After dovish Fed and GDP miss, can PCE inflation rise rescue the US dollar? – Forex News Preview

It’s official - taper discussions are in full swing at the Fed. Yet, a timeline is nowhere in sight and Fed Chair Jerome Powell isn’t in a hurry to set a firm date either. Clearly, policymakers want to see what effect the end of the enhanced unemployment benefits in September will have on the labour market and whether the surge in inflation will show signs of peaking over the next few months.

If Powell had his way, a decision would probably be put off until early next year. But a growing chorus of FOMC hawks means it will be difficult to delay a move beyond the end of this year. Either way, the odds of the Fed making a call on tapering in September are diminishing and this is creating downside pressure on the dollar as pushing back tapering would also determine how soon the Fed funds rate can start to go up.

Hence, Friday’s numbers on personal income and spending, as well as the all-important PCE inflation print may only have a limited impact in terms of altering the outlook for Fed policy.

PCE inflation to jump againPersonal consumption, which has somewhat disappointed lately, is expected to have increased by 0.7% month-on-month in June. But personal income likely fell by -0.3% m/m as the boost from the stimulus payments and other federal support continued to fade.

As for the core PCE price index, which is what the Fed pays most attention to for gauging inflation, analysts are predicting a monthly increase of 0.6% and an annual rise of 3.7% - both well above historical averages, well, that is if you exclude the 1970s.

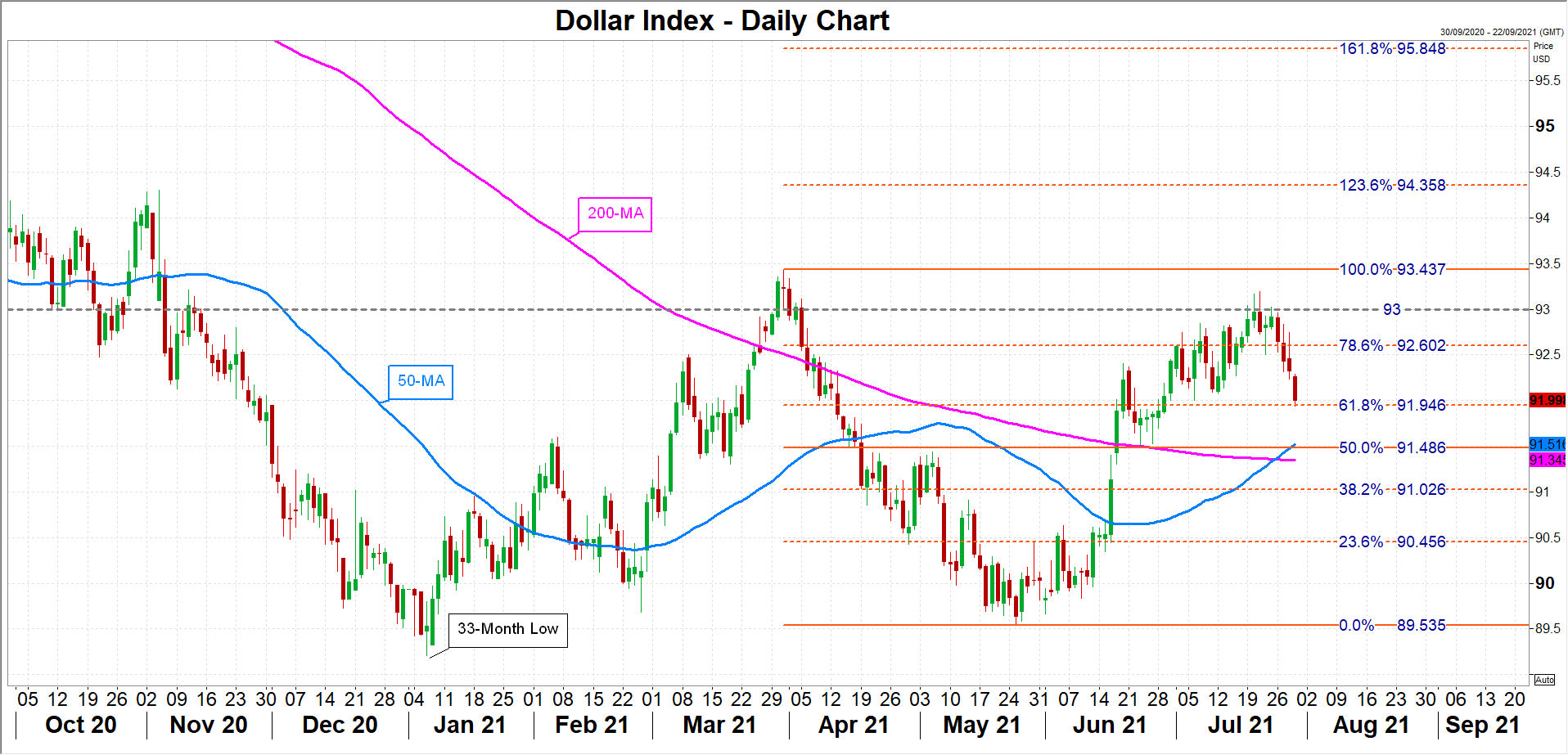

Dollar could do with some supportShould the core PCE price index soar more than expected, it could help put a floor under the dollar’s latest selloff, especially if it’s backed by strong consumption data. The dollar index is currently seeking support at the 61.8% Fibonacci retracement of the May – July upleg at 91.95. If this support fails, the 50% Fibonacci of 91.49 will be critical as the 50-day moving average happens to be in the same area.

However, should buyers re-enter the market, a rebound towards the 78.6% Fibonacci of 92.60 would not be too farfetched, though sharper gains would be more difficult. The dollar index’s best chance of reclaiming the 93.0 level and challenging the July top of 93.19 in the short term is if risk aversion were to return and draw in some safe-haven demand for the greenback.

However, should buyers re-enter the market, a rebound towards the 78.6% Fibonacci of 92.60 would not be too farfetched, though sharper gains would be more difficult. The dollar index’s best chance of reclaiming the 93.0 level and challenging the July top of 93.19 in the short term is if risk aversion were to return and draw in some safe-haven demand for the greenback.Pinakabagong Balita

Disclaimer: Ang mga kabilang sa XM Group ay nagbibigay lang ng serbisyo sa pagpapatupad at pag-access sa aming Online Trading Facility, kung saan pinapahintulutan nito ang pagtingin at/o paggamit sa nilalaman na makikita sa website o sa pamamagitan nito, at walang layuning palitan o palawigin ito, at hindi din ito papalitan o papalawigin. Ang naturang pag-access at paggamit ay palaging alinsunod sa: (i) Mga Tuntunin at Kundisyon; (ii) Mga Babala sa Risk; at (iii) Kabuuang Disclaimer. Kaya naman ang naturang nilalaman ay ituturing na pangkalahatang impormasyon lamang. Mangyaring isaalang-alang na ang mga nilalaman ng aming Online Trading Facility ay hindi paglikom, o alok, para magsagawa ng anumang transaksyon sa mga pinansyal na market. Ang pag-trade sa alinmang pinansyal na market ay nagtataglay ng mataas na lebel ng risk sa iyong kapital.

Lahat ng materyales na nakalathala sa aming Online Trading Facility ay nakalaan para sa layuning edukasyonal/pang-impormasyon lamang at hindi naglalaman – at hindi dapat ituring bilang naglalaman – ng payo at rekomendasyon na pangpinansyal, tungkol sa buwis sa pag-i-invest, o pang-trade, o tala ng aming presyo sa pag-trade, o alok para sa, o paglikom ng, transaksyon sa alinmang pinansyal na instrument o hindi ginustong pinansyal na promosyon.

Sa anumang nilalaman na galing sa ikatlong partido, pati na ang mga nilalaman na inihanda ng XM, ang mga naturang opinyon, balita, pananaliksik, pag-analisa, presyo, ibang impormasyon o link sa ibang mga site na makikita sa website na ito ay ibibigay tulad ng nandoon, bilang pangkalahatang komentaryo sa market at hindi ito nagtataglay ng payo sa pag-i-invest. Kung ang alinmang nilalaman nito ay itinuring bilang pananaliksik sa pag-i-invest, kailangan mong isaalang-alang at tanggapin na hindi ito inilaan at inihanda alinsunod sa mga legal na pangangailangan na idinisenyo para maisulong ang pagsasarili ng pananaliksik sa pag-i-invest, at dahil dito ituturing ito na komunikasyon sa marketing sa ilalim ng mga kaugnay na batas at regulasyon. Mangyaring siguruhin na nabasa at naintindihan mo ang aming Notipikasyon sa Hindi Independyenteng Pananaliksik sa Pag-i-invest at Babala sa Risk na may kinalaman sa impormasyong nakalagay sa itaas, na maa-access dito.