Daily Market Comment – Wall Street slips, dollar shines, RBNZ holds fire

- Stock markets edge lower after US retail sales disappoint

- Risk aversion reawakens the dollar ahead of Fed minutes today

- RBNZ says rate hikes ‘delayed not derailed’, kiwi goes wild

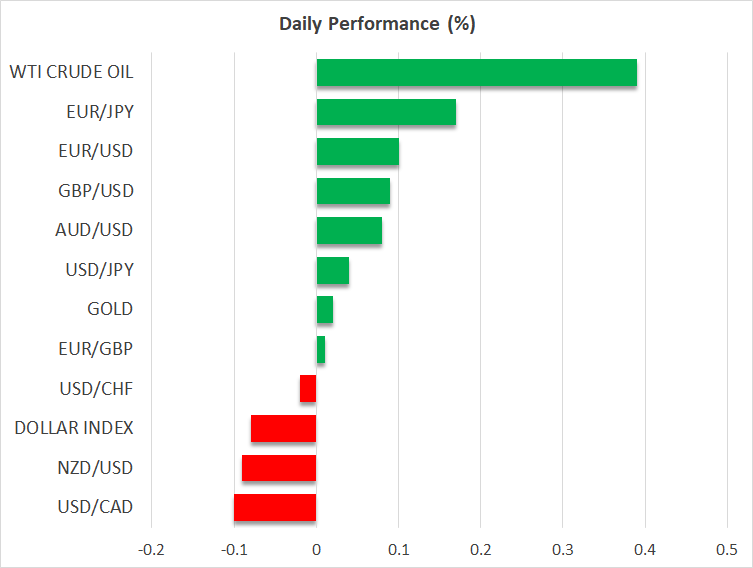

Stocks bleed, but not muchIt was a lively session across global markets. Wall Street came under pressure on Tuesday after US retail sales fell short of expectations, amplifying concerns that consumer spending may be rolling over and reinforcing the narrative that economic growth has already peaked. Of course, the retreat was mild and there wasn’t any sense of panic selling, with the S&P 500 losing just 0.7%. It is quite impressive that US markets are still within touching distance from record highs, defying an imminent withdrawal of Fed liquidity as well as a worsening Delta outbreak in America and Asia, even with valuations being so stretched. This resilience might boil down to expectations that the Fed will be infinitely cautious in reining back stimulus and that Congress will put a floor under economic growth by delivering another multi-trillion round of spending. Monetary policy will still be super-loose after tapering and the fiscal taps aren’t closing. Stock markets can always bleed, but dip buyers aren’t going away anytime soon. Dollar stands tall, looks to Fed minutesThe FX market traded exactly as one would expect when growth worries are the dominant theme, with commodity currencies getting blasted alongside the risk-sensitive British pound. Across the risk spectrum, it was the dollar that shined the brightest even despite the disappointing US retail sales, highlighting once again that ‘when the going gets tough’ everyone seeks shelter in the world’s reserve currency. The yen also performed well, but its advance was capped by global bond yields rising a little. Euro/dollar is currently testing its lows for the year around $1.17 and whether it manages to pierce through this region might depend on what the Fed minutes have to say about tapering today at 18:00 GMT. That said, the Jackson Hole symposium next week is where any real hints will drop, so this might steal the thunder from the upcoming minutes. The question is whether we will get a formal taper announcement in September or November. That doesn’t matter much in the big picture. Tapering is coming, it’s just a matter of time. Even the Fed’s arch dove - Neel Kashkari - said so yesterday. The path of least resistance for the dollar still seems higher, especially against low-yielders like the euro and yen. RBNZ holds rates, kiwi goes for a rollercoaster rideThe real fireworks today were in the kiwi after the Reserve Bank of New Zealand kept interest rates unchanged. What looked like a certain rate increase until a couple of days ago was thrown under the bus after the nation went into a snap lockdown yesterday to battle the first virus outbreak in months. The kiwi took some damage as the RBNZ held its fire, but it came back roaring as Governor Orr signaled that their normalization plans were merely delayed, not derailed. Rate forecasts were revised higher to reflect that, now penciling in around five rate hikes by the end of next year. Overall, the message was that this isn’t a game changer, but merely a speed bump in the road towards higher rates. The kiwi’s fortunes are now tied to the domestic health situation. Will New Zealand eradicate the virus from its borders again or will it follow Australia in a vicious lockdown spiral? That will determine whether the RBNZ honors its promises.

Stocks bleed, but not muchIt was a lively session across global markets. Wall Street came under pressure on Tuesday after US retail sales fell short of expectations, amplifying concerns that consumer spending may be rolling over and reinforcing the narrative that economic growth has already peaked. Of course, the retreat was mild and there wasn’t any sense of panic selling, with the S&P 500 losing just 0.7%. It is quite impressive that US markets are still within touching distance from record highs, defying an imminent withdrawal of Fed liquidity as well as a worsening Delta outbreak in America and Asia, even with valuations being so stretched. This resilience might boil down to expectations that the Fed will be infinitely cautious in reining back stimulus and that Congress will put a floor under economic growth by delivering another multi-trillion round of spending. Monetary policy will still be super-loose after tapering and the fiscal taps aren’t closing. Stock markets can always bleed, but dip buyers aren’t going away anytime soon. Dollar stands tall, looks to Fed minutesThe FX market traded exactly as one would expect when growth worries are the dominant theme, with commodity currencies getting blasted alongside the risk-sensitive British pound. Across the risk spectrum, it was the dollar that shined the brightest even despite the disappointing US retail sales, highlighting once again that ‘when the going gets tough’ everyone seeks shelter in the world’s reserve currency. The yen also performed well, but its advance was capped by global bond yields rising a little. Euro/dollar is currently testing its lows for the year around $1.17 and whether it manages to pierce through this region might depend on what the Fed minutes have to say about tapering today at 18:00 GMT. That said, the Jackson Hole symposium next week is where any real hints will drop, so this might steal the thunder from the upcoming minutes. The question is whether we will get a formal taper announcement in September or November. That doesn’t matter much in the big picture. Tapering is coming, it’s just a matter of time. Even the Fed’s arch dove - Neel Kashkari - said so yesterday. The path of least resistance for the dollar still seems higher, especially against low-yielders like the euro and yen. RBNZ holds rates, kiwi goes for a rollercoaster rideThe real fireworks today were in the kiwi after the Reserve Bank of New Zealand kept interest rates unchanged. What looked like a certain rate increase until a couple of days ago was thrown under the bus after the nation went into a snap lockdown yesterday to battle the first virus outbreak in months. The kiwi took some damage as the RBNZ held its fire, but it came back roaring as Governor Orr signaled that their normalization plans were merely delayed, not derailed. Rate forecasts were revised higher to reflect that, now penciling in around five rate hikes by the end of next year. Overall, the message was that this isn’t a game changer, but merely a speed bump in the road towards higher rates. The kiwi’s fortunes are now tied to the domestic health situation. Will New Zealand eradicate the virus from its borders again or will it follow Australia in a vicious lockdown spiral? That will determine whether the RBNZ honors its promises.

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.