Market Comment – Hawkish Fed boosts the dollar, BoE and BoJ next

Fed revises rate path higher, lifting dollar and yields

Stock markets and gold move lower in the aftermath

BoE decision today a coin toss, BoJ unlikely to move

Fed commits to higher for longer

Fed commits to higher for longer

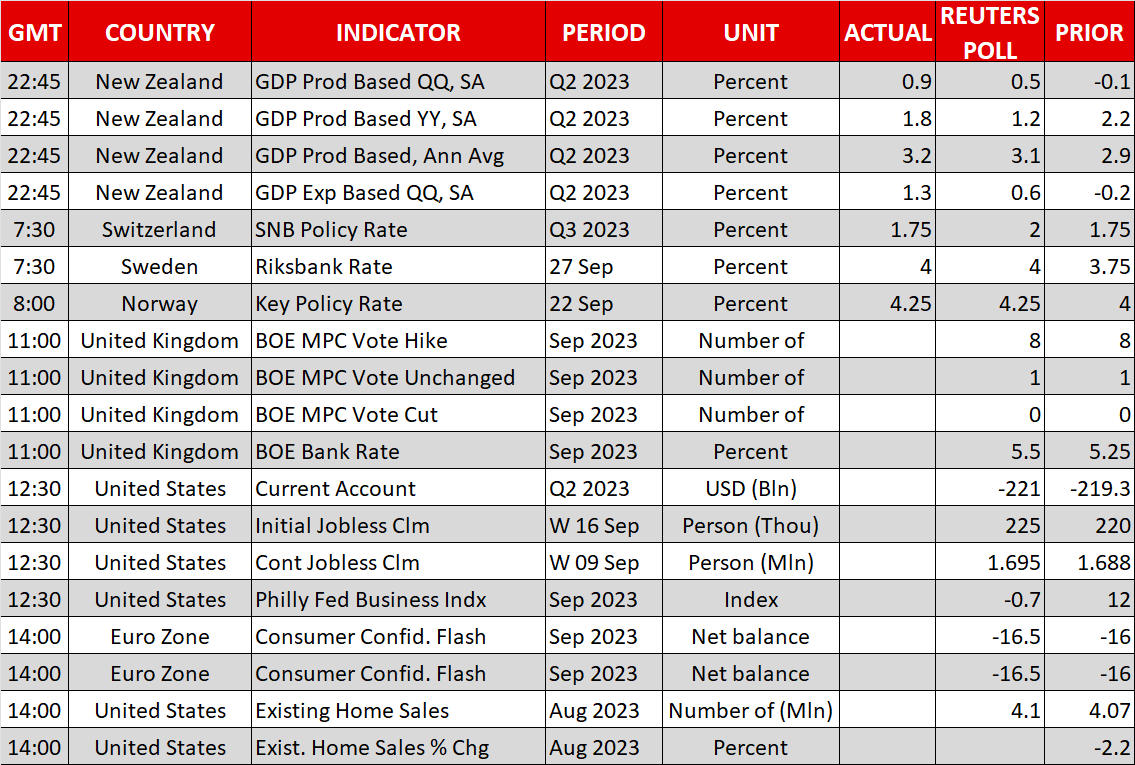

The Federal Reserve kept interest rates unchanged yesterday, as widely expected, but revised its economic forecasts and interest rate projections higher. Reflecting the recent flow of resilient US data releases, the Fed raised its economic growth estimates for 2023 and 2024, softly signaling that the risk of an imminent recession has faded.

Most importantly, the updated ‘dot plot’ telegraphed one more rate increase for this year and fewer rate cuts for next year. Specifically, FOMC officials now see interest rates closing 2024 at 5.1%, which is 50bps higher than the 4.6% they anticipated back in June. Hence, the Fed now predicts only two rate cuts for next year, from four cuts previously.

Overall, the Fed delivered rosy economic forecasts and lifted its rate path to reflect the notion that interest rates will remain at higher levels for a longer period of time, in order to cool the US economy. This was the overarching message from Chairman Powell as well.

Investors responded by pushing out the anticipated timing of the first Fed rate cut, which is now expected in one year. This translated into a boost for US Treasury yields, with the yield on ten-year debt racing higher to trade at its highest levels in 16 years.

Dollar shines, equities and gold retreat

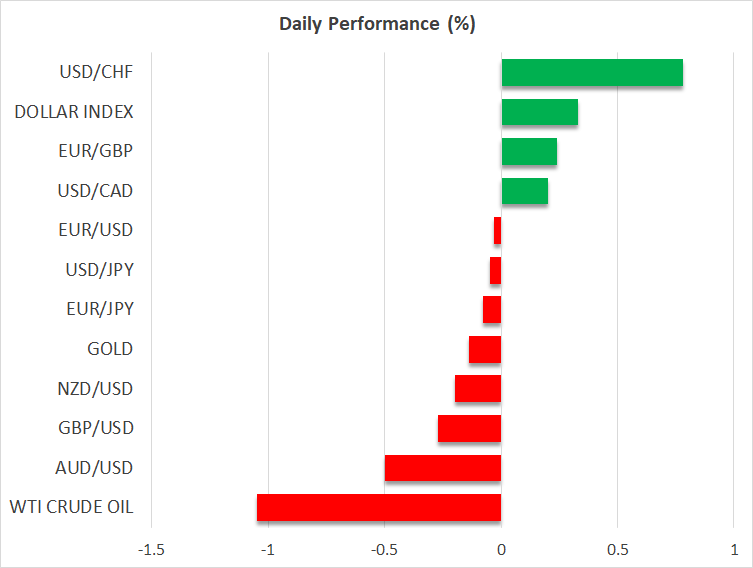

With the Fed’s rate path getting recalibrated higher and long-dated US yields hitting new cycle highs, the natural beneficiary was the US dollar, which reached its strongest levels in 11 months against the low-yielding Japanese yen.

The dollar currently offers a unique combination of solid economic fundamentals, high interest rates, and safe-haven qualities. In contrast, other major currencies such as the euro are haunted by faltering economic growth, rising fuel costs, and high exposure to slowing Chinese demand. This economic divergence might be increasingly reflected in FX rates moving forward.

Meanwhile, Wall Street lost ground on Wednesday as the prospect of elevated interest rates for a prolonged period of time is harmful for riskier assets like stocks. Valuations are stretched by historical standards and rising yields are usually the ‘medicine’ that helps compress valuation multiples, which is what played out yesterday.

Similarly, an environment of rising yields and an appreciating dollar is toxic for gold, which got rejected near $1,947 yesterday and fell sharply after the Fed decision. That said, bullion continues to display relative resilience. It remains 7% away from record highs even though US yields have reached their highest levels in a generation, so it seems there’s ‘real’ demand from inelastic buyers, most likely central banks raising their gold reserves.

BoE decision is a coin toss

As for today, the central bank torch will pass to the Bank of England. Following the latest inflation report that was colder than expected, markets are pricing this rate decision almost as a 50-50 coin toss.

Admittedly, the data pulse argues for no action. The labor market lost jobs in July while economic growth stagnated, and business surveys suggest these trends will persist or worsen. The only real argument in favor of a rate increase is wage growth, which is extremely hot and continues to accelerate.

As for the pound, the risks seem tilted to the downside. Even if the BoE raises rates, the vote will probably be split and the officials are unlikely to commit to any further action. Hence, any upside FX reaction on a hike might be short-lived, and if the BoE does not raise rates, the pound could fall immediately.

Elsewhere, the Swiss National Bank kept rates unchanged today, sinking the Swiss franc. Early on Friday, the spotlight will shift to the Bank of Japan. There isn’t much prospect for any policy changes, leaving the battered yen vulnerable to further downside as rate differentials widen against it.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.