Fed actually pulls the QE plug.

Aside from the dollar, the FX market has been exceptionally quiet. There's been a clear disconnect lately, with currencies being mostly immune to the troubles in stock markets.

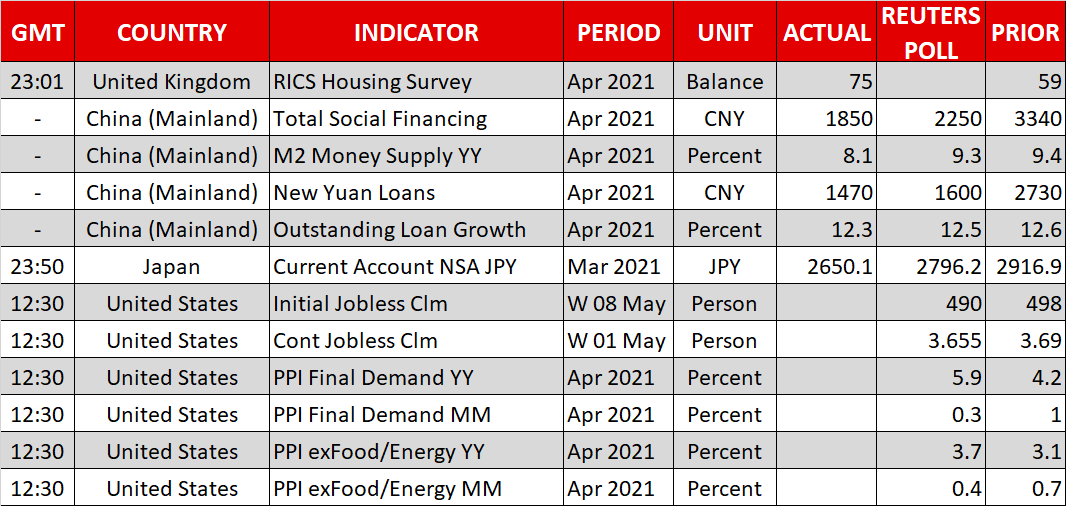

As for today, US producer prices could attract some attention amid the ongoing inflation scare. The Fed's Barkin (14:00 GMT), Waller (17:00 GMT), and Bullard (20:00 GMT) will all deliver remarks.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.