Market Comment – Trade war nerves send stock markets lower

Apple concerns rock stock markets after China’s iPhone ban

Dollar rally takes a breather as yields retreat, but outlook intact

Gold creeps higher, helped by yields and sovereign purchases

Trade risks hit markets

The specter of the Sino-American trade war returned to haunt global markets this week, putting another risk on the radar screen of investors that are already grappling with signs of a global economic slowdown and elevated interest rates.

Shares of Apple fell nearly 3% on Thursday, dragging the entire stock market lower following reports that China ordered government officials not to use iPhones at work. Separate reports suggest Beijing is planning to expand this ban to include state-owned enterprises and other government-related agencies, massively widening the restrictions.

China sales account for almost one-fifth of Apple’s revenue, which was already under pressure having declined three consecutive quarters in year-over-year terms, even in a high-inflation environment.

The iPhone ban can be seen as retaliation for US restrictions on cutting-edge chip exports to China, and the timing of the move appears calculated too as Huawei just launched its newest smartphone, whose sales will likely reap the benefits. The question now is whether we are back in a tit-for-tat trade war environment, and if so, what Washington’s next move will be.

Sentiment shaky, dollar takes step back

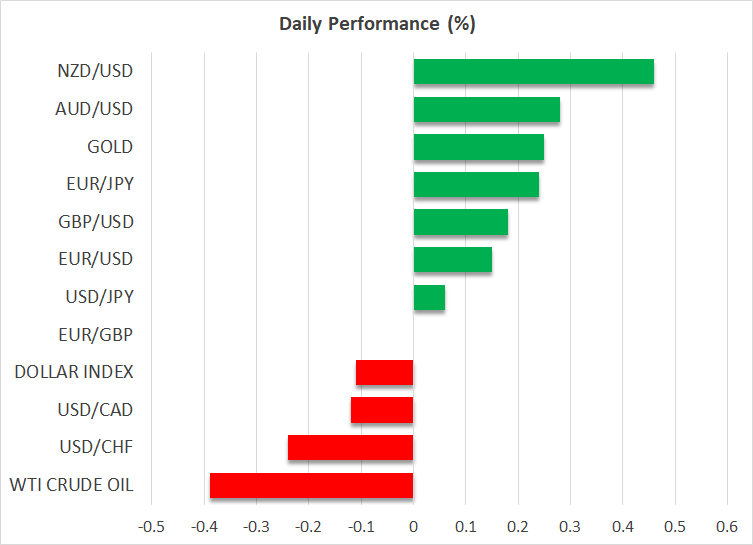

Despite the worrisome headlines, risk-linked currencies like the Australian and New Zealand dollars traded higher on Friday, licking their wounds after a bruising week. However, this rebound was not reflected in other China-sensitive assets. The yuan fell to its lowest levels in almost a year against the dollar despite signs that Beijing has stepped up FX interventions to defend the currency, which highlights the force of the capital stampede out of China.

Wall Street has been caught in the US-China firestorm as well. The major US indices pared some of their losses yesterday as dip buyers stepped in, but futures point to another lower open today as investors seem to be trimming their risk exposure.

The risk tone is so fragile that it has started to push down on US yields, which in turn has taken the steam out of the dollar’s rally. Still, the outlook for the greenback remains bright amid a resilient US economy that stands in contrast to Europe and China, both of which are plagued by a severe slowdown in growth.

The FX market has been trading almost entirely on interest rate differentials over the last year but with most central banks about to conclude their tightening cycles, the focus might shift to economic growth differentials, which clearly favor the United States at this stage.

Gold gets a reprieve, more yen intervention threats

Gold prices are on the mend. The precious metal managed to rebound off its 200-day moving average yesterday and is trading higher today, but remains on track to close the week with serious injuries.

An environment of elevated real yields and a shining US dollar is anathema for gold, but admittedly, the metal’s losses have not been as extreme as one might fear given the seismic moves in bond markets. The stabilizing force for gold prices was likely sovereign demand by central banks, spearheaded by China, which continues to raise its gold reserves at a striking pace according to the latest data.

Finally in Japan, another round of FX intervention threats fell on deaf ears. Finance Minister Suzuki repeated that Tokyo will respond “appropriately” to excessive FX volatility, and yet the Japanese yen weakened in the aftermath.

Subdued levels of implied volatility in yen options suggest traders view another yen-buying operation as unlikely for now. In other words, Tokyo might bark but won’t bite, mostly because the currency’s depreciation has been much slower and orderly this time around.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.