Market Comment – Stocks climb after sizzling US jobs report

Nonfarm payrolls smash forecasts, reaffirming labor market strength

But dollar unable to hold onto gains, as stock markets race higher

Gold hits new record highs, defying rising yields and geopolitics

US labor market sizzles

The American economy continues to hum along, with the labor market still firing on all cylinders. Nonfarm payrolls rose by 303k in March, handily surpassing forecasts. What is most impressive is that the unemployment rate fell even as labor force participation rose, which suggests the new wave of workers entering the labor market were easily absorbed. It increasingly seems that heightened immigration flows are the main driver behind the persistent gains in US employment growth, something that would also help explain why wage growth hasn’t fired up.This is a dream scenario for the Fed.

This is a dream scenario for the Fed. Increased labor supply diminishes the risk of a wage-fueled reignition in inflation, while the boost in demand could help shield economic growth. Hence, the best of all worlds for a central bank trying to vanquish inflation while avoiding a recession.

Investors scaled back their bets on the timing and depth of Fed rate cuts following the employment report, and currently view the prospect of a cut in June almost like a 50-50 coin toss.

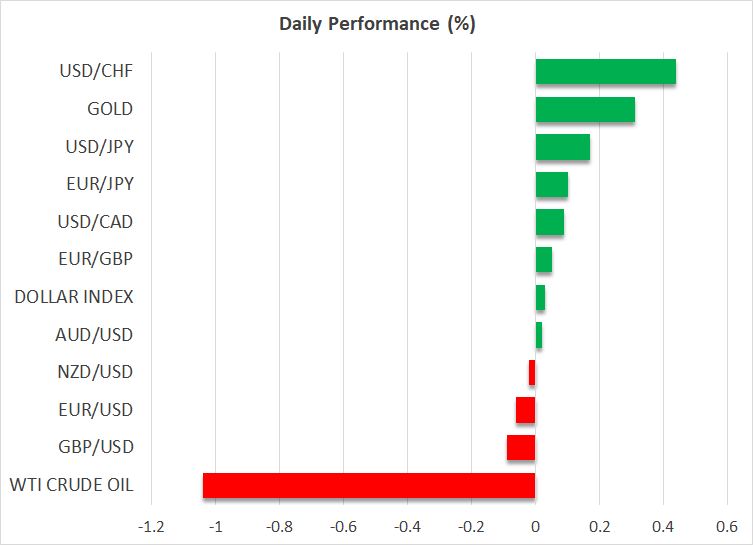

Dollar cannot shine as equities jump

In the markets, the dollar jumped in the aftermath of this data but erased those gains in the following hours to close the session almost unchanged. There was no news catalyst behind the sudden reversal in the dollar, which seems to have been driven by a shift in risk sentiment. Stock markets soared as traders concluded that a booming labor market could ultimately translate into stronger corporate earnings, even if interest rates remain higher for a little longer. This optimism dampened the rally in the US dollar, as its safe haven qualities came back to bite.This optimism dampened the rally in the US dollar, as its safe haven qualities came back to bite.With equity markets trading near record highs and valuations being stretched in an environment where bond yields are rising, the stakes are extremely high going into the earnings season that kicks off this week. If earnings don’t live up to expectations, the stunning market rally could suffer a setback as rising yields begin to compress valuations.

Oil retreats, but gold keeps flying

In energy markets, oil prices opened the week with losses, pressured by signs that Middle East tensions are finally easing. Ceasefire talks are ongoing and the Israeli foreign minister expressed cautious optimism today, saying these negotiations are the closest the two sides have come to a deal in several months. But the calmer atmosphere was not enough to dent the rally in gold prices, which reached a new record high on Monday. Central bank purchases and Asian retail demand seem to be the driving forces behind the non-stop rally in gold, as the precious metal has defied the negative pressure exerted by rising bond yields and de-escalating geopolitical tensions. Looking ahead, it’s going to be a huge week for global markets, with a crucial US inflation report on Wednesday and three central bank meetings that could fuel volatility in most assets. Most important among those will be the European Central Bank decision on Thursday, where the central bank will most likely open the door for a summer rate cut.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.