Daily Market Comment – US equities shine ahead of Fed but caution prevails elsewhere

- Wall Street rallies on strong earnings even as US Covid hospitalizations surge

- Caution is the order of the day elsewhere as Delta and growth fears linger

- Dollar starts Fed week on steady note but yen and gold inch higher, yields slip again

US stocks ride high; can anything spoil the fun?

US stocks ride high; can anything spoil the fun?Wall Street ended Friday in a euphoric mood as Q2 earnings continued to beat expectations, but trading has gotten off to a much more cautious start on Monday, with the Fed meeting high on investors’ agenda. All three leading indices finished the week in record territory, with the Dow Jones closing above 35,000 for the first time, while the S&P 500 shot above the 4,400 level.

The earnings season continues in earnest this week as all the Big Tech names are due to report, starting with Tesla today, followed by Apple, Microsoft and Alphabet tomorrow.

Nasdaq futures were outperforming on Monday, standing flat in early European trading amid strong optimism about tech earnings. But Dow Jones and S&P 500 futures were tracking the broader markets lower.

Worries about rising virus cases around the world and the subsequent toll on economic growth were heightened on Monday. Even the United States is seeing a fresh spike not just in infections but in hospitalizations as well, as the country’s vaccination pace has ground to a halt lately.

Further roiling markets today are more signs of regulatory crackdown in China on locally listed tech companies, with Tencent becoming the latest victim after authorities’ recent assault on Didi. But the intervention is now widening to the education and property sectors, sending shares in Hong Kong and China into a spin and dragging the rest of Asia lower as well, with the exception of Tokyo.

Markets hoping for a dovish but optimistic FedThe question now is whether the worsening outbreak of the Delta variant will eventually catch up with Wall Street. Throughout the pandemic, ‘buy the dip’ mantra has always generated a quick rebound from any panic selling, though US tech giants’ newfound status as defensive stocks has ensured that the dips haven’t been very steep. But lately, the appeal of non-tech US equities has also been growing, attracting funds from emerging markets in particular as, apart from stellar earnings, the American economy is increasingly being seen as the most resilient to further virus crises.

Whether the Fed is feeling quite as upbeat could be crucial as to how well the positive sentiment holds up. The Federal Open Market Committee (FOMC) meets on Tuesday and Wednesday to deliberate how soon the $120 billion a month in asset purchases should be dialled back. Although it’s unlikely policymakers will explicitly flag a tapering decision just yet, investors will be anxious to see how much further progress the Fed thinks has been achieved since the last meeting and whether the rampant spread of the Delta variant has affected the outlook.

Judging by which way Treasury yields were headed on Monday, the market doesn’t seem to be betting on a hawkish surprise.

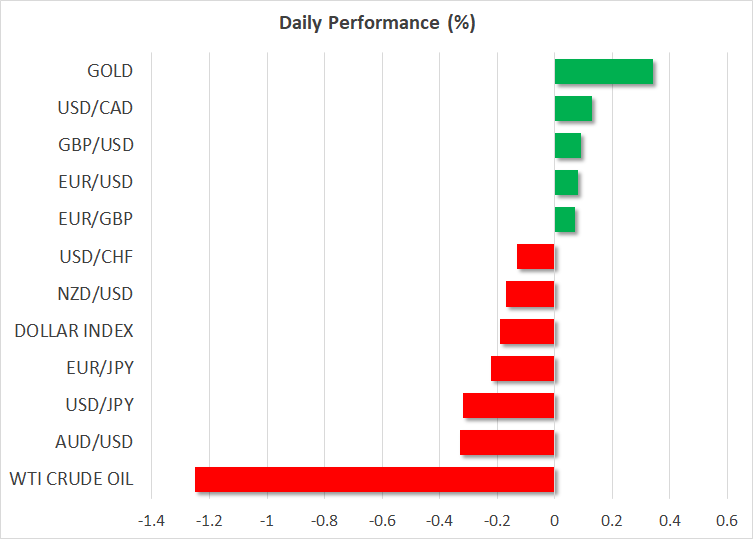

Safe havens up, riskier currencies underperformThe downside reversal in yields lifted gold, which is advancing above the $1,800/oz level. Aside from the surge in virus cases, concerns about the growth outlook have been exacerbated by the recent extreme rainfall in China and Europe, adding to safe haven flows. But there are geopolitical concerns at play too amid brewing Sino-US tensions over Taiwan.

The dampened outlook weighed on oil prices but boosted the Japanese yen, and to a lesser extent the Swiss franc. The US dollar, however, was marginally down on the day on a firmer euro and pound.

But the commodity-linked dollars were all weaker on Monday, led by the aussie.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.