Market Comment – Kiwi plunges on RBNZ’s dovish turn, Wall Street consolidates

Aussie and kiwi take a dive as Australian CPI, RBNZ ease rate hike fears

China’s property troubles also weigh

Wall Street and dollar await PCE data for direction

RBNZ disappoints hawkish bets

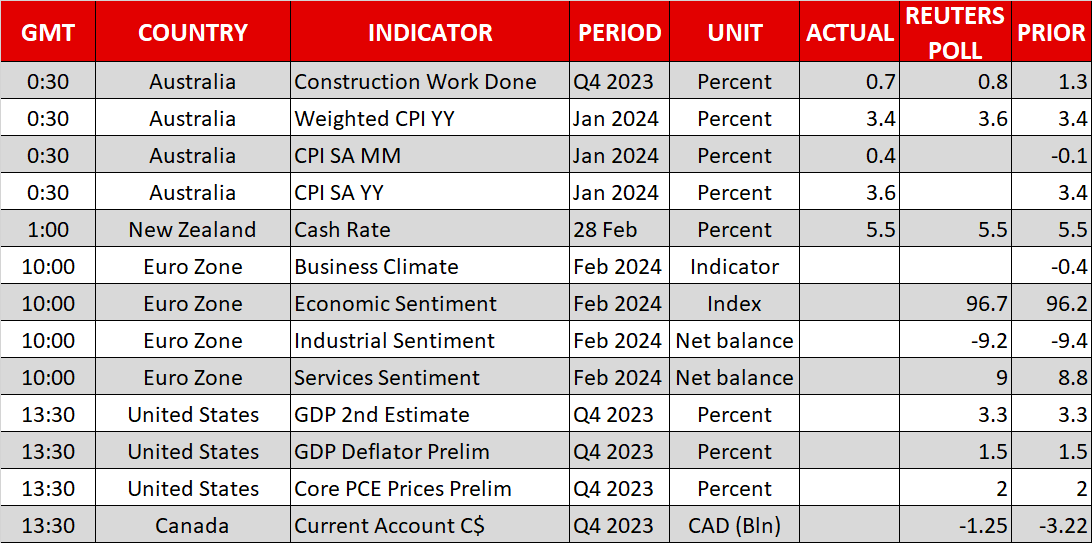

RBNZ disappoints hawkish betsThe Reserve Bank of New Zealand did not live up to the hawkish expectations that had been building up in the run up to today’s interest rate decision. Despite the recent hawkish commentary from Governor Orr and much speculation that the next move in the OCR is more likely to be up than down, the RBNZ signalled that rates have probably peaked as it kept policy unchanged.

In another dovish tilt, the RBNZ did not even push back on the timing of the expected rate cut, maintaining its projection that the OCR could be cut in the first quarter of 2025.

The New Zealand dollar skidded on the announcement, losing about 1% against its US counterpart to test the $0.61 level. Chatter about a possible rate hike had spurred a more than 2.5% rally for the kiwi this month but its bullish prospects have been dimmed now that the RBNZ does not appear to be willing to buck the global central bank trend of a neutral stance.

Aussie rebound also suffers a setbackThe Australian dollar was another big loser on Wednesday as the currency came under pressure from weaker-than-expected inflation data. Australia’s consumer price index held unchanged at 3.4% y/y in January, confounding forecasts of a rise to 3.6%, while underlying measures eased from the prior month.

The softer readings put the spotlight on the RBA, which had also recently struck a more hawkish tone. Investors slightly upped their bets for year-end rate cuts by the RBA, weighing on the aussie, which slid to below the $0.65 level after the data.

More cracks in China’s real estate marketIn a further knock for the risk-sensitive aussie and kiwi, news that one of China’s embattled property developers, Country Garden, is facing a liquidation petition in a Hong Kong court added to worries about the Chinese economy.

Stocks in China fell sharply on the headlines, but the reaction elsewhere was muted. Investors likely continue to see little risk of contagion for the moment, while fresh troubles for property developers can be seen as prompting authorities for more action to support the sector.

There was already some announcement on that front today as authorities in Hong Kong announced an easing of property restrictions to boost housing demand.

Stocks turn cautious as rally loses steamMost Asian indices ended Wednesday’s session in the red and European shares also opened lower following a mixed close on Wall Street yesterday. Traders have been in wait-and-see mode this week as all the focus is on Thursday’s PCE inflation numbers.

The S&P 500’s rally appears to have cooled as it reaches the 5,100 level, but the increased caution isn’t so much about the next big psychological hurdle, but more about the dialling back of Fed rate cut expectations.

Soft landing narrative keeps bull market afloatIn a dramatic repricing since the start of the year, markets are no longer anticipating more rate reductions than the Fed’s own median projection.

Fed officials have all been singing from the same hymn sheet lately, preaching patience and stressing that there’s no urgency to cut rates. The unified message comes after a string of hotter-than-expected economic data, including inflation.

The next inflation test will be on Thursday when the Fed’s closely watched metric – the core PCE price index – is released. Markets appear to have digested this re-assessment of Fed rate cut bets rather well as recession fears have also receded. However, equities might struggle more should we head towards just two rate cuts for 2024.

Investors will also be keeping an eye on Fed speakers, with Bostic, Collins and Williams due to speak later today.

Dollar bounces back as oil rangeboundThe US dollar is edging up today against a basket of currencies, having yesterday broken its week-long losing streak. The euro and pound both slipped, taking their cues from the aussie and kiwi, while the yen extended its gains against all the majors apart from the greenback.

The stronger dollar dragged gold prices lower and oil futures were down as well in European trading. Oil prices have been stuck in a tight sideways range since mid-February as the ongoing attacks on Red Sea shipping by Houthi rebels has kept tensions in the region elevated even as efforts have intensified for Israel and Hamas to agree to some kind of a ceasefire in the fighting.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.