Daily Market Comment – Virus concerns cast aside as upbeat data boosts sentiment

- Stocks rebound as risk aversion eases on positive data from China and the US

- But virus worries linger as Australia and the UK impose local lockdowns

- Dollar heads higher, eyes Powell testimony and more US data

- Pound hammered by Brexit and virus woes

Risk appetite improves on recovery optimism

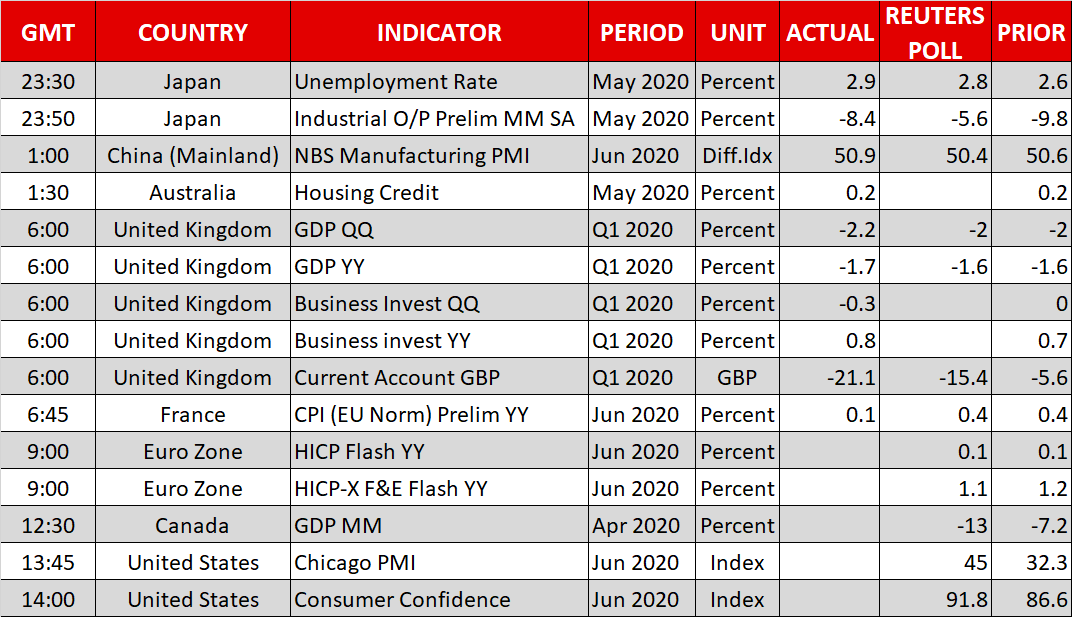

Risk appetite improves on recovery optimismHopes for a V-shaped recovery were bolstered after encouraging data out of the United States and China over the past 24 hours showed that the growth revival remains on track in the world’s two largest economies. US pending home sales soared by a record 44.3% between April and May, while China’s manufacturing PMI beat expectations in June.

Data from other countries was not quite so positive as industrial output slumped further in Japan during May. But nevertheless, investors continue to give more weight to the good news and downplay the negatives.

The latest developments that markets should be more worried about are the spikes in coronavirus cases in various parts of the world. US virus cases have surpassed the 2.5 million mark, while the death toll is nearing 130,000. Several states have already rolled back on plans to reopen their economies, with Arizona being the latest to shut down bars, gyms and other businesses again.

Yet, nothing seems to be able to keep Wall Street down as the Dow Jones surged by more than 2% on Monday, lifting Asian stocks this morning.

Second flare-ups are also causing alarm in Australia and the United Kingdom, which have become the latest countries to place certain cities or areas under regional lockdown, in a further sign that the reopening of economies will not be a smooth process.

Downbeat Powell and Hong Kong tensions cap sentimentThe reality that the recovery will not be plain sailing is likely to become more evident in the coming weeks and until then, markets will probably remain confined to the sideways range that has been taking shape in both the FX and equities spheres during June.

But it’s not only the threat of a faltering recovery that is holding down the pause button in the risk rally. US-China tensions are brewing in the background and could escalate again after the US Commerce Department began withdrawing Hong Kong’s special status that gives it preferential treatment on trade and other areas. The move follows the passage of the controversial Hong Kong security law by China today, raising question marks about the ‘one country, two systems’ arrangement.

The renewed frictions between the two superpowers may be one reason weighing on risk sentiment today as European trading got off to a mixed start and US stock futures turned negative.

Another warning by Fed chief Jerome Powell of the “extraordinary uncertain” outlook could also be playing on investors’ minds. In prepared remarks for his hearing before the House Financial Services Committee later today, Powell said “Output and employment remain far below their pre-pandemic levels” and again called on Congress for additional fiscal support.

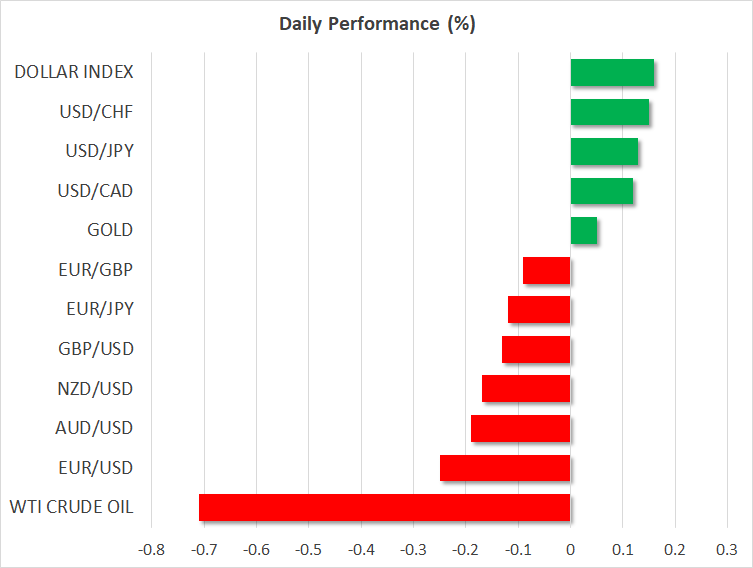

Gold was trading flat ahead of Powell’s appearance before Congress, while the US dollar was slightly positive after rebounding sharply overnight. The yen was also firmer, underlining some caution in the markets as investors await Thursday’s nonfarm payrolls report. But before that, there will be plenty of other US indicators to keep an eye on, including today’s consumer confidence gauge.

No respite for the poundThe euro and the Australian dollar were both on the backfoot on Tuesday, though the pound was a little steadier after tumbling to a one-month low of $1.2249 yesterday.

Sterling came under pressure on Monday after Prime Minister Boris Johnson suggested he would be happy with a bare-minimum ‘Australia-style’ trade deal with the European Union. Apart from ongoing Brexit troubles, there are also concerns about how the UK will pay for its massive virus stimulus given the already high government and current account deficits.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.