Market Comment – Stocks perk up ahead of US CPI and ECB tests, dollar resumes climb

Markets steady as US data and ECB decision awaited

Wall Street starts week on optimistic note

Yen eases slightly as dollar back on the front foot, pound unfazed by jobs data

Calm prevails ahead of big tests

Calm prevails ahead of big testsMarkets remained in a cautiously risk-on mode on Tuesday as hopes that China’s economic meltdown is stabilizing and that central banks are nearing the end of their tightening cycle shored up sentiment ahead of some key events lined up this week.

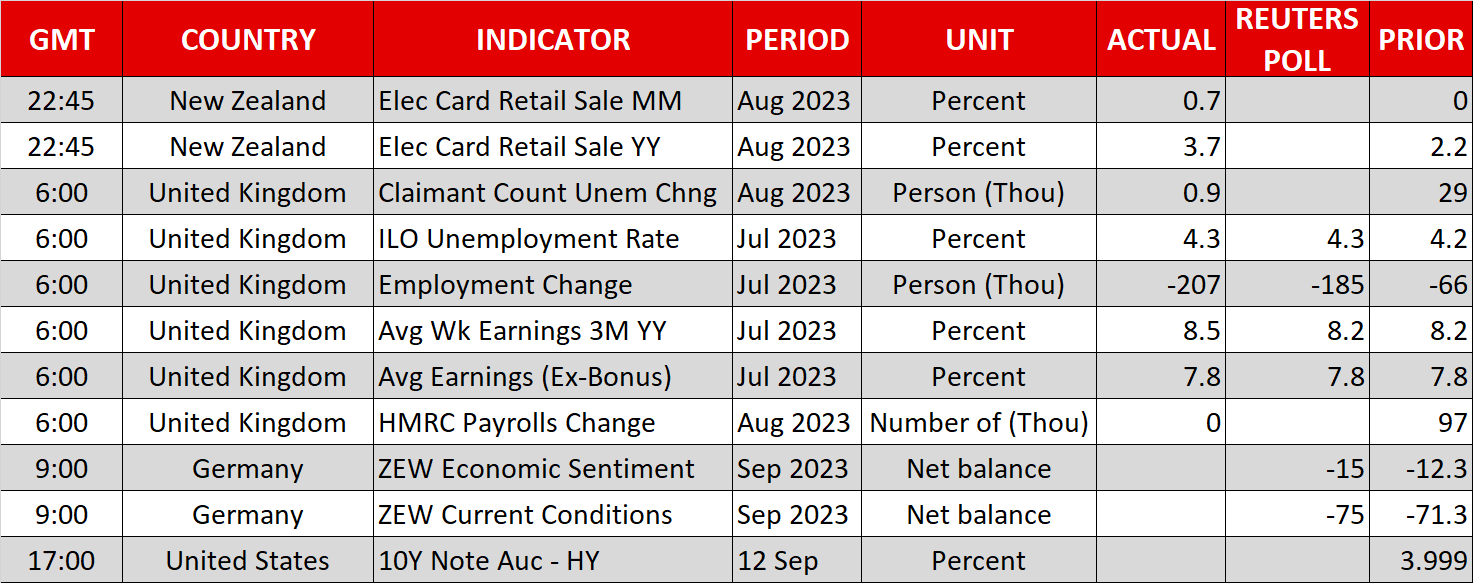

Traders are anxiously anticipating two major clues on what the Fed will decide at its policy meeting next week. The August inflation report is out tomorrow and retail sales will follow on Thursday amid signs that growth momentum remains plentiful in the US economy despite some concerns about a slowdown.

But before the Fed meets, the European Central Bank will have the honours of kicking off the 10-day central bank bonanza on Thursday. Markets are split as to whether the ECB will raise rates this week and should they press ahead with a 25-bps hike, investors would likely ratchet up their bets of further tightening by the Fed also.

Tech stocks lead Wall Street higherEither way, the Fed is not seen as having a lot of firepower left and this has put a halt on the rally in Treasury yields, at least for the time being, giving Wall Street some breathing space. Both the S&P 500 and Nasdaq have rebounded from August’s two-month lows, with the latter being boosted from a jump in some Big Tech names, the latest being Tesla.

The electric vehicle giant’s shares surged by 10% yesterday after an analyst upgrade from Morgan Stanley, claiming that the rewards the stock could reap from Tesla’s Dojo supercomputer could be as much as $600 billion. Amazon was another strong performer, pulling the Nasdaq Composite up 1.1%.

The spotlight today will fall on Apple as the company is set to launch its latest products, including the next generation iPhone.

But equities were somewhat more mixed today in Europe as US futures turned red. In Asia, meanwhile, Hong Kong and Chinese indices see-sawed as the initial euphoria that the troubled property developer, Country Garden, has struck a deal with creditors to extend the repayment deadline on some of its bonds faded.

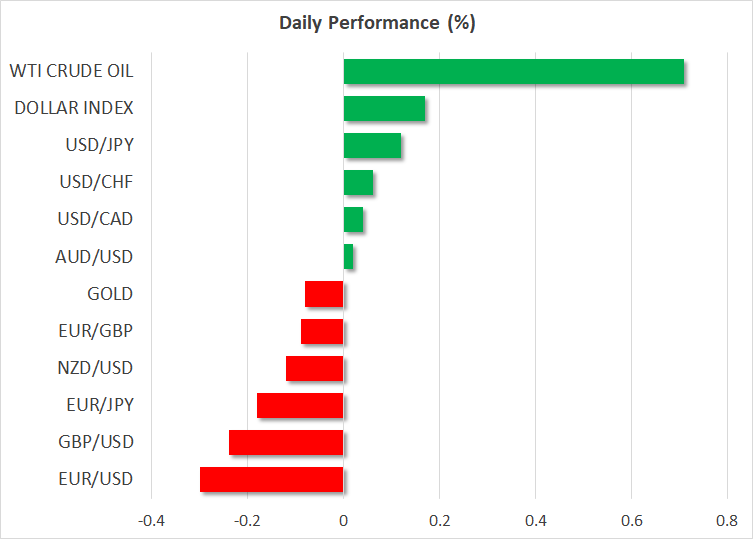

Yen eases from highs as dollar bounces backIn FX markets, the US dollar clawed back some of the prior day’s losses, edging up 0.2% against a basket of currencies. It was slightly firmer against the Japanese yen, trading around 146.70 yen.

Japan’s 10-year government bond yield spiked to the highest since January 2014 on Tuesday, reaching 0.723%, following comments from Bank of Japan Governor Kazuo Ueda over the weekend. Ueda alluded to the possibility of ending negative interest rates by year end if there is enough data to indicate that inflation and wages are rising sustainably.

Whilst that would likely represent the best-case scenario that the BoJ could hope for and it’s questionable how attainable it is, it has provided the struggling yen with a bit of a lifeline, buying policymakers some valuable time amid the dollar’s latest rampage.

Pound shrugs off hot wage growth dataEven 2023’s star performer – the pound – hasn’t been able to put up much of a fight against the greenback in this latest round as the Bank of England has hinted that UK rates are close to peaking.

Yet, job numbers released earlier in the session highlight the dilemma facing the BoE as employment in the UK fell more than expected in the three months to July, but average earnings accelerated further to 8.5% y/y.

Sterling has fallen back below $1.25 today, while the euro slipped to $1.0715. With investors pricing in only about a 40% probability of a rate rise by the ECB on Thursday, a surprise hike could provide some upside for the single currency.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.