Market Comment – Gold and oil keep rising as Israel-Gaza conflict shows no sign of easing

Possibility of weekend escalation in Middle East propels gold and oil higher

Powell remarks provide only modest respite to bond selloff, dollar holds steady

Stocks continue to struggle as uncertainties rise, Powell keeps rate hike option

Simmering tensions keep markets on edge

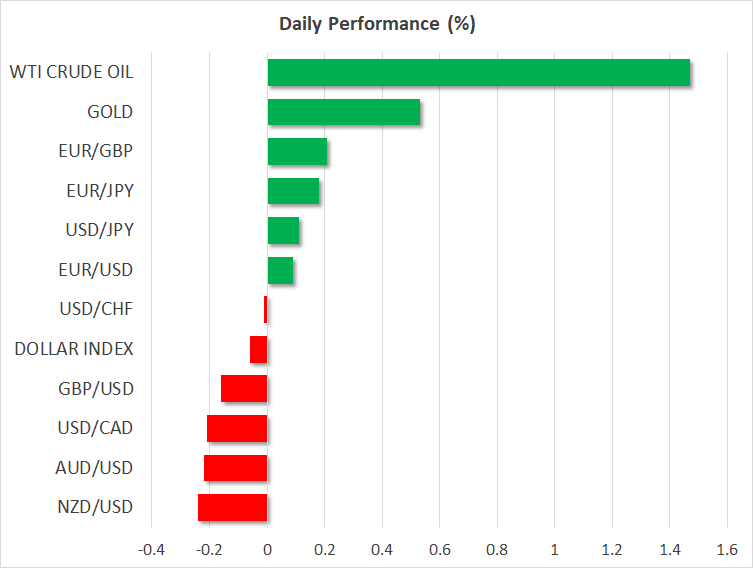

Simmering tensions keep markets on edgeThe ongoing conflict in the Middle East continued to weigh on market sentiment on Friday as investors were on alert for a possible escalation over the weekend. With reports suggesting that a ground offensive by Israel into the Gaza Strip could be imminent, oil futures headed higher, extending their weekly gains to between 2% and 3%.

Gold, which has been the safe haven of choice during this latest episode, climbed to a three-month high above $1,980/oz, as the risk of the conflict widening appears to be growing. Tensions on Israel’s northern border with Lebanon are boiling over after Hezbollah reportedly fired more rockets, while a US warship intercepted three missiles from Yemen, likely to have been launched by Iranian-backed Houthi forces.

Traders are all too wary that a full-scale ground invasion could drag the entire region into a war, so these latest gains in oil and gold prices would likely be just the start if we end up with the worst-case scenario.

Stocks weighed by mixed earnings and geopoliticsThe heightened geopolitical risks are starting to become a major worry for equity markets. Investors already have to navigate through an uncertain outlook for interest rates and a further complication from a fresh surge in oil prices is the last thing that markets need.

The Q3 earnings season isn’t turning out to be what many investors were hoping for either. This week’s earnings have been a mixed bag, with Tesla’s big miss sounding the alarm for the other big tech earnings due next week.

The S&P 500 and Nasdaq closed at their lowest in two weeks on Thursday as the jump in Netflix stock (+16.1%) could only go so far in boosting the broader indices.

Powell signals conditional pauseBut the biggest drag on Wall Street at the moment is the Fed’s ‘higher for longer’ stance, which pushed the 10-year Treasury yield just shy of 5% yesterday. Ten-year yields at 5% is what is considered by many as the threshold that could cause something to break in the economy, and combined with the geopolitical tensions, it’s hard to see Wall Street bulls surviving in such an environment.

Those investors betting that the Fed would come to the markets’ rescue have been left disappointed and Chair Powell’s remarks yesterday reinforced the view that policymakers are not about to start wavering.

In comments at the Economic Club of New York, Powell appeared to agree with his colleagues that higher yields could “at the margin” reduce the need for further tightening. However, Powell also signalled that if economic growth remains above trend or the labour market stops cooling down, then further tightening might be warranted.

Rate hike expectations dipped slightly and rate cut bets increased somewhat after his remarks, pulling the two-year yield lower. But long-term yields ended the day higher, although both the 10- and 30-year yields are softer today, with the former easing to 4.94%.

Dollar lacks direction, pound and yen slipThe fact is that Powell’s comments could be interpreted as both dovish and hawkish and that might explain why there wasn’t any major reaction in the US dollar. Weekly jobless claims out of the US yesterday were exceptionally strong, underscoring Powell’s caution on inflation.

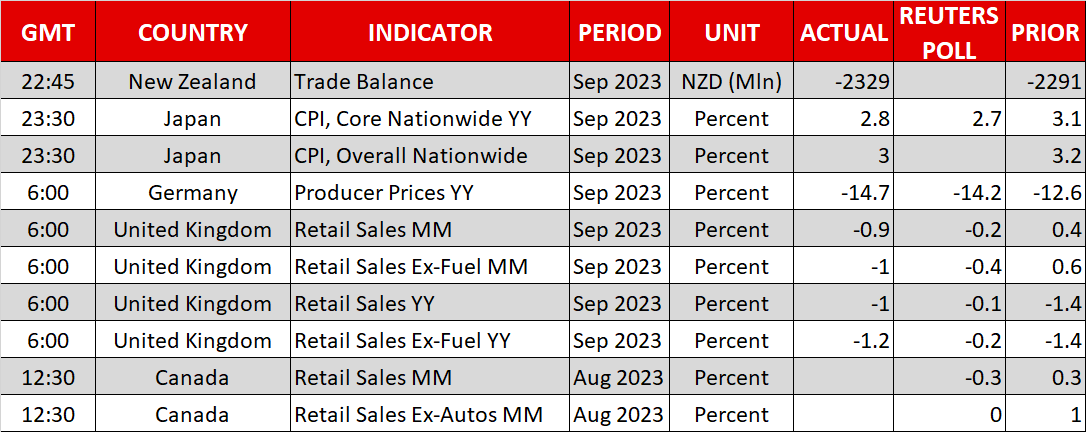

In contrast, UK retail sales released earlier today were far weaker-than-expected, briefly pushing the pound below $1.21. Further weighing on sterling was a warning from Bank of England Governor Andrew Bailey that he expects UK inflation to fall sharply next month.

The yen also came under pressure, weakening towards the 150 per dollar mark after data showed that Japan’s core CPI rate fell below 3.0% in September for the first time in two years.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.